Government/Policy

August 7, 2016

Commerce Announces Final Margins on Hot Rolled Steel

Written by John Packard

There were some surprises on Friday afternoon when the U.S. Department of Commerce came out with their final determinations regarding antidumping and countervailing duties on hot rolled steel. Perhaps the biggest surprise was saved for POSCO out of Korea and the joint venture partner with US Steel on USS/POSCO mill in California. The UPI mill uses 75,000 to 100,000 tons of hot rolled steel per month and POSCO was by far the largest supplier.

Here is what the press release had to say:

On August 5, 2016, the Department of Commerce (Commerce) announced its affirmative final determinations in the antidumping duty (AD) investigations of imports of certain hot-rolled steel flat products (hot-rolled steel) from Australia, Brazil, Japan, Korea, the Netherlands, Turkey, and the United Kingdom, and the CVD investigations of imports of hot-rolled steel from Brazil, Korea, and Turkey.

The AD and CVD laws provide U.S. businesses and workers with a transparent, quasi-judicial, and internationally accepted mechanism to seek relief from the market-distorting effects caused by injurious dumping and unfair subsidization of imports into the United States, establishing an opportunity to compete on a level playing field.

For the purpose of AD investigations, dumping occurs when a foreign company sells a product in the United States at less than its fair value. For the purpose of CVD investigations, a countervailable subsidy is financial assistance from a foreign government that benefits the production of goods from foreign companies and is limited to specific enterprises or industries, or is contingent either upon export performance or upon the use of domestic goods over imported goods.

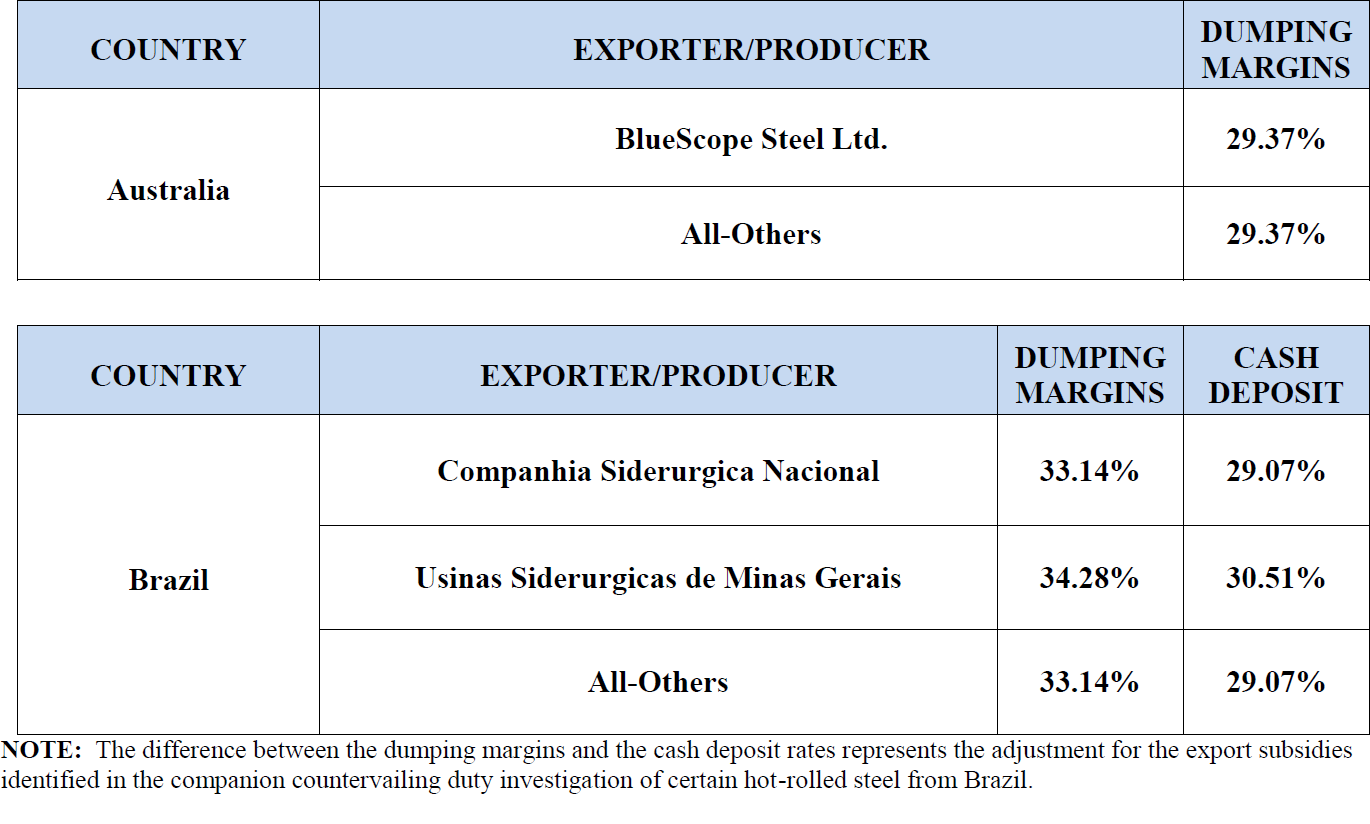

In the Australia investigation, Commerce found that dumping has occurred by mandatory respondent BlueScope Steel Ltd. at a dumping margin of 29.37 percent. Commerce calculated a final dumping margin of 29.37 percent for all other producers/exporters in Australia.

In the Brazil AD investigation, Commerce found that dumping has occurred by mandatory respondents, Companhia Siderurgica Nacional (CSN) and Usinas Siderurgicas de Minas Gerais (Usiminas) at dumping margins of 33.14 percent and 34.28 percent, respectively. The rate for Usiminas was calculated using total adverse facts available because the company did not respond to Commerce’s questionnaire. Commerce calculated a final dumping margin of 33.14 percent for all other producers/exporters in Brazil.

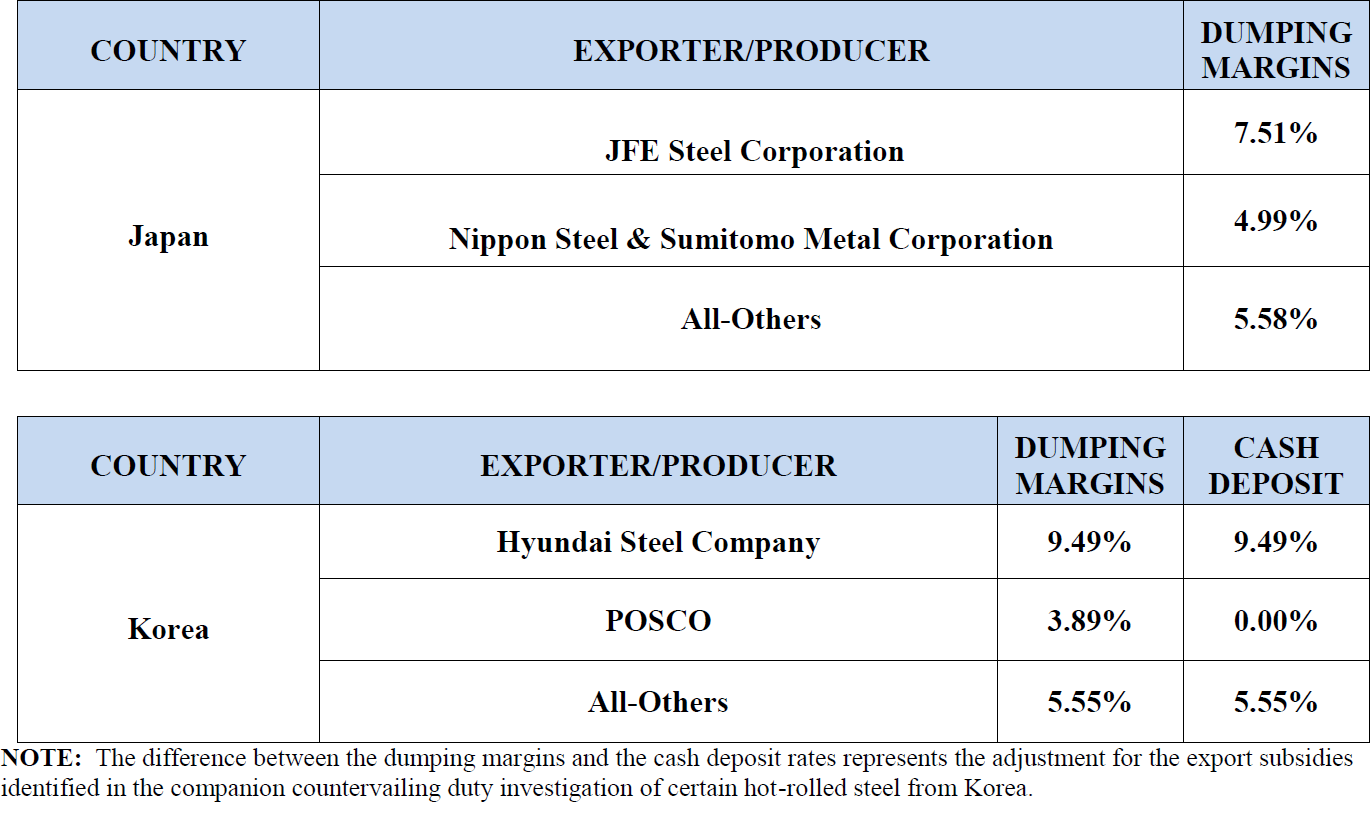

In the Japan AD investigation, Commerce found that dumping has occurred by mandatory respondents JFE Steel Corporation and Nippon Steel & Sumitomo Metal Corporation at dumping margins of 7.51 percent and 4.99 percent, respectively. Commerce calculated a final dumping margin of 5.58 percent for all other producers/exporters in Japan.

In the Japan AD investigation, Commerce found that dumping has occurred by mandatory respondents JFE Steel Corporation and Nippon Steel & Sumitomo Metal Corporation at dumping margins of 7.51 percent and 4.99 percent, respectively. Commerce calculated a final dumping margin of 5.58 percent for all other producers/exporters in Japan.

In the Korea AD investigation, Commerce found that dumping has occurred by mandatory respondents Hyundai Steel Company and POSCO at dumping margins of 9.49 percent and 3.89 percent, respectively. Commerce calculated a final dumping margin of 5.55 percent for all other producers/exporters in Korea.

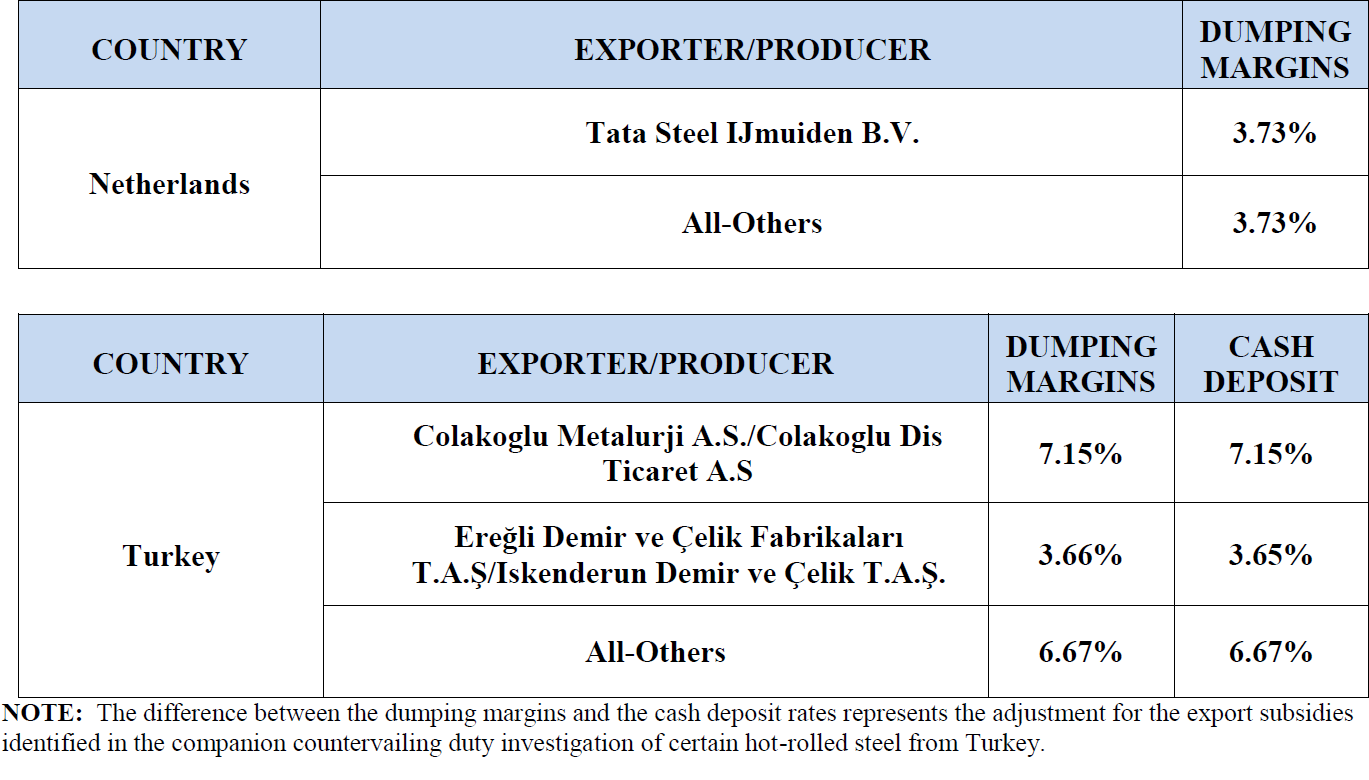

In the Netherlands AD investigation, Commerce found that dumping has occurred by mandatory respondent Tata Steel IJmuiden B.V at a dumping margin of 3.73 percent. Commerce calculated a final dumping margin of 3.73 percent for all other producers/exporters in the Netherlands.

In the Netherlands AD investigation, Commerce found that dumping has occurred by mandatory respondent Tata Steel IJmuiden B.V at a dumping margin of 3.73 percent. Commerce calculated a final dumping margin of 3.73 percent for all other producers/exporters in the Netherlands.

In the Turkey AD investigation, Commerce found that dumping has occurred by mandatory respondents Colakoglu Metalurji A.S./Colakoglu Dis Ticaret A.S and Ereğli Demir ve Çelik Fabrikaları T.A.Ş./Iskendrun Demir ve Çelik T.A.Ş. at dumping margins of 7.15 percent and 3.66 percent, respectively. Commerce calculated a final dumping margin of 6.67 percent for all other producers/exporters in Turkey.

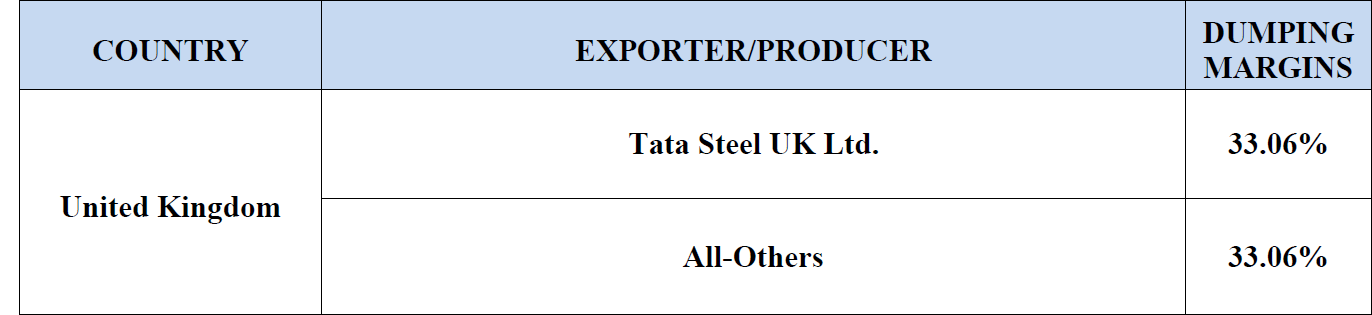

In the United Kingdom AD investigation, Commerce found that dumping has occurred by mandatory respondent Tata Steel UK Ltd. at a dumping margin of 33.06 percent. Commerce calculated a final dumping margin of 33.06 percent for all other producers/exporters in the United Kingdom.

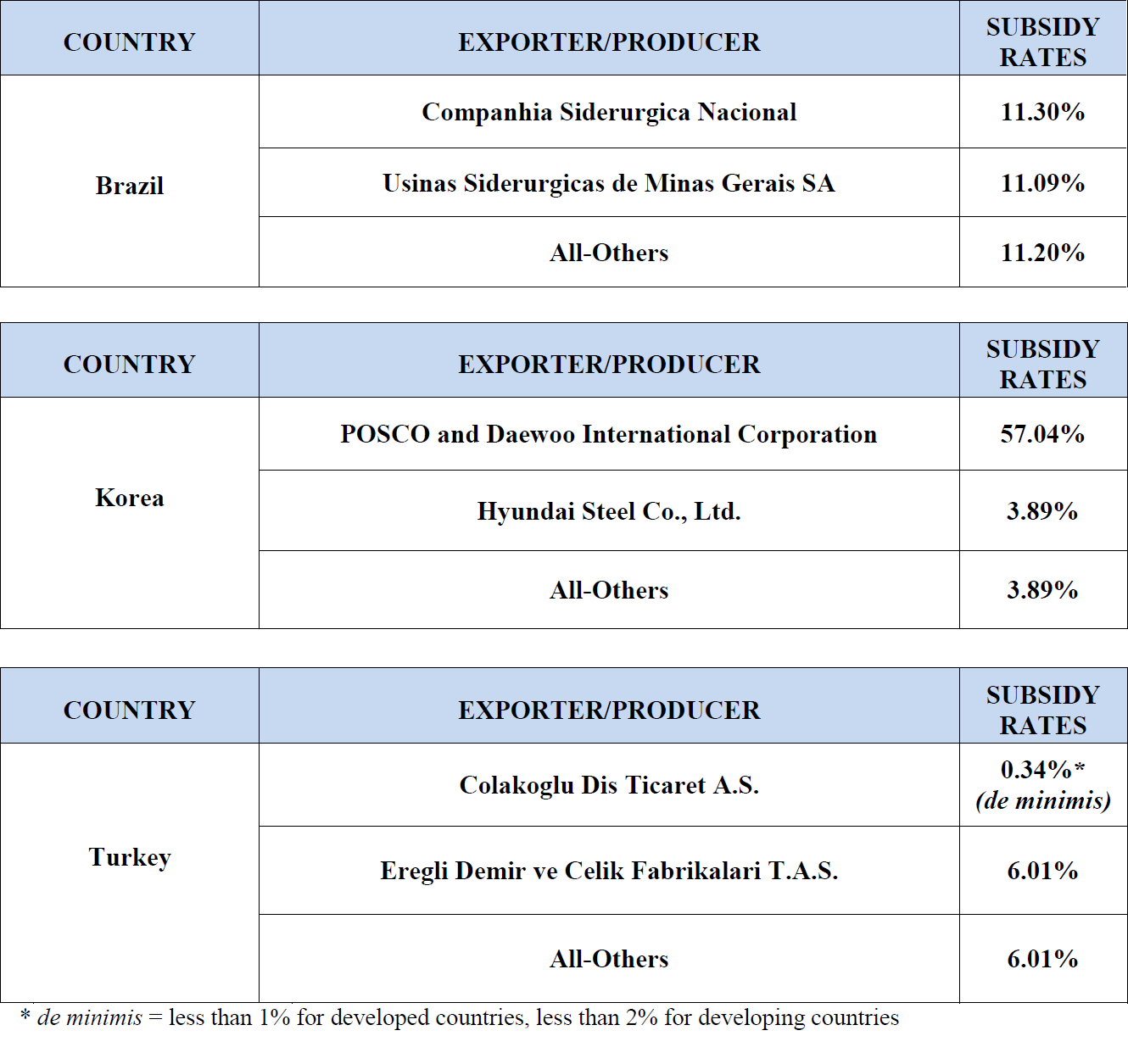

CVD Subsidy Rates:

In the Brazil CVD investigation, Commerce calculated subsidy rates of 11.30 and 11.09 percent, respectively, for mandatory respondents CSN and Usiminas. Commerce calculated a final subsidy rate of 11.20 percent for all other producers/exporters in Brazil.

In the Korea CVD investigation, Commerce calculated a final subsidy rate of 3.89 percent for mandatory respondent Hyundai Steel Co., Ltd. For the other mandatory respondent, POSCO, Commerce calculated a subsidy rate of 57.04 percent based on adverse facts available because we were unable to verify the accuracy of certain key elements of POSCO’s questionnaire response. Commerce calculated a final subsidy rate of 3.89 percent for all other producers/exporters in Korea.

In the Turkey CVD investigation, Commerce calculated subsidy rates of 0.34 percent (de minimis) and 6.01 percent for mandatory respondents Colakoglu Dis Ticaret A.S. and Eregli Demir ve Celik Fabrikalari T.A.S., respectively. All other producers/exporters in Turkey have been assigned a final subsidy rate of 6.01 percent.

As a result of the affirmative final AD determinations , Commerce will instruct U.S. Customs and Border Protection (CBP) to collect cash deposits equal to the applicable weighted-average dumping margins. For the Korea and Turkey CVD investigations, which both had negative preliminary determinations and affirmative final determinations, Commerce will instruct CBP to collect cash deposits equal to the applicable subsidy rates effective on the date of publication of the final determinations in the Federal Register. Further, as a result of the affirmative final CVD determination in the Brazil investigation, if the U.S. International Trade Commission (ITC) issues affirmative injury determinations, Commerce will order the resumption of the suspension of liquidation and will require cash deposits for CVD duties equal to the final subsidy rates established during the investigation, except where these rates are zero or de minimis. Commerce will also adjust the AD cash deposit rates by the amount of the CVD export subsidies, where appropriate. If the ITC issues negative final injury determinations, the investigations will be terminated and no producers or exporters will be subject to future cash deposits for either AD or CVD duties. In such an event, all previously collected cash deposits will be refunded.

As a result of the affirmative final AD determinations , Commerce will instruct U.S. Customs and Border Protection (CBP) to collect cash deposits equal to the applicable weighted-average dumping margins. For the Korea and Turkey CVD investigations, which both had negative preliminary determinations and affirmative final determinations, Commerce will instruct CBP to collect cash deposits equal to the applicable subsidy rates effective on the date of publication of the final determinations in the Federal Register. Further, as a result of the affirmative final CVD determination in the Brazil investigation, if the U.S. International Trade Commission (ITC) issues affirmative injury determinations, Commerce will order the resumption of the suspension of liquidation and will require cash deposits for CVD duties equal to the final subsidy rates established during the investigation, except where these rates are zero or de minimis. Commerce will also adjust the AD cash deposit rates by the amount of the CVD export subsidies, where appropriate. If the ITC issues negative final injury determinations, the investigations will be terminated and no producers or exporters will be subject to future cash deposits for either AD or CVD duties. In such an event, all previously collected cash deposits will be refunded.

Critical circumstances were alleged with respect to imports of hot-rolled steel from Australia, Brazil, Japan, and the Netherlands. On December 9, 2015, Commerce preliminarily found that critical circumstances exist with respect to certain exporters from Brazil and Japan, and continues to do so in the final determinations. Where critical circumstances were found, CBP will be instructed to retroactively impose provisional measures on entries of hot-rolled steel effective 90 days prior to publication of the preliminary determinations in the Federal Register. Critical circumstances were not found with respect to imports of hot-rolled steel from Australia and the Netherlands.

The petitioners for these investigations are AK Steel Corporation (OH), ArcelorMittal USA LLC (IL), Nucor Corporation (NC), SSAB Enterprises, LLC (IL), Steel Dynamics, Inc. (IN), and United States Steel Corporation (PA).

Steel Market Update will have more about the hot rolled trade suit and its impact on the flat rolled steel market in Sunday evening’s edition of our newsletter.