Prices

November 1, 2016

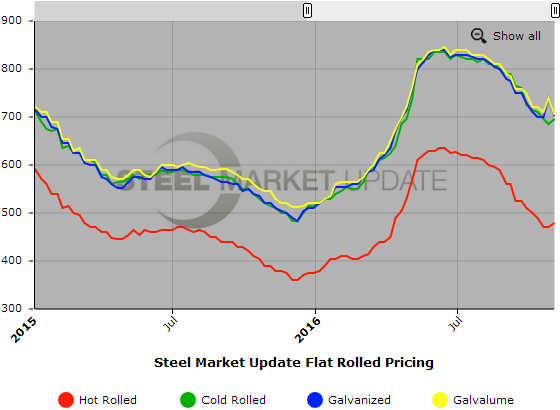

SMU Price Ranges & Indices: Moving on Up

Written by John Packard

It does not feel like a “rocket” market. By that we mean we are seeing prices skyrocketing at a breakneck pace. Don’t get us wrong. Prices have indeed changed coarse and the Momentum is for prices to trend higher over the next month of two. We just need to be careful as different products and different mills may be reacting differently to the market. We are seeing flat rolled prices tightening – especially at the lower end of the range. A number of buyers have come out of the woodwork which has impacted the mill lead times. Again, not all mills are created equally so you may see one mill on an “inquire only” basis while a second mill with the same products located in a different region of the country may have 2-4 week lead times.

SMU is seeing strength in the coated markets while hot rolled continues to be the weakest product – stronger than it was but still not at par with the other flat rolled products.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $460-$500 per ton ($23.00/cwt- $25.00/cwt) with an average of $480 per ton ($24.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton over one week ago while the upper end remained the same. Our overall average is up $10 per ton over last week. Our price momentum on hot rolled steel has been adjusted to Higher which means that prices are expected to move higher over the next 30-60 days.

Hot Rolled Lead Times: 2-5 weeks

Cold Rolled Coil: SMU Range is $680-$710 per ton ($34.00/cwt- $35.50/cwt) with an average of $695 per ton ($34.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton over last week while the upper end remained the same. Our overall average is up $10 per ton over one week ago. Our price momentum on cold rolled steel has been adjusted to Higher which means that prices are expected to move higher over the next 30-60 days.

Cold Rolled Lead Times: 4-7 weeks

Galvanized Coil: SMU Base Price Range is $34.00/cwt-$36.25/cwt ($680-$725 per ton) with an average of $35.125/cwt ($702.50 per ton) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton over one week ago while the upper end rose $15 per ton. Our overall average is up $22.50 per ton over last week. Our price momentum on galvanized steel has been adjusted to Higher which means that prices are expected to move higher over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU Range is $740-$785 per net ton with an average of $762.50 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks

Galvalume Coil: SMU Base Price Range is $34.00/cwt-$36.50/cwt ($680-$730 per ton) with an average of $35.25/cwt ($705 per ton) FOB mill, east of the Rockies. The lower end of our range rose $30 per ton over last week while the upper end increased $20 per ton. Our overall average is up $25 per ton over one week ago. Our price momentum on Galvalume steel has been adjusted to Higher which means that prices are expected to move higher over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $971-$1021 per net ton with an average of $996 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.