Prices

January 26, 2017

Why Have Flat Rolled Prices Gone Up?

Written by John Packard

Steel Market Update (SMU) received the following question from one of our readers:

“We are a galvanized sheet metal fabricator. We purchase around 5 million pounds a year (mostly 26ga-14ga). I was hoping you could help us out. We have not had to raise prices in years but galvanized pricing has steady risen over the last few months. What I would like from you is just a brief email explaining why the prices have gone up so much. If you have already done an article on this please forward me the article. I am trying out whatever information I can, so I can explain it better to my customers.”

Last week SMU participated in the monthly HARDI conference call. Those on the call were wholesalers who service the HVAC mechanical contractors around the United States and Canada. One of the items sold to the contractors is galvanized sheet or coiled steel which is used in ductwork, connections, furnace applications and other heating and ventilating applications.

The HARDI wholesalers discussed one of the issues they were having was being able to explain how much steel has gone up and why prices are changing as their customers were not as in tune to the markets as the wholesalers.

So, the question from this sheet metal fabricator is probably on the minds of many contractors who may have bought in early 4th Quarter to cover them into January 2017 and now they are getting “sticker shock” because galvanized prices (as well as other steels) are up $160 per ton ($8.00/cwt) since October 25, 2016.

What Has Been Pushing Galvanized Steel Prices?

During most of calendar year 2016, service centers and many end users were carrying excessive flat rolled steel inventories. At the same time, foreign steel imports continued to flood the USA, especially with galvanized steel.

As 2016 progressed, inventories did drop as steel buyers began weaning off their inventories by reducing domestic steel buys. This put pressure on the steel mills as they were producing too much steel and it became necessary for the mills to remove capacity from the market. This was accomplished by the shuttering of the US Steel Fairfield blast furnace along with the idling of the furnaces at US Steel Granite City and AK Steel Ashland.

By late October 2016, the inventories at service centers were at a point where it was necessary to begin building back some inventories as they moved into the first of the year. This was also the time when many annual contracts were settled and they too needed to buy inventories.

At the beginning of 2016 62% Fe iron ore fines in China were fetching $43 per dry metric ton. Today that same product is going for $82/dmt in China.

Midwest busheling scrap, which is used in the sheet mills (flat rolled mills) due to its low residuals, was selling for $185 per gross ton delivered in January 2016. This month the same product is selling for $323 per gross ton delivered.

The combination of commodities and rationalized steel mill capacity, when added to trade suits blocking or slowing the amount of foreign steel available to US buyers, are the background to the current price scenario.

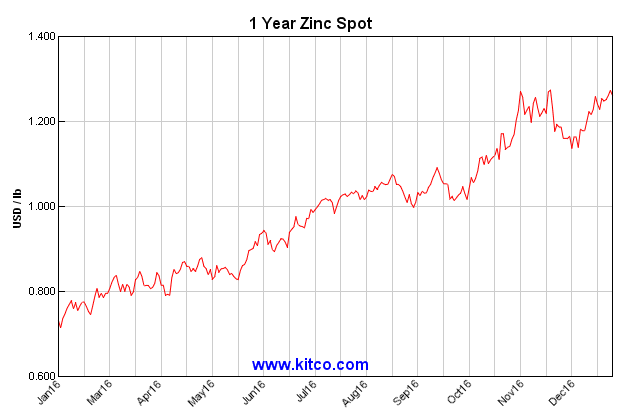

To that we need to add the revision of the zinc extras for galvanized due to the higher costs for zinc being traded on the LME exchange. There was a revision of the galvanized coating extras in November 2016 when zinc was trading at $1.10 per pound. Today, Kitco.com has the LME price at $1.24 per pound.

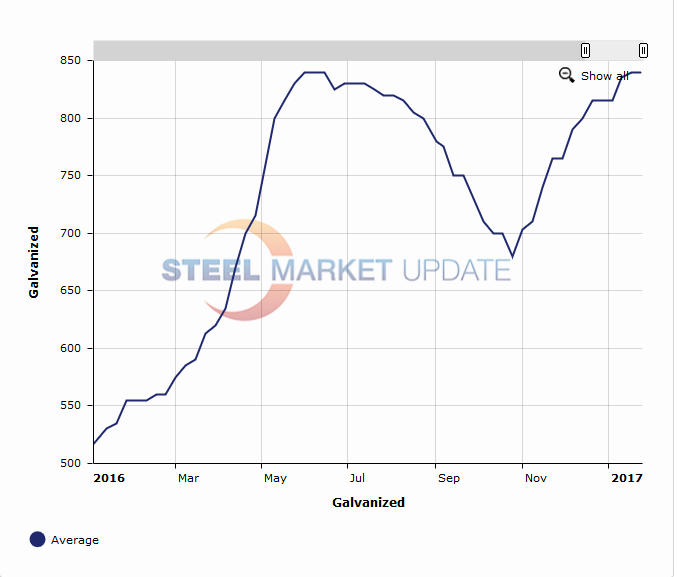

In the first graph shown in this article, we are showing galvanized “base price” average since January 1, 2016. When buying galvanized steel, it is necessary to add “extras” when buying from a steel mill in order to calculate your FOB mill transaction price.

In the case of 24 gauge galvanized, if you take the SMU index average for GI which is $840 per ton this week (same as the 2016 peak shown on the graph) or $42.00/cwt, to that you add your extras for gauge and width and then coating (cost to apply the zinc to the substrate).

For .0236” minimum gauge galvanized by 60” X Coil we would need to add +$1.00 for thickness (Nucor extras) and $8.00/cwt for G90 zinc coating (also Nucor extras). Assuming no other extras for special testing, small coils, etc. are needed, the total FOB mill price would be $51.00/cwt. To that we need to add freight to the customer.

If the fabricator is buying from a service center he needs to understand the distributor has freight to his building, freight to the end customer and his margin (assuming the fabricator is buying a 60” wide master coil). Our understanding from a couple of service center/wholesaler suppliers is that the resale to an end user would be somewhere in the $51.00/cwt-$56.50/cwt range at this moment and will most likely move even higher as new higher priced steel starts hitting the supplier’s floor.