Market Data

February 5, 2017

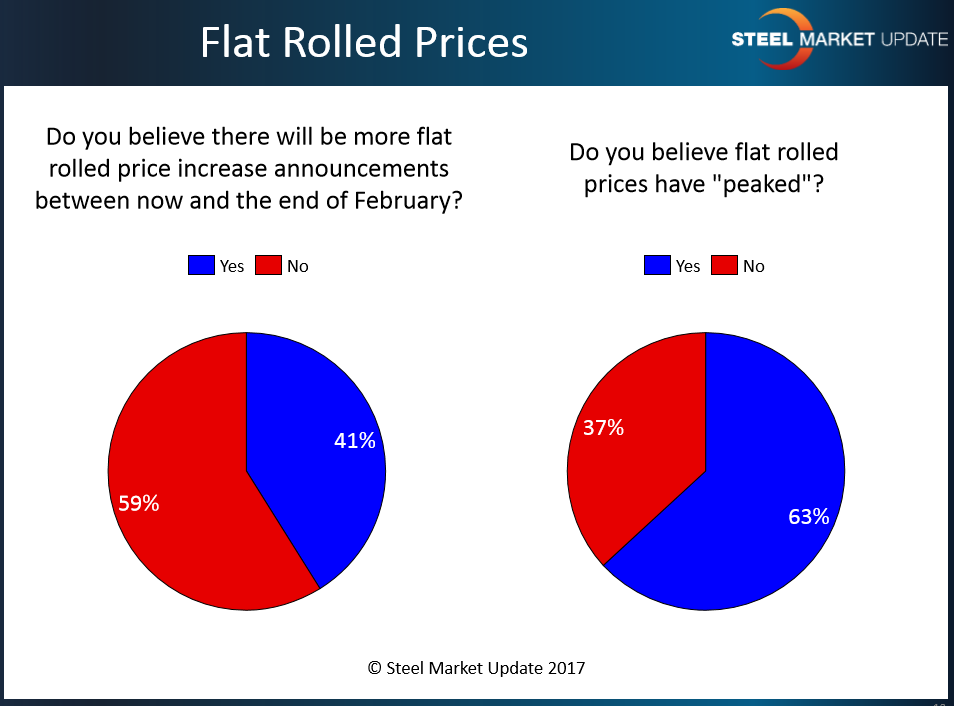

SMU Survey Results: More Price Announcements & Have Prices Peaked?

Written by John Packard

Last week Steel Market Update (SMU) conducted our early February flat rolled steel market trends analysis which is just a long way of saying our survey. Our analysis began on Monday and ended on Thursday afternoon. We covered a large number of topics with manufacturing companies, service centers, steel trading companies, steel mills and suppliers to the industry responding.

We asked those responding to our request to participate in our trends analysis if, as a group (all respondents), they believe there would be more flat rolled price announcements between last week and the end of February. We found a slight majority are of the opinion that there would not be any more price announcements in February. Fifty-nine percent of our respondents did not believe there would be further announcements while forty-one percent thought announcements would come.

SMU also asked if flat rolled prices had “peaked” and 63 percent believe they have with 37 percent believing they have not.

What Our Respondents Had to Say Regarding Price Increase Potential for February:

“Taking a breather for the market to catch up and a pause with lower scrap. Expect more in the March/April time frame but feel we are reaching the plateau.” Trading company

“IF scrap and lead times come down, there will be no increase.” Manufacturing company

“I believe Trump’s push for American steel in his infrastructure projects just provides the mills with additional ammunition to keep pushing the increases.” Manufacturing company

“Downward pressure on scrap pricing will prevent that. doesn’t rule out a late February increase if it appears scrap is in tight supply late in the month.” Service center

“Scrap is going down, the mills should just focus on holding the line.” Manufacturing company

“Hope the mills are smart enough to see that they went up too much and too fast in announcements in less than 75 days apart!” Service center

“I believe on HR only [more price announcements to come]. Virtually no imports except for Serbia/Egypt primarily; Mexico out of the picture and has stated no FEB/MAR production for U.S.” Manufacturing company

“Maybe more than 1 [price increase announcement coming].” Service center

“No chance [for more price announcements].” Service center

What Our Respondents had to Say Regarding Prices Peaking

“Close but not yet.” Trading company

“My sense is that the fundamentals are aligning in favor of the mills and they will continue to try to capture price over the short term.” Manufacturing company

“Probably by end of 1st Quarter barring something unforeseen.” Manufacturing company

“I believe the mills will try for another increase but will not be able to hold.” Service center

“A lull before the spring storm.” Manufacturing company

“At least temporarily demand will have to kick in to see how strong the market truly is with auto down then may be May or June possible next one!” Service center