Prices

May 2, 2017

SMU Price Ranges & Indices: Quiet Week

Written by John Packard

From Steel Market Update perspective the past week was fairly quiet and we did not find any huge changes in prices from what we had reported one week ago. We have a flat rolled steel market trends survey in process right now and a portion of our indices are based on the approximately 100 companies that have responded to our inquiries so far this week. The survey will continue through Thursday afternoon.

We thought the comments received from a large service center provided some insight into what kind of market we are seeing this week, “Really depends on mill [price offers this week]. Lead times are short on some and mills shipping early, others 3 months out and not budging on prices. We think with the latest auto sales, schedules will be cut back and mills with heavy auto exposure may shorten lead times. Pivotal time right now. Heard [West Coast Mill] cut pricing $60 ton. SDI Columbus shipping orders early, Riverdale in August, so try to make sense of all that.”

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $600-$650 per ton ($30.00/cwt-$32.50/cwt) with an average of $625 per ton ($31.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on hot rolled steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

A special note on hot rolled pricing based on the results from our survey so far this week, we are finding a majority of our respondents telling us price offers are in the $610-$620 range.

Hot Rolled Lead Times: 3-7 weeks

Cold Rolled Coil: SMU price range is $790-$840 per ton ($39.50/cwt-$42.00/cwt) with an average of $815 per ton ($40.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on cold rolled steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

A special note on cold rolled based on our survey results so far, we are finding the most responses coming in at $820-$830 per ton.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $39.50/cwt-$42.50/cwt ($790-$850 per ton) with an average of $41.00/cwt ($820 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on galvanized steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

A special note on galvanized based on our survey results so far, we are finding most of the responses being in the $40.00/cwt-$42.00/cwt range.

Galvanized .060” G90 Benchmark: SMU price range is $868-$928 per net ton with an average of $898 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks

Galvalume Coil: SMU base price range is $40.00/cwt-$42.50/cwt ($800-$850 per ton) with an average of $41.25/cwt ($825 per ton) FOB mill, east of the Rockies. The lower end of our range declined $20 per ton compared to last week while the upper end declined $10 per ton. Our overall average is down $15 per ton compared to one week ago. Our price momentum on Galvalume steel is pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

A special note on Galvalume based on our survey results so far, there is an even distribution within the full range. We also had at least one outlier at $44.00/cwt.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1091-$1141 per net ton with an average of $1116 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-8 weeks

Plate: SMU price range is $710-$780 per ton ($35.50/cwt-$39.00/cwt) with an average of $745 per ton ($37.25/cwt) FOB delivered. The lower end of our range declined $30 per ton compared to one week ago while the upper end decreased $20 per ton. Our overall average is down $25 per ton compared to last week. Our price momentum on plate steel is now pointing to Neutral which means we expect prices to remain steady over the next 30-60 days.

A special note on plate prices based on our survey results so far, the focus seems to be at the $740-$760 range.

Plate Lead Times: 5-8 weeks

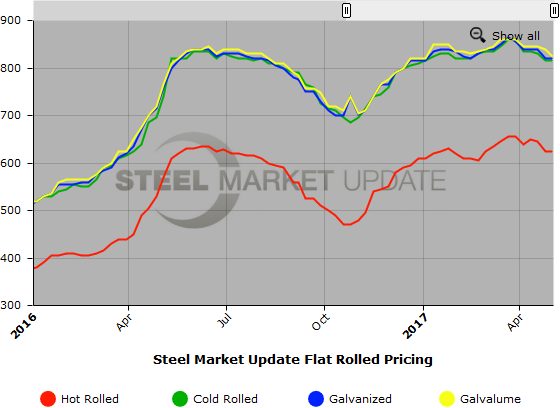

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. We will add plate prices to this graph once we have gathered a few months of data. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.