Market Data

July 23, 2017

HARDI/ITR Quarterly Forecast July 2017, Part 1

Written by Sandy Williams

U.S. industrial production is in Phase B, accelerating growth, but the latest HARDI/ITR quarterly construction forecast warns that the next phase of the cycle, slower growth, is on the horizon.

Steel Market Update is a member of an association connected to the construction industry called HARDI. HARDI stands for Heating, Air-conditioning & Refrigeration Distributors International. HARDI and the Institute for Trend Research (ITR), an economic forecasting company, work together to gather economic data to provide a forecast to the HARDI members located in the United States and Canada. The information shared in our newsletter is only part of a much larger package seen by participating HARDI member companies.

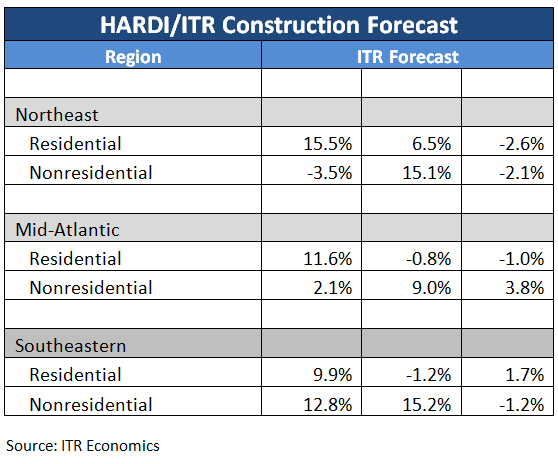

ITR looks at data using a 3-month and 12-month moving average to determine where business is within the growth cycle. Today’s issue will cover the general economic overview, as well as construction forecasts for the Northeast, Mid-Atlantic, and Southeastern Region based on data as of the end of May 2017.

Economic Overview

Real GDP has accelerated for three consecutive quarters, achieving a 2.1 percent gain in the first quarter. Industrial production in the 12 months through June rose 0.2 percent and is in Phase B, accelerating growth. Retail sales are up 1.7 percent from a year ago and are showing tentative signs of an upward trend, according to ITR. Signals that Phase B will transition to Phase C in 2018 include a general declining trend in the U.S. Purchasing Managers Index since February. ITR’s Leading Indicator has declined for two months and, if it continues to do so, Indicator and PMI combined would support ITRs forecast of cyclical rise through the end of 2017 and cyclical decline of the economy by early 2018.

ITR is predicting that starts for multi-unit housing will decline further in 2017 and end with a decline of 13.5 percent year-over-year for 2017. Housing continues to be supported by single-family starts, which were up 6.9 percent in the 12 months through June.

Construction material prices are at an all-time high and accelerating, said ITR, and will rise further as the economy and construction activity expand. Steel prices, which lead the U.S. Materials and Components for Construction Price Index by six months, are up 33.6 percent on an annual basis and will impact the construction industry in the second half of 2017. HVAC equipment pricing has accelerated 2.6 percent in June for air conditioning and refrigeration and 1.6 percent for heating equipment.

ITR suggests that tightening of steel capacity in China will support steel prices at the current level. SMU notes, however, that a Section 232 action against China and others may serve to increase steel prices in in the U.S., at least in the short term, making steel products more expensive for HARDI members.

Northeast

Residential construction in the Northeast saw U.S. housing permits drop 13.2 percent during the 12 months through May. Permit authorizations fell 13.9 percent from May to June from the previous month. Single-family construction continues to grow but at a slower rate, while multi-family construction is down by double digits. Home pricing in the Northeast followed the national trend and grew in most of the region in the 12 months through May. Overall housing construction, as measured by permit authorization, is expected to gain 15.5 percent year-over-year in 2017 and start a slowing trend in 2018 that will end with 6.4 percent growth, followed by contraction throughout 2019 to -2.6 percent.

Nonresidential construction spending is in recession, but is expected to rebound in the second half of 2017. Growth will persist through late 2018 before declining through mid-2019. Commercial construction in the region was down 77 percent from 2016 in the 12 months through May. Medical construction during the period showed the most strength, growing by 130.5 percent. The nonresidential construction forecast is -3.5 percent in 2017, 15.1 percent in 2018, and -2.1 percent in 2019.

Mid-Atlantic

ITR expects housing permits to rise through 2017 and into early 2018. Single-family housing is outperforming multi-housing currently, but multi-family accounts for about 60 percent of total housing permits. Permits were down by double digits in New Jersey, Maryland and New York City at the end of May. Maryland remains in recession, but Maryland, NYC and Pennsylvania are in recovery trends. Permit authorizations were up 13.6 percent in the District of Columbia and 1.2 percent in Delaware. ITR called home price growth tepid in the region during the first quarter except for a 13.9 percent y/y price jump in D.C. and 3.5 percent acceleration in New York City. ITR is forecasting housing permits will accelerate through the end of the year for a y/y of 11.6 percent in 2017. The forecast is for a 0.8 percent decline in 2018 and -1.0 percent in 2019.

Nonresidential construction is expected to fare much better than residential over the next two years. Nonresidential construction spending was up 9.8 percent year-over-year in the 12 months through May. Construction spending is expected to soften in 2017 for a total growth of 2.1 percent in 2017, accelerating to 9.0 percent in 2018 and declining again in mid-2019 to end up at a positive 3.8 percent. Currently, commercial, medical, and educational construction is offsetting declines in government and retail construction.

Southeast

Permit growth is on track with previous ITR forecasts in the Southeast. South Carolina and Florida permits are in an accelerating growth trend. Housing authorizations are up by double digits in North Carolina and Mississippi. Home prices in the region slowed their rate of growth in the first quarter except for Tennessee. Permit issuance is expected to accelerate throughout 2017 for an increase of 9.9 percent from 2016. Contraction will begin in the second half of the year and persist into mid-2019 before rebounding. Permits will be at -1.2 percent in 2018 and 1.7 percent in 2019 as a consumer-based recession takes hold.

Nonresidential spending looks strong for 2017, rising through early 2019 before declining later in that year. Commercial construction in the 12 months through May increased 26.6 percent, while retail and medical construction were up 60.2 percent and 31.5 percent, respectively. Double-digit growth was reported in six of the eight states of the region and bodes well for HARDI opportunities.