Market Data

August 3, 2017

Mills Mixed on Price Negotiation

Written by Tim Triplett

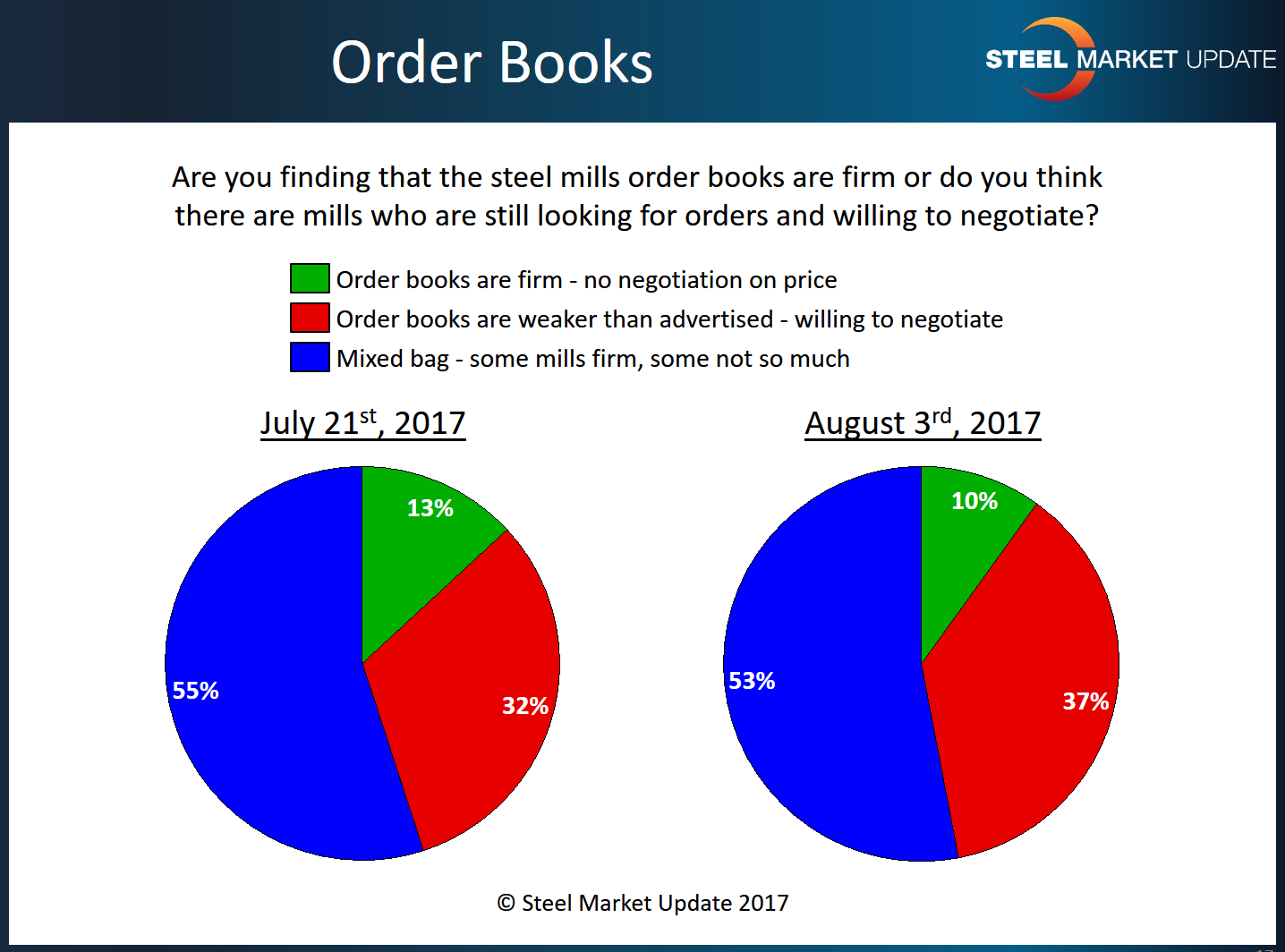

Over the course of this week, Steel Market Update has been canvassing active participants in the flat rolled steel markets as we try to capture any changes in market trends. The more than 100 respondents we had this week provided us a snapshot on how steel mills are handling price negotiations. As a group, respondents reported mills sending mixed signals on their willingness to negotiate steel prices. The majority of respondents (53 percent) to this week’s flat rolled market trends questionnaire report that some mills are open to negotiation, while others are not. Another 37 percent say mill order books are weaker than expected and mills do tend to be open to price discussions. Only 10 percent have found that mill order books are full and negotiation is off the table.

Steel Market Update analyzes negotiations in more than one way. The most reliable data on negotiations we have found over the history of our market surveys has been what we get from the manufacturing companies and service centers.

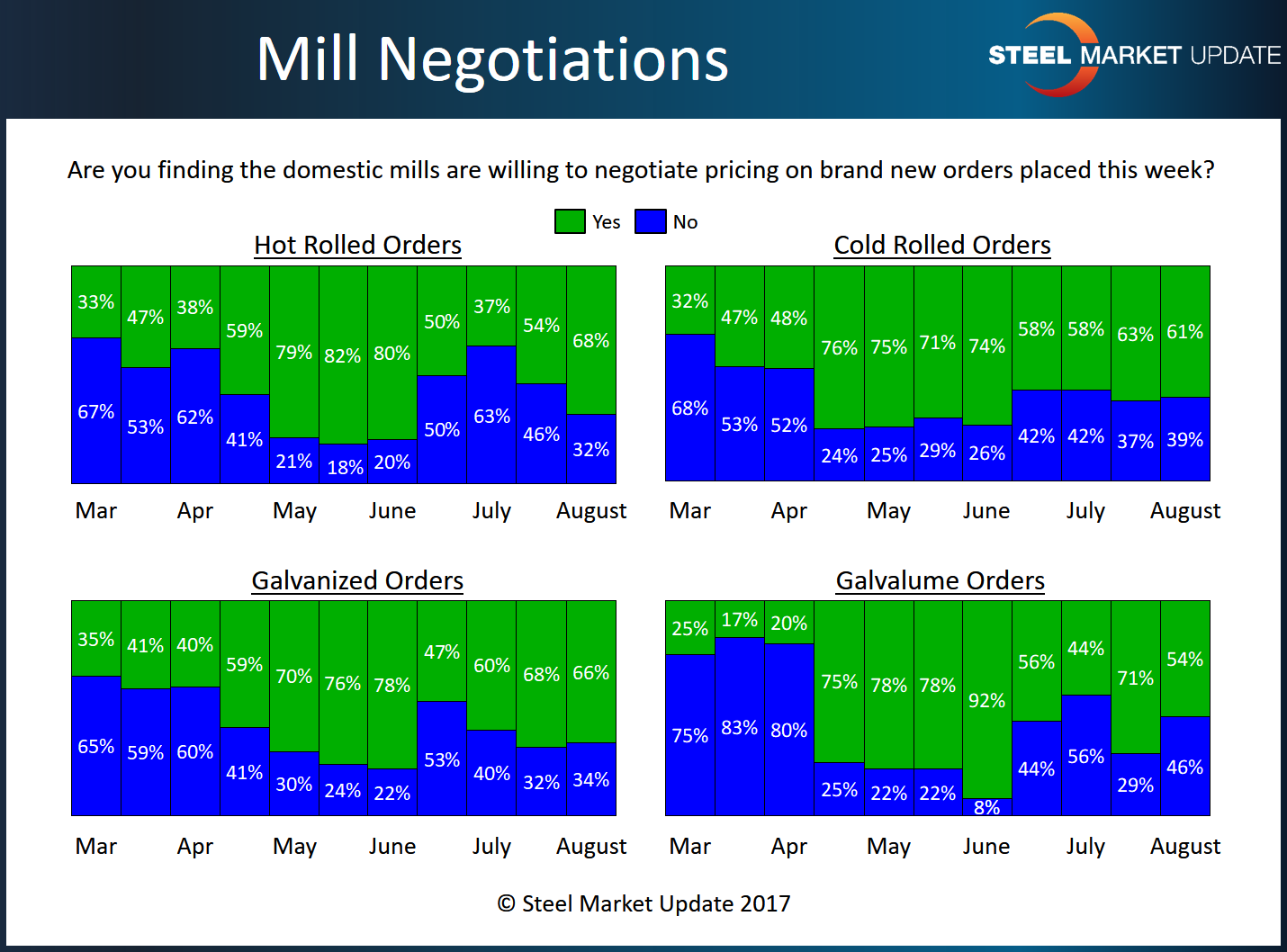

By product category, 68 percent of manufacturing and service center respondents saw mills willing to negotiate hot roll orders, up from 54 percent in the last survey. In cold roll, the percentage dipped slightly to 61 percent who found the price negotiable, from 63 percent two weeks ago. Galvanized also saw a slight dip to 66 percent from 68 percent, while Galvalume declined to 54 percent from 71 percent, indicating less willingness to talk price on coated products.

One service center executive described the market as a mixed bag, but added that the trend is not positive. “Many customers bought heavily in anticipation of a Section 232 ruling in July and now have retreated to the sidelines, which means reduced order activity over the next 30-60 days.” One manufacturer noted that lead times from integrated mills are long, which means they are busy and less likely to negotiate. Another says he has found mills in the Midwest open to discussions, though not mills on the West Coast. “I’m told prices are firm, but I don’t believe it. I am about to test those waters today,” said a service center executive.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.