Prices

August 8, 2017

SMU Price Ranges & Indices: Where Are We Going from Here?

Written by John Packard

Flat rolled steel prices remained range-bound on most items for yet another week. We picked up a couple of points of weakness in coated products, but they seem to be isolated in nature. Many of the steel buyers are reporting the mills (especially Nucor) are talking up the idea of a price increase on flat rolled – and soon. NLMK has been telling some of their customers to expect up to $40 per ton by the 1st of September. The buyers who have been speaking to Nucor are referencing numbers closer to $25 to $30 per ton.

As we have reported elsewhere in tonight’s issue of Steel Market Update, there are opinions that prices will go lower from here. One of our sources told us today, “I don’t have anything [orders] to give them [steel mills] at that number [just lowered by one mill]. I can’t imagine prices going anywhere but down.”

Other comments are miles from that one. We heard from a Midwest buyer, “Overall, the mills seem pretty content with booking levels and I don’t see a lot of movement on pricing. There may be a little aggressiveness on Galv since at the spread between HR and Galv base they are making so much money – but I expect them to hold the line and not give back the increases that they’ve been working on.”

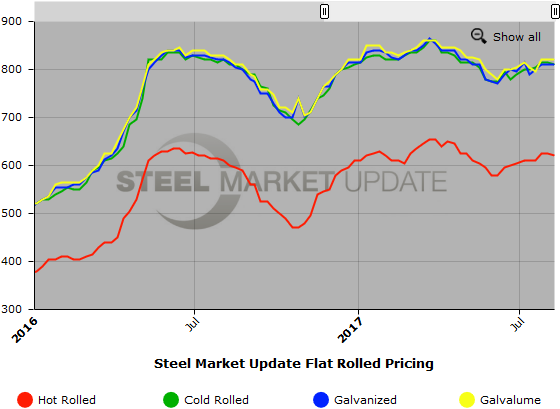

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $600-$640 per ton ($30.00/cwt-$32.00/cwt) with an average of $620 per ton ($31.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago, while the upper end decreased $10 per ton. Our overall average is down $5 per ton compared to last week. Our price momentum on hot rolled steel is now pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $780-$840 per ton ($39.00/cwt-$42.00/cwt) with an average of $810 per ton ($40.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week, while the upper end remained the same. Our overall average is down $5 per ton compared to one week ago. Our price momentum on cold rolled steel is pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU base price range is $39.00/cwt-$42.00/cwt ($780-$840 per ton) with an average of $40.50/cwt ($810 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on galvanized steel is pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Galvanized .060” G90 Benchmark: SMU price range is $858-$918 per net ton with an average of $888 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks

Galvalume Coil: SMU base price range is $40.00/cwt-$42.00/cwt ($800-$840 per ton) with an average of $41.00/cwt ($820 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to last week. Our overall average is unchanged compared to one week ago. Our price momentum on Galvalume steel is pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,091-$1,131 per net ton with an average of $1,111 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $670-$725 per ton ($33.50/cwt-$36.25/cwt) with an average of $697.50 per ton ($34.875/cwt) FOB delivered. The lower end of our range declined $10 per ton compared to one week ago, while the upper end decreased $15 per ton. Our overall average is down $12.50 per ton compared to last week. Our price momentum on plate steel is pointing to Neutral indicating prices are expected to remain steady over the next 30-60 days.

Plate Lead Times: 3-6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. We will add plate prices to this graph once we have gathered a few months of data. To use the graph’s interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.

Written by John Packard, John@SteelMarketUpdate.com