Market Segment

October 19, 2017

Nucor: Delay of Section 232 Causing Import Surge

Written by Sandy Williams

The delay by the Trump administration in making a decision on Section 232 is allowing further damage to the steel industry, said Nucor CEO, Chairman and President John Ferriola during the company’s third-quarter conference call.

Ferriola said he is not surprised by the surge of imports that have come into the U.S. since spring. Countries are doing everything they can to get their products across the U.S. border before Section 232 or other trade restrictions take effect.

“I think it is a direct result of a commitment that was made by the president earlier in the year,” Ferriola said. President Trump initially stated that Section 232 would be in place by June. “With every month that passes that it doesn’t go into effect, all we see is a continued surge.”

Nucor believes that any results of Section 232 should be applied retroactively to the early part of this year when the president first made his commitment to the industry. Such a commitment by the administration, said Ferriola, would put an immediate stop to the surge and prevent more damage while time is taken to complete the Section 232 study. He remains confident that President Trump will act by early 2018 at the latest, if not an early “Christmas gift.”

Nucor is encouraged by the stable or improving market conditions for nonresidential construction, automotive, energy, heavy equipment and agriculture as the industry goes into 2018.

“This country is in dire need of a very intense infrastructure program,” said Ferriola. Nucor is urging Congress to put forward a bipartisan infrastructure bill. The recent hurricanes have shown the need to upgrade infrastructure across the nation, he said. “When that happens, we expect to see improved demand in plate.”

He noted that Nucor is working on grades of plate to qualify to supply large pipes and transmission pipe. Although Nucor cannot make all of the products necessary to feed the U.S. pipe market, others in the industry can, said Ferriola, and there is no need for exceptions for foreign pipe in the trade case.

Nucor’s Louisiana DRI plant has been subject to a series of unplanned maintenance outages, and the company is taking time to look at the engineering of the entire process to make changes to improve reliability. Nucor is looking to its Trinidad facility as a model. When it is running, the Louisiana plant is making quality DRI and with fewer emissions—a dual goal that Nucor is pursuing. The recent improvements made to the plant may have fixed the problem, but Nucor is being proactive to ensure continued reliability.

Nucor is searching for locations where it can install micro-mill technology to fully utilize its melt capacity in regions that have good scrap availability and have underserved demand in the rebar segment. The micro-mill investments will have rebar production capability in the range of 200,000 to 300,000 tons annually.

Ferriola said that Nucor’s recent $40 price increase was appropriate and the market was ready for it. Shipments are up, backlogs are stronger and the company anticipates a stable fourth quarter.

The graphite electrode shortage is not affecting Nucor. The company does not buy electrodes on the spot market and does not buy at all from China. Inventory is sufficient for the first half of the year and contractual arrangements with domestic suppliers assure supply for the rest of 2018. There may be some increase in pricing in the second half of next year. Nucor’s use of DRI also allows single charging that reduces power-on times at the EAF and reduces energy and electrical consumption by about 10 percent.

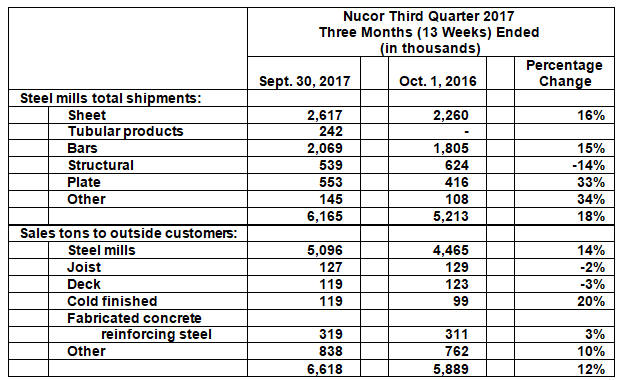

Nucor Corp. net earnings totaled $268.5 million for the third quarter of 2017 compared to $323.0 million for the second quarter of 2017 and $305.4 million for the third quarter of 2016. Net sales were $5.17 billion, consistent with results of the second quarter.

The average scrap and scrap substitute cost per ton used during the third quarter of 2017 increased 1 percent sequentially to $317.

Capacity utilization decreased to 83 percent in the third quarter of 2017 as compared to 88 percent in the second quarter of 2017 and 74 percent in the third quarter of 2016.