Prices

November 9, 2017

Imports of Cold Rolled, Galvanized, Galvalume Exceed Pre-AD/CVD Rates

Written by John Packard

There was a surge in foreign steel imports during calendar year 2014. That high rate continued into the first half of 2015 at which time the domestic steel mills filed antidumping (AD) and countervailing duty (CVD) cases on CORE (coated steels), cold rolled and hot rolled steels. The U.S. Department of Commerce investigation found most of the accused countries guilty of dumping and imposed duties intended to curb or totally eliminate imports from those countries into the United States. The AD/CVD cases worked, well, at least for a couple of years. The year 2017 (and possibly PresidentTrump) appear to be working against the domestic steel industry. Let us explain:

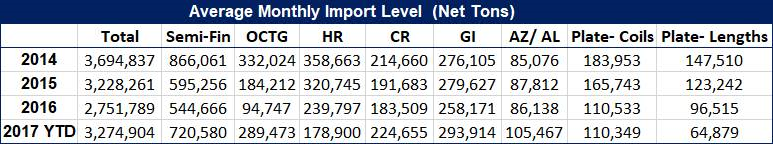

Total steel imports (all products) for 2014 were 3,694,837 net tons, with the biggest importers being the domestic steel mills themselves who brought in 866,061 net tons of semi-finished steels (mostly slabs with some billets). A portion of the hot rolled imported also is attributed to mills like USS/POSCO, Steelscape and CSN. As you can see in the table below, OCTG (oil country tubular goods) averaged 332,024 net tons per month, hot rolled averaged 358,663 net tons, cold rolled averaged 214,660 net tons, galvanized averaged 276,105 net tons, Galvalume and aluminized averaged 85,076 tons, and plate coils and lengths together averaged 331,463 net tons.

The U.S. did see total imports drop in 2015 and again in 2016 when the monthly average for total steel products dipped below three million net tons, coming in at 2,751,789 net tons. OCTG dropped to 94,747 net tons, hot rolled averaged 239,797 net tons, cold rolled 183,509 net tons, galvanized 258,171 net tons, and plates (coils and sheet) averaged 207,048 net tons per month. The only product that did not decline was Galvalume/aluminized, which averaged 86,138 net tons.

When calendar year 2017 began, we saw a continuation of the 2016 trend with January and February of this year averaging 2,768,059 net tons of total foreign steel imports.

Then President Trump announced he had charged the U.S. Department of Commerce and Secretary Wilbur Ross to investigate whether steel and the steel industry were germane to U.S. national security. The belief by most in the steel community was that the results were going to be “fixed” against foreign steel, yet the prospect of losing their suppliers did not move steel buyers to buy more domestic steel, but just the opposite. The amount of foreign steel being imported into the U.S. once again came close to the 2014 pre-AD/CVD levels. The months of March, April, May, June, July, August and September averaged 3,443,274 nets tons of imported foreign steel.

Steel Market Update expects that foreign steel tonnages will drop in the coming months, not so much due to AD/CVD or the threat of circumvention, Section 337 or Section 232, but rather due to ordinary market forces as foreign steel prices have been rising. The areas where we expect to see foreign imports continue to take market share away from the domestic steel mills is in cold rolled and coated steels. These are the products where the domestic mills raised the traditional spread between the base prices associated with those products and hot rolled coil. What was once a $100-$120 per ton spread was pushed to $200 per ton. SMU’s Steel Index reported hot rolled as averaging $600 per ton this week; cold rolled base pricing is +$185 higher than HR, galvanized is +170 per ton higher and Galvalume is +$200 per ton higher than the hot rolled average base.

As many of you know, Section 232 has been put off until after tax reform legislation has been completed. The report from Wilbur Ross is due in mid-January 2018. At this point, there is no guarantee that anything will happen until mid-late first-quarter 2018, and it no longer seems like a slam dunk that the steel industry will reap any benefits from 232. SMU has been hearing from steel mills who tell us they never asked for 232 and are now operating as though nothing will happen, and instead are concentrating their efforts on AD/CVD trade remedies.