Market Data

December 7, 2017

SMU Steel Buyers Sentiment Index: Start of a New Up Trend?

Written by Tim Triplett

Current and future sentiment among flat rolled steel buyers ticked up a bit in the past two weeks, according to the Steel Market Update Steel Buyers Sentiment Index. The same pattern started to appear at this time last year, leading into a strong first quarter.

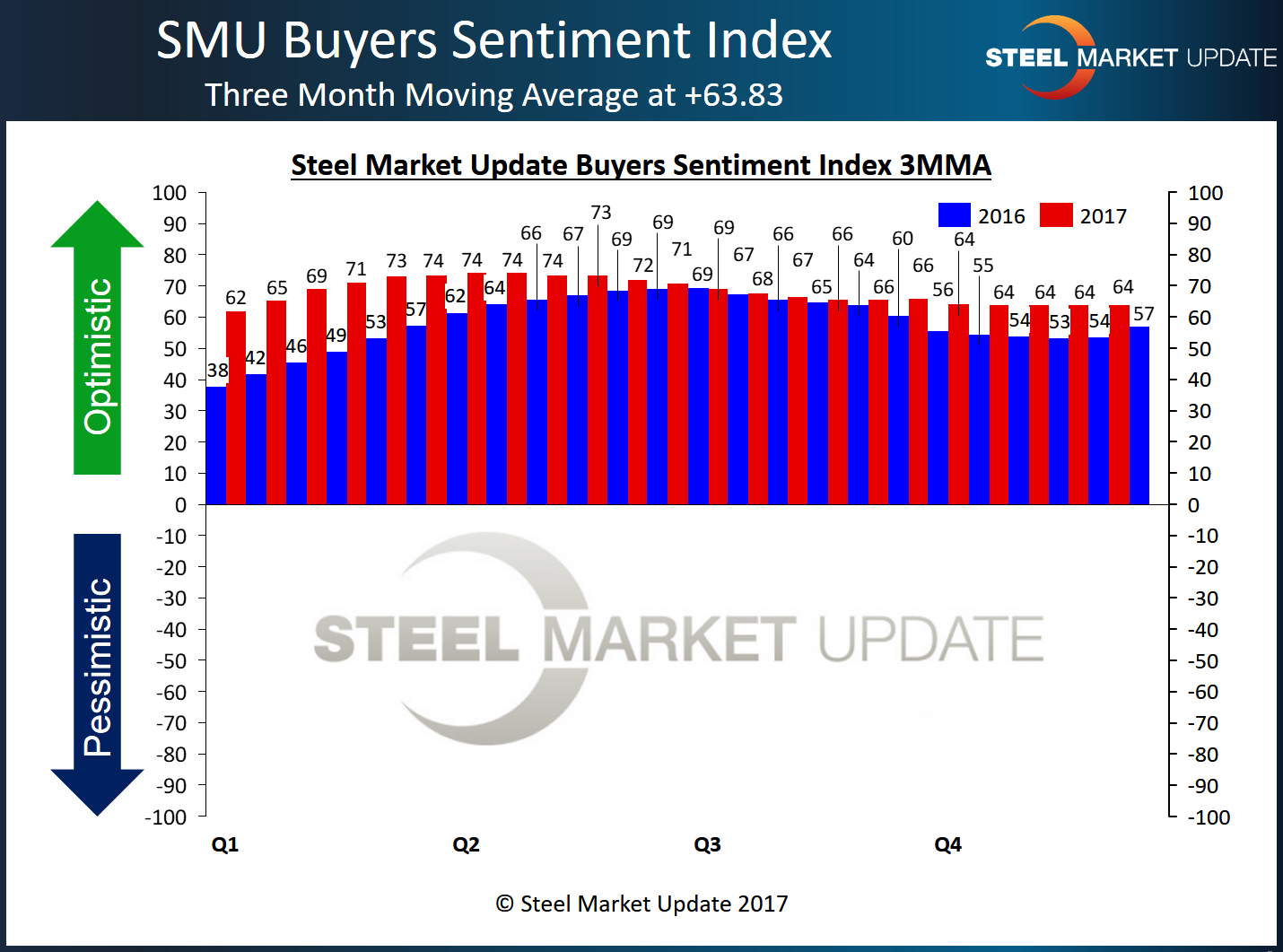

The SMU Steel Buyers Sentiment Index measures changes in buyers’ optimism levels, which offers some insight into their likely decision-making on such factors as purchasing and inventory levels. Most buyers and sellers of flat rolled steel remain optimistic about their company’s ability to be successful in the current market environment, as well as three to six months into the future.

Measured as a single data point, the average among those responding to this week’s flat rolled steel market trends questionnaire was +70, up from +65 two weeks ago and at its highest level since mid-May. At this time last year, the reading was +65.

SMU’s preference is to look at the data based on a three-month moving average (3MMA), which smooths out the index and provides a truer picture of the trend. The Current Sentiment 3MMA is at +63.83, basically unchanged since mid-October, but about +10 points more optimistic than levels in December 2016.

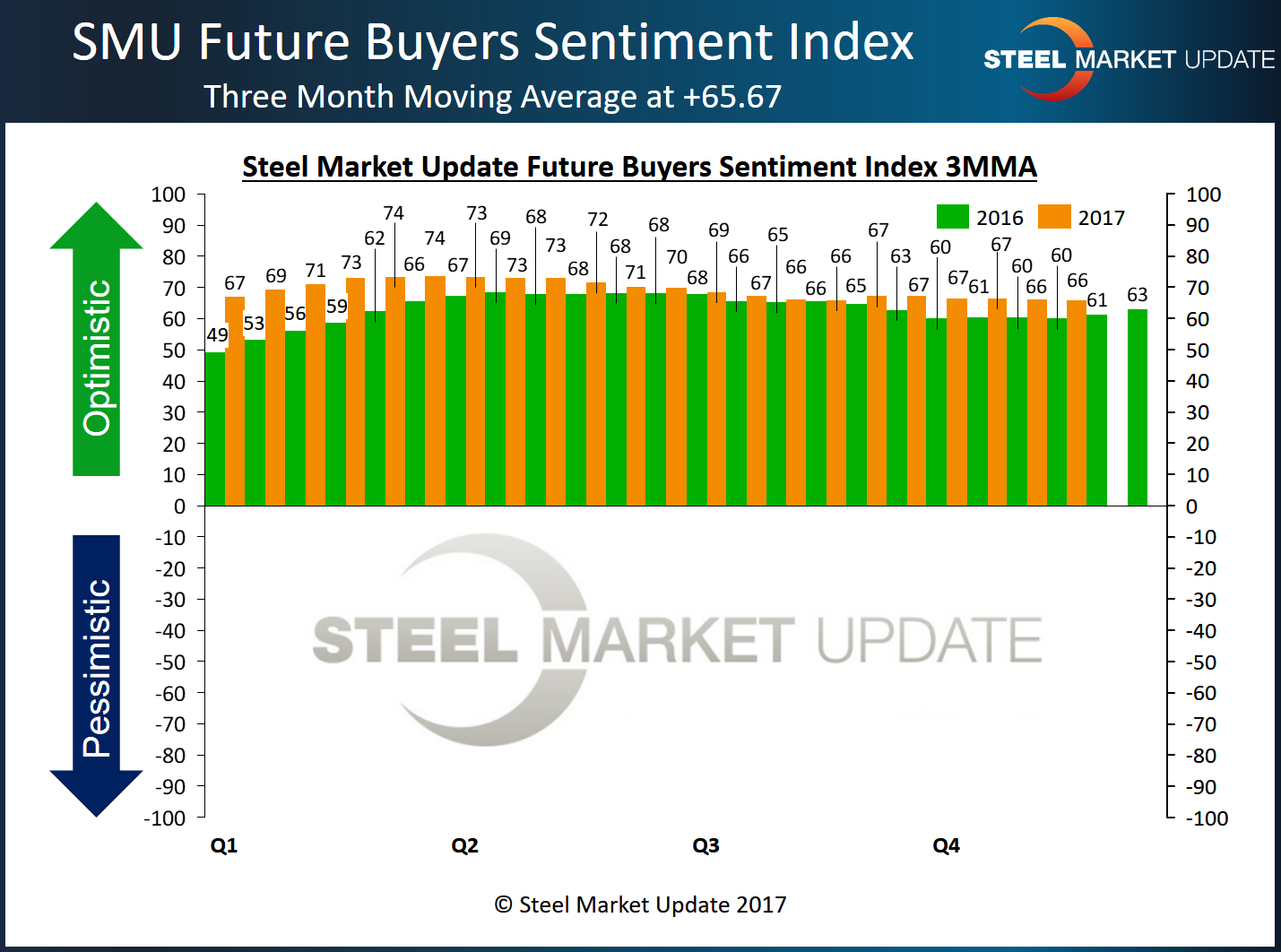

Future Steel Buyers Sentiment Index

SMU also asked respondents how they feel about their company’s ability to be successful three to six months in the future. Future Sentiment indexed as a single data point also improved to +71, up from +65 two weeks ago and about the same level as this time last year.

As a three-month moving average, Future Sentiment registered +65.67, down slightly from +66.17 a month ago. Last year in early December, the Futures Sentiment Index was a less-optimistic +61.33.

In general, steel buyers have been more optimistic, notably in the early and later parts of 2017, than in 2016, as illustrated by the charts.

“Present ‘signs’ indicate it could be a very strong first quarter and possibly holding into second quarter.” Steel Mill

“Very strong November; 20 percent higher than expected.” Manufacturer/OEM

“We remain optimistic that the first half of 2018 will be good for business.” Service Center/Wholesaler

“Bookings and customer forecasts are strong.” Steel Mill

“The first quarter looks to be very strong. All customer subsets are very busy, which is unusual this time of year. Many are not shutting down for normal holiday downtime.” Manufacturer/OEM

“Margins are compressing across the board making it more difficult every day to maintain profitability.” Service Center/Wholesaler

“We need competitors to awake to the pain of the lower margins. Until they do, profitability will be very tight.” Service Center/Wholesaler

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 36 percent were manufacturers and 47 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.