Analysis

December 8, 2017

October Heating and Cooling Equipment Shipment Data

Written by Brett Linton

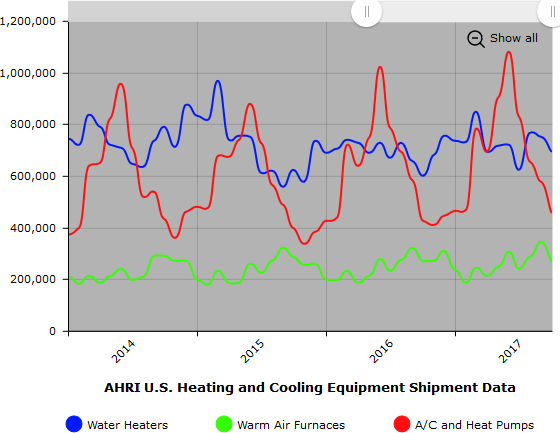

Below is the latest data released by the the Air-Conditioning, Heating, and Refrigeration Institute (AHRI) regarding residential and commercial heating and cooling equipment shipments through October 2017. You may read the press release on their website here.

Residential Storage Water Heaters

U.S. shipments of residential gas storage water heaters for October 2017 increased 12.2 percent, to 334,854 units, up from 298,405 units shipped in October 2016. Residential electric storage water heater shipments increased 15.9 percent in October 2017, to 334,901 units, up from 289,068 units shipped in October 2016.

Year-to-date U.S. shipments of residential gas storage water heaters increased 4.6 percent, to 3,633,403, compared to 3,472,245 shipped during that same period in 2016. Residential electric storage water heater shipments increased 5.0 percent year-to-date, to 3,443,093 units, compared to 3,279,208 shipped during the same period in 2016.

Commercial Storage Water Heaters

Commercial gas storage water heater shipments increased 13.1 percent in October 2017, to 7,174 units, up from 6,343 units shipped in October 2016. Commercial electric storage water heater shipments increased 102.1 percent in October 2017, to 16,365 units, up from 8,096 units shipped in October 2016.

Year-to-date U.S. shipments of commercial gas storage water heaters decreased 4.3 percent, to 78,355 units, compared with 81,837 units shipped during the same period in 2016. Year-to-date commercial electric storage water heater shipments increased 21.8 percent, to 124,230 units, up from 102,027 units shipped during the same period in 2016.

Warm Air Furnaces

U.S. shipments of gas warm air furnaces for October 2017 decreased 1 percent, to 261,794 units, down from 264,440 units shipped in October 2016. Oil warm air furnace shipments decreased 3.2 percent, to 4,827 units in October 2017, down from 4,985 units shipped in October 2016.

Year-to-date U.S. shipments of gas warm air furnaces increased 7 percent, to 2,538,683 units, compared with 2,372,017 units shipped during the same period in 2016. Year-to-date U.S. shipments of oil warm air furnaces increased 1.1 percent, to 28,249 units, compared with 27,940 units shipped during the same period in 2016.

Central Air Conditioners and Air-Source Heat Pumps

U.S. shipments of central air conditioners and air-source heat pumps totaled 455,303 units in October 2017, up 6.9 percent from 425,882 units shipped in October 2016. U.S. shipments of air conditioners increased 7.6 percent, to 292,559 units, up from 271,913 units shipped in October 2016. U.S. shipments of air-source heat pumps increased 5.7 percent, to 162,744 units, up from 153,969 units shipped in October 2016.

Year-to-date combined shipments of central air conditioners and air-source heat pumps increased 6.5 percent, to 6,900,365, up from 6,476,347 units shipped in October 2016. Year-to-date shipments of central air conditioners increased 5.9 percent, to 4,621,922 units, up from 4,365,690 units shipped during the same period in 2016. The year-to-date total for heat pump shipments increased 7.9 percent, to 2,278,443, up from 2,110,657 units shipped during the same period in 2016.

Below is a graph showing the history of water heater, warm air furnace, and air conditioner shipments. You will need to view the graph on our website to use it’s interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.