Market Segment

February 27, 2018

Solid First Half for North Star BlueScope

Written by Sandy Williams

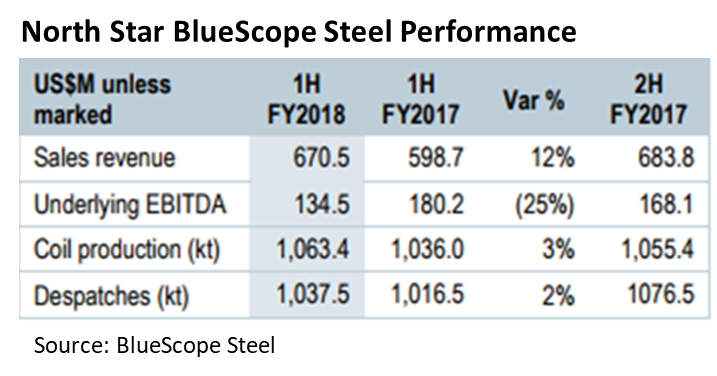

North Star BlueScope sales for the first half of FY 2018 totaled $670 million from shipments of 1,037,500 metric tons. The 12 percent year-over-year gain in sales revenue was due to higher steel prices and volume.

Underlying EBIT fell 31 percent to $113.3 million in the first half of FY 2018 as prices receded from historical highs. Steel spreads were in the range of $280-$290 per ton during the first half.

Spreads are expected to increase by $40 per ton in the second half of the fiscal year along with shipment volumes. Upward pressure is expected on electrode, refractory and alloy costs in the rest of 2018 and into 2019. North Star BlueScope continues to operate at 100 percent capacity.

Australian parent company BlueScope Steel is working hard to have Australia exempted from any Section 232 action that would impact its U.S. businesses, North Star BlueScope and its coating business Steelscape. During the G20 meetings in July, Prime Minister Malcom Turnbull was assured that Australia would not be included in any steel restrictions, but that promise appeared to weaken over time. Turnbull returned from a meeting with President Trump in Washington last week with renewed hope for exclusion.

BlueScope CEO Mark Vasalla said the company has “put its best foot forward” to ensure a positive outcome regarding Section 232, but “nothing is firm until it is decided.”

“The U.S. is in an interesting position where it is effectively short steel,” said Vasalla, “but they are talking Section 232 sanctions, as you are aware. So that is a positive outcome for us. Our read at this stage is we see it as a positive for the two million tons of steel we make out of North Star.”

Risks would mostly be associated with BlueScope’s joint venture Steelscape that imports steel from Australia to transform in its coating processes. Vasalla said the U.S. West Coast is basically a 100 percent import market.

“Even though we are talking about a negative impact for Steelscape,” he said, “one could only imagine that if prices are impacted on the West Coast, then prices will be impacted for everybody. So I expect what we would see in Steelscape is that its competitors would have to increase prices on the back of increased trade costs. So in some ways, it’s probably a zero sum game for Steelscape, almost irrespective of the Section 232 outcome.”

BlueScope Steel says strengthening its antidumping measures in Australia is important, particularly in light of any Section 232 action. “Australia needs to have an effective and very solid antidumping ratio because if materials are displaced from North America, they need to find a home,” Vasalla commented.

BlueScope is eager to grow its business in the United States, especially in coated products, but Vasalla said it is too early to give any specifics. Energy prices are much more reasonable in the U.S. than Australia, making it an attractive location for investment. “North America is now an obvious place for us to look,” he said. “We’re not in any great rush to do anything.”