Prices

March 4, 2018

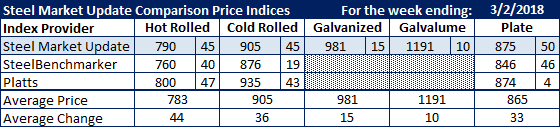

Comparison Price Indices: Big Jump Last Week

Written by John Packard

Flat rolled steel prices surged this past week on all of the steel indexes followed by Steel Market Update. Benchmark hot rolled reached the $800 per ton mark ($40.00/cwt) on Platts with SMU’s HRC index close behind at $790 per ton. SteelBenchmarker, which only produces its index twice per month, was trailing way behind, raising their index by $40 per ton since the last time they reported. But at $760 per ton, they seem to be out of the mainstream.

Cold rolled jumped over the $900 per ton ($45.00/cwt) mark and hit $935 per ton ($46.75/cwt) on Platts, which for them was up $43 per ton during the course of the week. SMU at $905 per ton was also up big at +$45 per ton, while SteelBenchmarker was up $19 and trailed way behind at $876 per ton.

SMU had galvanized .060″ G90 up $15 to $981 per ton and Galvalume .0142″ AZ50 Grade 80 up $10 to $1,191 per ton. We were hearing over the weekend of much higher numbers being offered by the domestic mills and we expect spot numbers on GI and AZ to rise in the coming week.

Platts and SMU were close on plate with SMU’s $875 per ton being one dollar higher than Platts’ $874 per ton. SteelBenchmarker, using an FOB price as opposed to delivered, came in at $846 per ton.

SMU Note: Galvanized prices include $86 in extras for a .060″ G90 product. Galvalume prices include $291 in extras for a .0142” AZ50 Grade 80 product.

FOB points for each index:

SMU: Domestic Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Plate price FOB points are different for each of the indexes:

SMU: FOB Delivered to the Customer (includes freight)

Platts: FOB Midwest Mill (includes freight)

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers, we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.