Prices

April 18, 2018

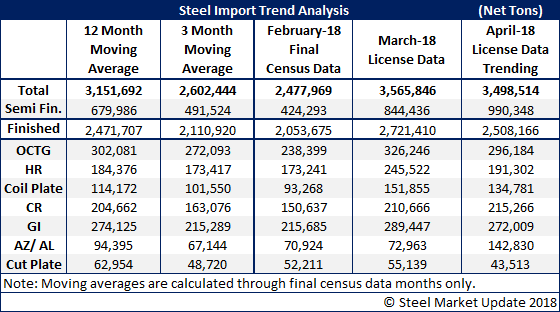

April Steel Imports Trending Toward 3.5 Million Ton Month

Written by John Packard

The U.S. Department of Commerce updated their license data for the months of March and April, and we now have data through April 17. Based on the data just released, both March and April appear poised to come in around 3.5 million net tons. The largest importers continue to be the domestic steel mills as they are the only ones that import semi-finished steels (slabs and billets), which are then rolled into sheet, longs or pipe and tube products.

Finished steel imports are trending toward 2.7 million net tons in March and 2.5 million net tons for April. Our graph below puts the 12-month moving average at just shy of 2.5 million net tons and the 3-month moving average at 2.1 million net tons (based on final census months only).

A reminder to our readers, the April import numbers shown below are produced by taking the daily license rate for the first 17 days of the month and then applying that rate to the full month. That gives us the “trend,” and as the month progresses we will be better able to see whether the trend is lower or higher than the actual census numbers, which are produced well after each month has closed.

Listed below are the countries that currently have exclusions and what they have already requested for licenses for the month of April 2018 (all products). We are not extrapolating a full month number. We are providing the data as collected by the Department of Commerce and reported on their website:

• Canada = 293,000 net tons

• Mexico = 172,000 net tons

• Korea = 201,000 net tons

• Australia = 24,000 net tons

• Argentina = 8,000 net tons

• Brazil = 285,000 net tons

• EU = 219,000 net ton

Total of Above= 1,202,000 net tons (trending toward 2.2 million of the 3.5 million shown in table)

The European Union countries are: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Spain, Sweden and the United Kingdom.