Logistics

May 6, 2018

Truck Driver Shortage Slowing Freight Across U.S.

Written by Sandy Williams

Shortage of truck availability and drivers is putting the squeeze on freight shipments in May. Anecdotal comments in steel earnings reports indicate mills and distribution centers are having difficulty finding trucks to move their products and higher freight costs are increasing operating costs.

Steel Market Update looks at some of the current issues facing freight shipments by ocean, rivers, rails, and roads.

Seaborne Freight

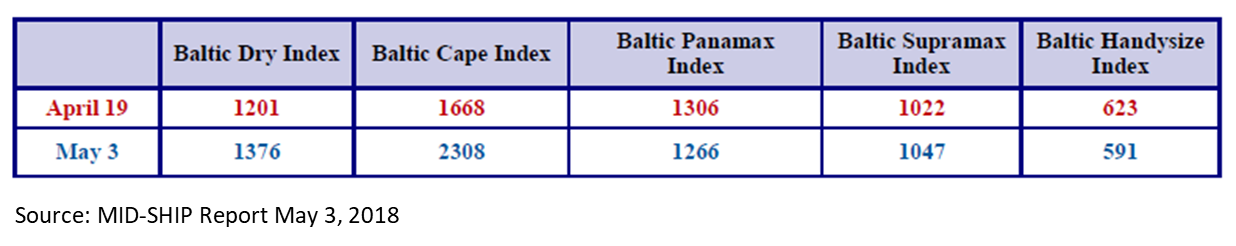

Trade tariffs and resulting countermeasures are adding uncertainty to the freight market. MID-SHIP says rates have increased in the past three weeks for the Capesize market. With rates up to $33,000 per day for the largest vessels. Panamax and Supramax rates are stabilizing, but rates in the Handysize market remain low.

Rivers

High water on the nation’s rivers is resulting in tight supply of barges and higher spot market rates. “Some barge lines are sold out in short term and others are not quoting additional spot business unless it fits well into their desired traffic patterns,” said MID-SHIP. “Longer transit times are also creating significant supply chain challenges for some shippers. In some cases this situation is compounded by the tight supply of railcars and trucks being experienced throughout the US.”

Chicago/ Illinois / Upper Miss – Peoria and Lagrange Locks were closed last week for maintenance issues and intermittent closures to Peoria Lock will continue from May 8 through May 10. Intermittent lock closures are also expected on Upper Mississippi Lock 11 during the first two weeks of May as four gates are replaced. Main chambers will be closed at Dashields on May 8 and at Emsworth Lock on June 6, restricting one barge at a time through the auxiliary locks. Slower transits and 1-2 week delays may occur during the time period. Reduced tow sizes are in effect on the Lower Mississippi causing congestion and delays of 24-72 hours, says MID-SHIP. As water recedes, normal tow size is predicted to resume around the middle of May.

Trucking

The flatbed load-to-truck ratio was 108 loads per truck, exceeding 100 loads per truck for five consecutive weeks. Flatbed volume surged last week led by Houston, Ft. Worth, and Cleveland, but the shortage in flatbeds was seen across the entire U.S. Flatbed spot rates increased another cent per mile last week and is now at a national average rate of $2.65 per mile, the highest ever recorded at DAT Trendlines.

DAT Carrier News editor explained, “Now, that doesn’t necessarily mean that there are literally more than 100 loads for every flatbed trailer. Brokers repost loads when they have trouble finding trucks, and flatbedders are often less likely than dry van and reefer truckers to post their equipment to the load board. For those reasons, flatbed load-to-truck ratios are often elevated. But we can still use the ratio as a way to measure pressure in the market – and when the ratio goes up or down, rates almost always follow.”

The American Trucking Association reported the advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index declined 1.1 percent to 110 in March after easing from a revised 0.8 percent in February. The SA Index was 6.3 percent higher than March 2017. The index without seasonal adjustment, representing the change in tonnage actually hauled by fleets during the month, was up 12.9 percent from February.

Shortage of drivers is pushing up freight costs as well as increasing retail prices for consumers. ATA says currently the industry is in need of about 51,000 drivers and projects the shortage will increase to more than 100,000 drivers by 2022.

“We’ve probably never had a situation like we have today, where the demand is strong and capacity is constrained,” says ATA Chief Economist Bob Costello.

Railroads

Total U.S. weekly rail traffic was 551,498 carloads and intermodal units, up 5.9 percent in the week ending April 28, 2018, compared with the same week a year ago. The American Association of Railroads reports total carloads for the week were 266,453 carloads, up 3.7 percent compared with the same week in 2017, while U.S. weekly intermodal volume was 285,045 containers and trailers, up 8.1 percent compared to 2017.

Combined carloads and intermodal originations during the month of April increased 5.1 percent to 2,250,026 from the same month a year ago.

“Total U.S. rail traffic so far this year is a shade below where it was in 2015, but otherwise is higher than it’s been in the last ten years” said AAR Senior Vice President of Policy and Economics John T. Gray. “Additionally, 15 of the 20 commodity categories we track had higher carloads in April 2018 than in April 2017, the most since January 2015. That’s good news for railroads and good news for the economy.”