Market Data

June 3, 2018

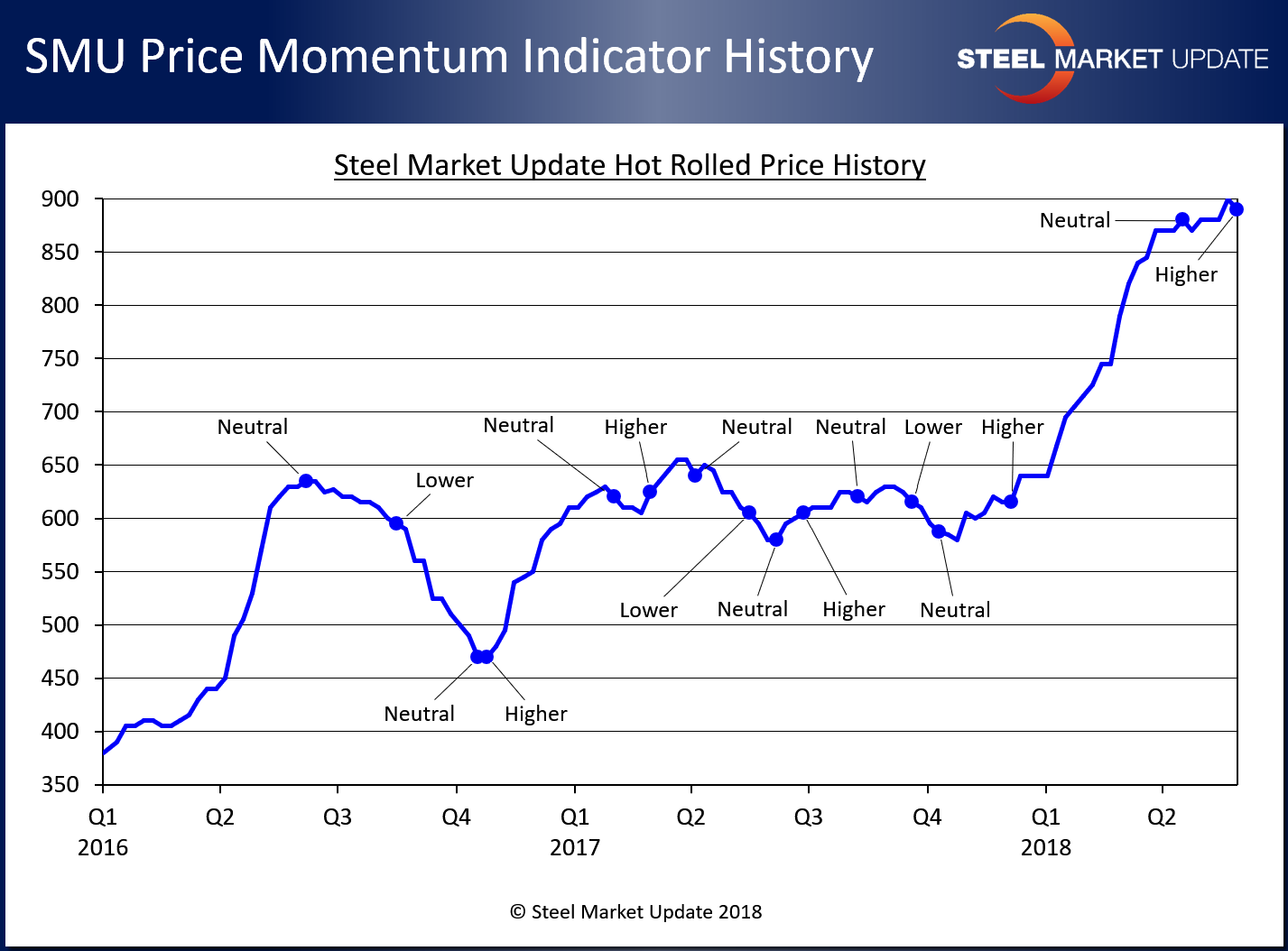

SMU Price Momentum Indicator Pointing Toward Higher Steel Prices

Written by John Packard

With the Trump administration eliminating the Section 232 tariff exclusions for Canada, Mexico and the European Union, it is our opinion that the squeeze on supply coupled with higher prices due to the tariff will provide cover for the domestic steel mills to raise flat rolled and plate steel prices.

SMU last moved our Price Momentum Indicator six weeks ago when we went from “Higher” to “Neutral.” As we explained at that time, we saw the market as being in transition, but we could not be certain in what direction flat rolled steel prices would move. At that time, we kept plate steel price momentum at “Higher” as there was, in our opinion, more upward pressure on plate prices than what we were seeing on flat rolled.

![]() We are seeing strong demand on hot rolled products and a tightening of foreign steel offers, which we believe will impact steel prices to the upside over the next 30-60 days. Here is what one of the large hot rolled service centers had to say about availability of HRC:

We are seeing strong demand on hot rolled products and a tightening of foreign steel offers, which we believe will impact steel prices to the upside over the next 30-60 days. Here is what one of the large hot rolled service centers had to say about availability of HRC:

“I believe HR availability specifically will become a real concern in the third quarter, and possibly beyond. The energy demand spike is putting real pressure on the HR and plate markets, and it looks to worsen in the months ahead. HR imports were already anemic prior to 232 and will drop even further. Expected outcomes for 232 OCTG imports point toward more restrictions, and domestic mills will maximize production of this HR product given its profitability. Users will not be able to satisfy their needs between domestic OCTG and that from ‘quota’ countries, and they will be forced to buy OCTG tons with a 25 percent tariff attached.

“In addition, domestic mills like Nucor and SDI will be directing more HR into downstream units like CR/Galv mills and Pipe/Tube subsidiaries.”

Our scrap sources are advising that domestic scrap prices will remain stable to slightly higher during the month of June. Prime grades of scrap will be short come July and into August due to the large OEM shutdowns for vacations and model year changeovers.

The construction markets continue to be quite strong, and so far there has been no negative fallout from the aggressive trade stance taken by the Trump administration.

It is SMU’s opinion there will be upward pressure on flat rolled and plate steel prices over the next 30-60 days.

We welcome your opinions, which can be sent to: info@SteelMarketUpdate.com.