Market Data

June 12, 2018

New SMU Report Identifies CR Sheet Imports by Product Detail

Written by Tim Triplett

Premium subscribers to Steel Market Update receive reports on imports broken down into district of entry and source nation. This new report from SMU takes the analysis to the product detail level. Our rationale is that the more information steel buyers have about product coming into their region, the better job they can do of negotiating with suppliers.

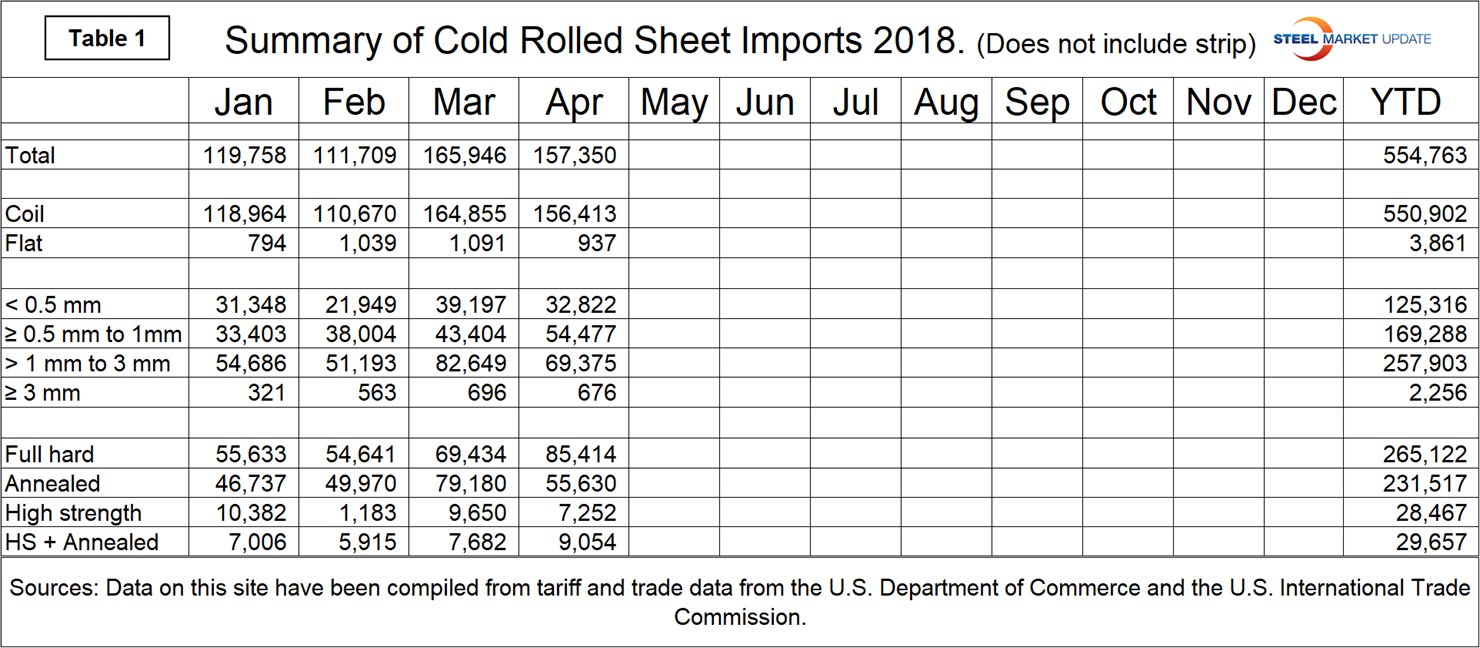

Using U.S. International Trade Commission (USITC) data, SMU has taken the import tonnage of cold rolled sheet and broken it down into coil and leveled, then breaks it out into four thickness ranges and identifies how much is full hard, annealed and high strength. Finally, this analysis is taken to the district-of-entry level. This report does not include strip. Total year-to-date sheet and strip imports through April were 554,763 and 15,576 metric tons, respectively.

Table 1 (click to enlarge) is a monthly summary and year-to-date 2018 showing each of these conditions.

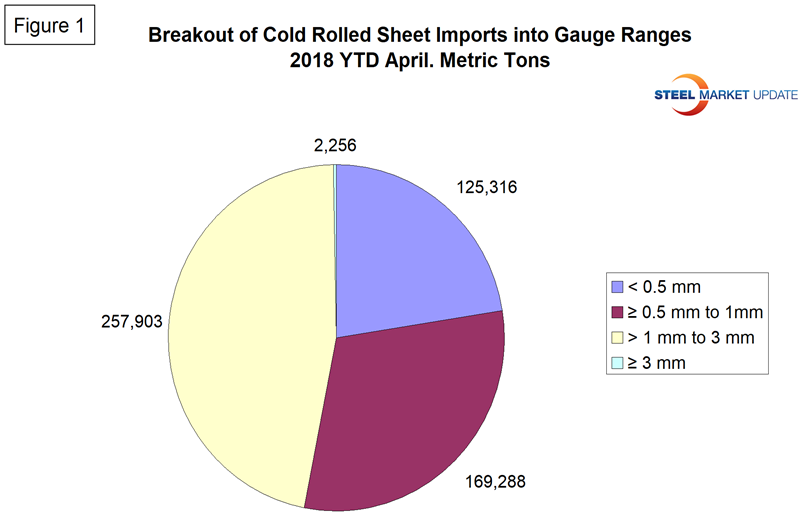

Figure 1 breaks the year-to-date cold rolled sheet tonnage down into the four gauge ranges that are identified in the HTS codes.

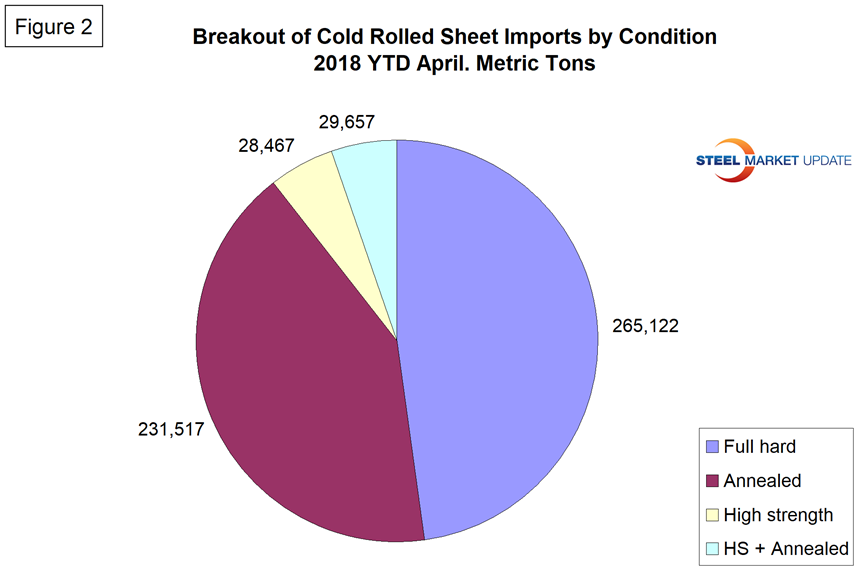

Figure 2 does the same thing for condition. It identifies the volume of full hard, annealed, high strength and high strength annealed.

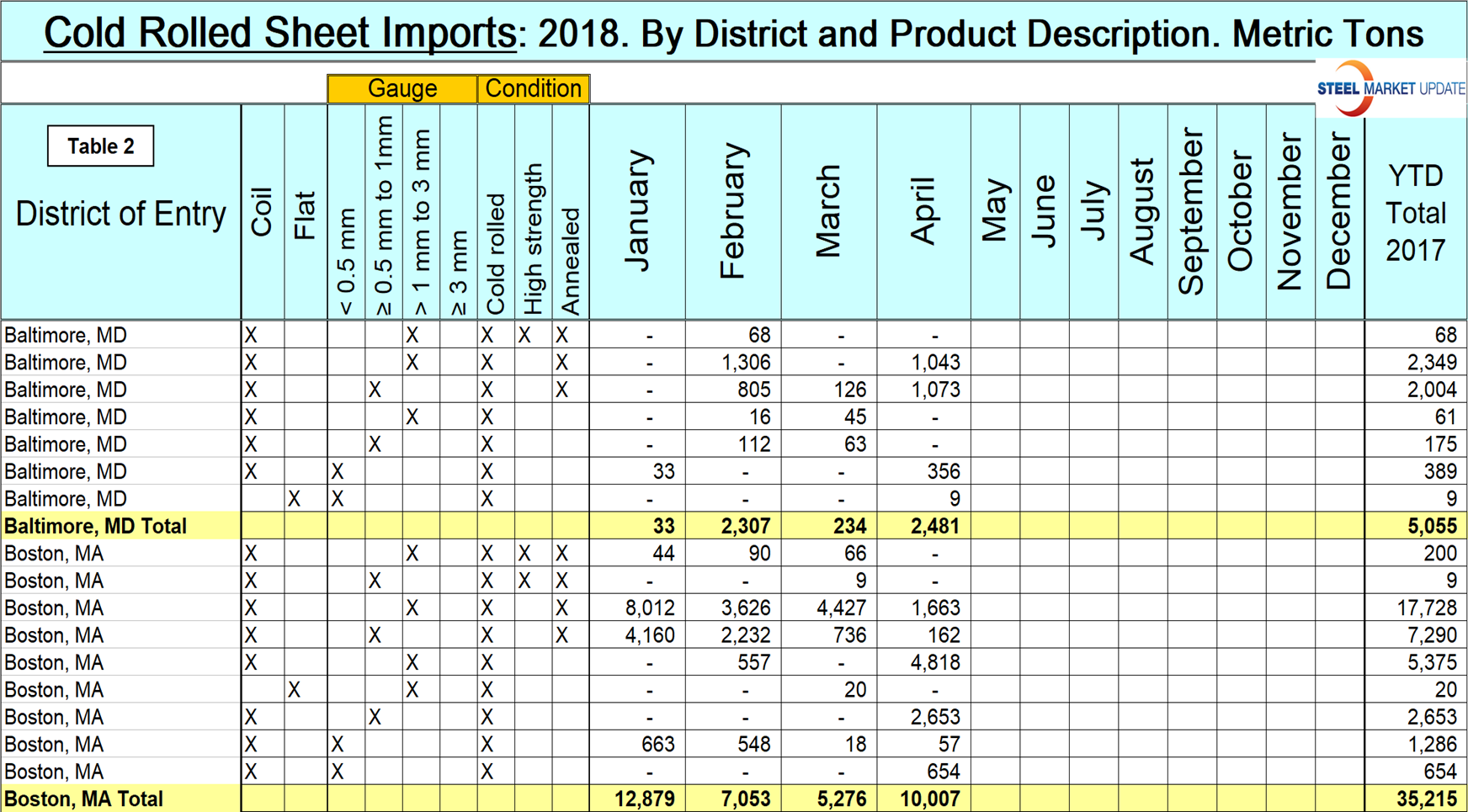

Table 2 is a small part of a sheet that shows detail for every region in the U.S. and is available in the premium section of our website. It shows the product detail of cold rolled sheet imports by district of entry. For example, the largest tonnage item entering Boston in the first four months of 2018 was 1-3 mm thick, annealed. How much of the same product came into Houston for the year? The answer is 18,589 tons, which was the highest volume item into that district.

Note: This data was accessed through the USITC database. All steel traded globally is classified by the Harmonized Tariff System (HTS). The HTS code has 10 digits. The first six are globally universal. The last four are used at the discretion of the nations involved in a particular transaction and are the basis of this report. The way the U.S. uses the last four digits to define products may be different from other nations’ product classification.