Market Data

January 29, 2019

SMU Trends Analysis: Service Center Spot in Limbo

Written by John Packard

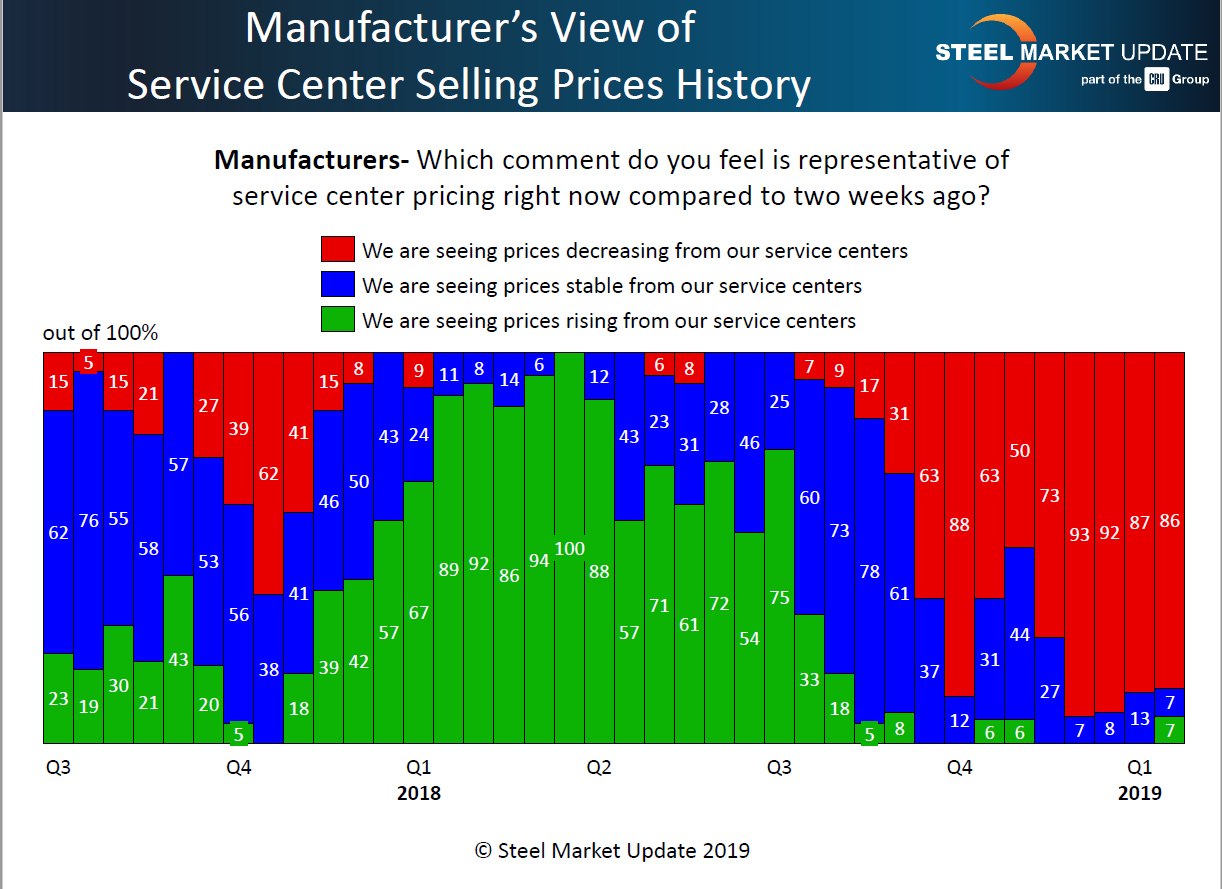

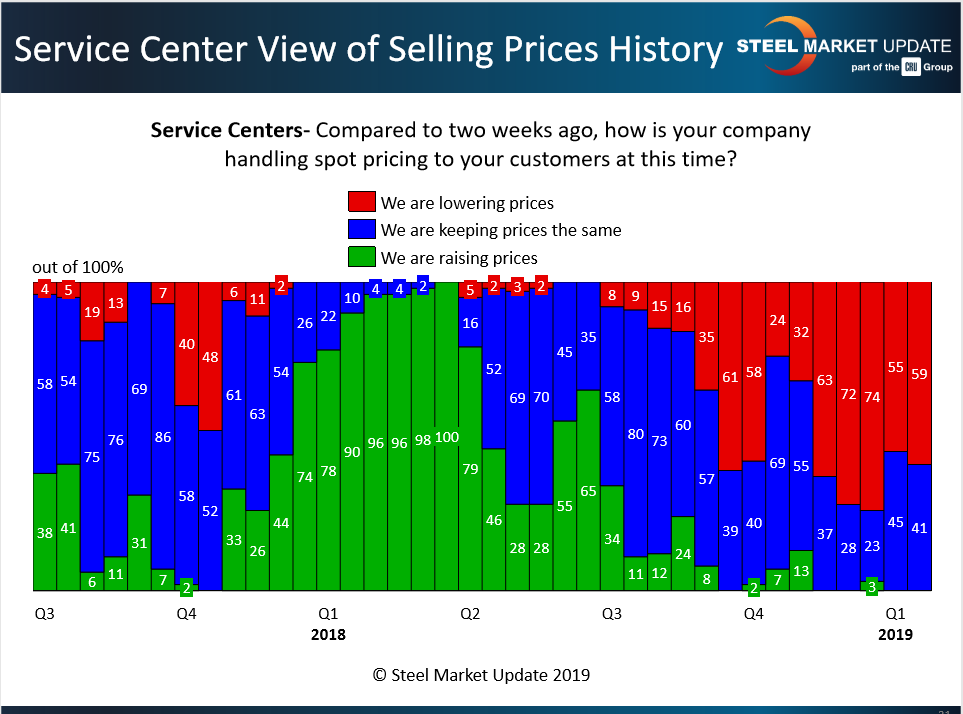

Last week, Steel Market Update conducted our mid-January flat rolled and plate steel market trends analysis. One of the areas of interest to SMU was how manufacturing companies and service centers would peg spot pricing coming out of the distributors to their end customers.

Prior to the New Year, just below 75 percent of the service centers reporting to SMU told us their company was lowering spot prices (compared to two weeks earlier). The manufacturing companies were almost unanimous with over 90 percent reporting their distributor suppliers as lowering spot pricing. We were close to “capitulation,” the point at which so many service centers were lowering spot prices, and in the process devaluing their inventories, that they would begin to support higher prices. Eventually, the distributors hope the steel mills raise prices (as they did this week) and attempt to break the downward cycle. So, are we at the point of capitulation?

Manufacturers Still Reporting Lower Spot Prices

If you were to listen to the manufacturing companies only, you would believe the service centers are giving steel away and at the point of capitulation. For the past two months, going back to the beginning of December 2018, manufacturing companies have been almost unanimous in their reporting. SMU found 86 percent of the end-users reporting distributors as lowering spot pricing. This is slightly lower than the 93 percent reported at the beginning of December, but not enough to say the trend (at least from the manufacturers perspective) has been broken.

Service Centers in a State of Limbo

Service centers, on the other hand, have been all over the board since Nucor tried to raise prices in early fourth-quarter 2018. We have seen the percentages of distributors reporting lower spot prices wander from 63 percent in mid-November 2018 to a high of 74 percent in mid-December. Since then, the percentage has dropped back to the 59 percent level measured this past week.

Most of the major mills have announced a $40 per ton increase ($2/cwt) on flat rolled products over the past eight days. With the yo-yoing of spot pricing at the service center level, the uncertainty will make it difficult for the domestic mills to collect higher prices right now, if past experience with our surveys is any indication. We will need to watch how the service centers react to market forces over the next few weeks to see if a clearer trend becomes apparent.