Market Segment

February 8, 2019

NLMK USA Has Great Year, Weaker Q4

Written by Sandy Williams

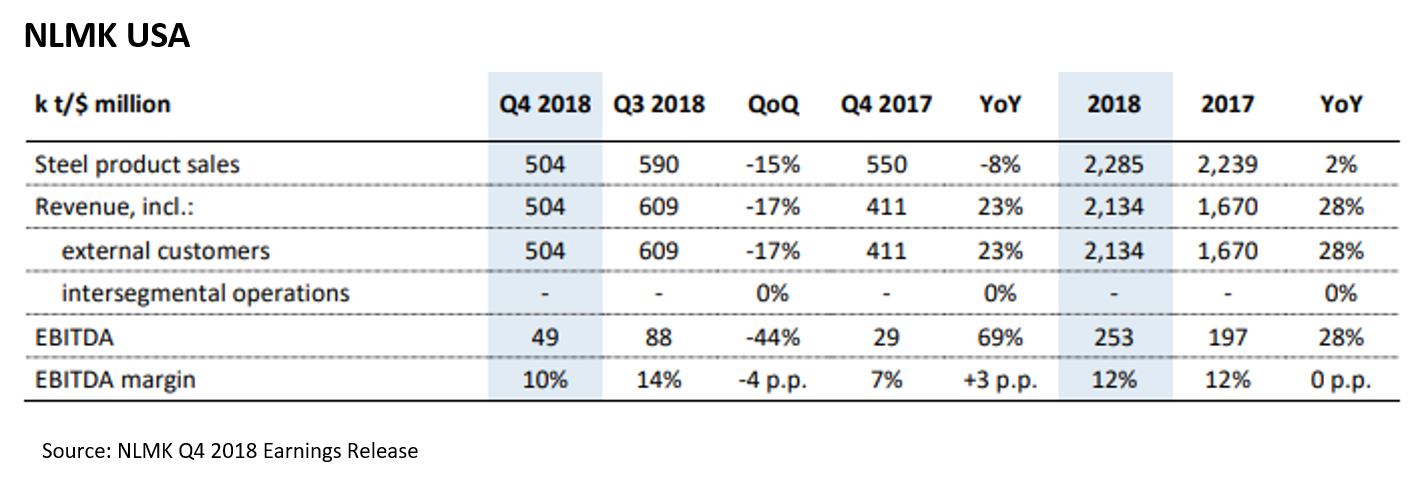

Sales at NLMK USA fell 15 percent from third- to fourth-quarter 2018 on expectation of lower steel prices. Shipments dropped 500,000 metric tons from 590,000 tons, sequentially. The decrease in shipments, combined with a 3 percent decline in average price, led to sales falling 17 percent to $500 million.

On a yearly basis, NLMK USA performed well. Shipments were up 2 percent year-over-year to 2.3 million metric tons and revenue increased 28 percent to $2.213 billion. “Prices surged to abnormal levels spurred by Section 232,” wrote NLMK. Slab sales from NLMK Group to its U.S. segment decreased during the year due to trade restrictions.

NLMK expects a strong U.S. economy to keep demand firm during the first quarter and to offset any drop in pricing. Capacity additions are expected to determine price movements in the U.S.

NLMK Group CFO Shamil Kurmashov commented on 2018 company results: “In 2018, demand for steel continued to recover, coupled with a rise in protectionism in key markets. In this context, NLMK Group’s flexible business model that helped it secure its presence in key sales markets enabled the company to grow its sales by 7 percent yoy (by 1.1 MT) to 17.6 million MT, hitting an all-time high for the company. NLMK Group retained its leadership on the Russian market in terms of steel output and consolidated its positions on global markets. Revenue grew by 20 percent yoy to $12.0 billion; NLMK’s EBITDA increased by 35 percent to $3.6 billion, while its EBITDA margin grew to 30 percent (+4 p.p. yoy).”

NLMK expects steel production and shipments to be flat in the first quarter.