Government/Policy

February 19, 2019

CAR: Auto Tariffs Would Cause “Substantial Harm” to Economy

Written by Sandy Williams

Section 232 tariffs on imported autos and auto parts would cause “substantial harm” to the U.S. economy, says a new report by the Center for Automotive Research.

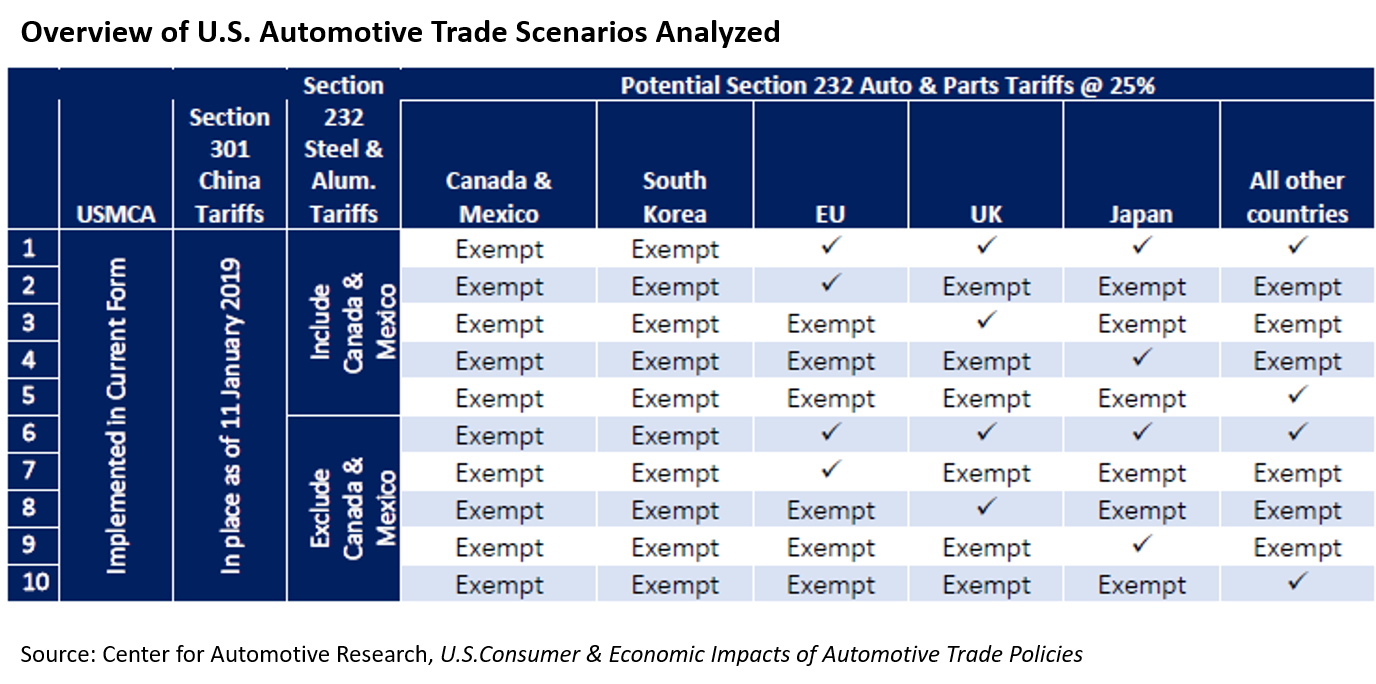

CAR analyzed the impact of 25 percent auto tariffs in 10 policy scenarios, concluding that, in all cases, the outcomes “are all profoundly negative for consumers, for new vehicle dealership revenue and employment, and for overall U.S. economic output and employment levels.” In every scenario, average vehicle prices rise and sales fall.

CAR used five possible tariff versions in their analysis:

- A broad-based tariff, where exemptions are granted only to Canada and Mexico, by the existing and already in-force side letters to the USMCA, and South Korea, because that country has successfully negotiated exemptions to prior protectionist trade measures;

- A narrowly-focused tariff that applies only to vehicles and parts imported from the (post BREXIT) European Union;

- A narrowly-focused tariff that applies only to vehicles and parts imported from the United Kingdom;

- A narrowly-focused tariff that applies only to vehicles and parts imported from Japan; or

- A broad-based tariff, but with exemptions for Canada, Mexico, South Korea, the EU, the UK and Japan.

Added into the mix were the USMCA, Section 302 tariffs, and two scenarios for the Section 232 steel and aluminum tariffs.

In CAR’s worst-case scenario where the USMCA is implemented in its current form, other tariffs are unmodified, and Canada, Mexico and South Korea are exempt from auto tariffs:

- a total of 366,900 U.S. jobs will be lost;

- U.S. light-duty vehicle prices will increase by an average of $2,750 per vehicle;

- U.S. new light-duty vehicle sales will drop by 1,319,700 units per year; and

- many consumers will be forced into the used car market.

Revenue at new vehicle dealerships would fall in every scenario, ranging between $6.1 billion and $46.3 billion in total. Likewise, employment losses would accrue in the range of 10,700 to 77,000 jobs.

Although foreign-made autos will be hit hardest, U.S.-made vehicles would not be spared from higher prices, increasing by an estimated $1,900 per vehicle. The jump in the U.S. auto price is due to the fact that no American-made car contains solely American-made parts. The average vehicle produced in the United States relies on 40 to 50 percent imported parts and component content, according to 2018 data from the National Highway Traffic Safety Administration.

U.S. GDP is estimated to fall between $6.0 billion and $30.4 billion with economy-wide employment plummeting in a range of 71,200 to 366,000 jobs across the 10 scenarios.

“Across all these policy scenarios, the impact on the U.S. new vehicle market and the broader U.S. economy is substantial and nearly entirely determined by the severity of the potential Section 232 tariffs on imported autos and auto parts,” stated CAR in the report.