Market Data

February 21, 2019

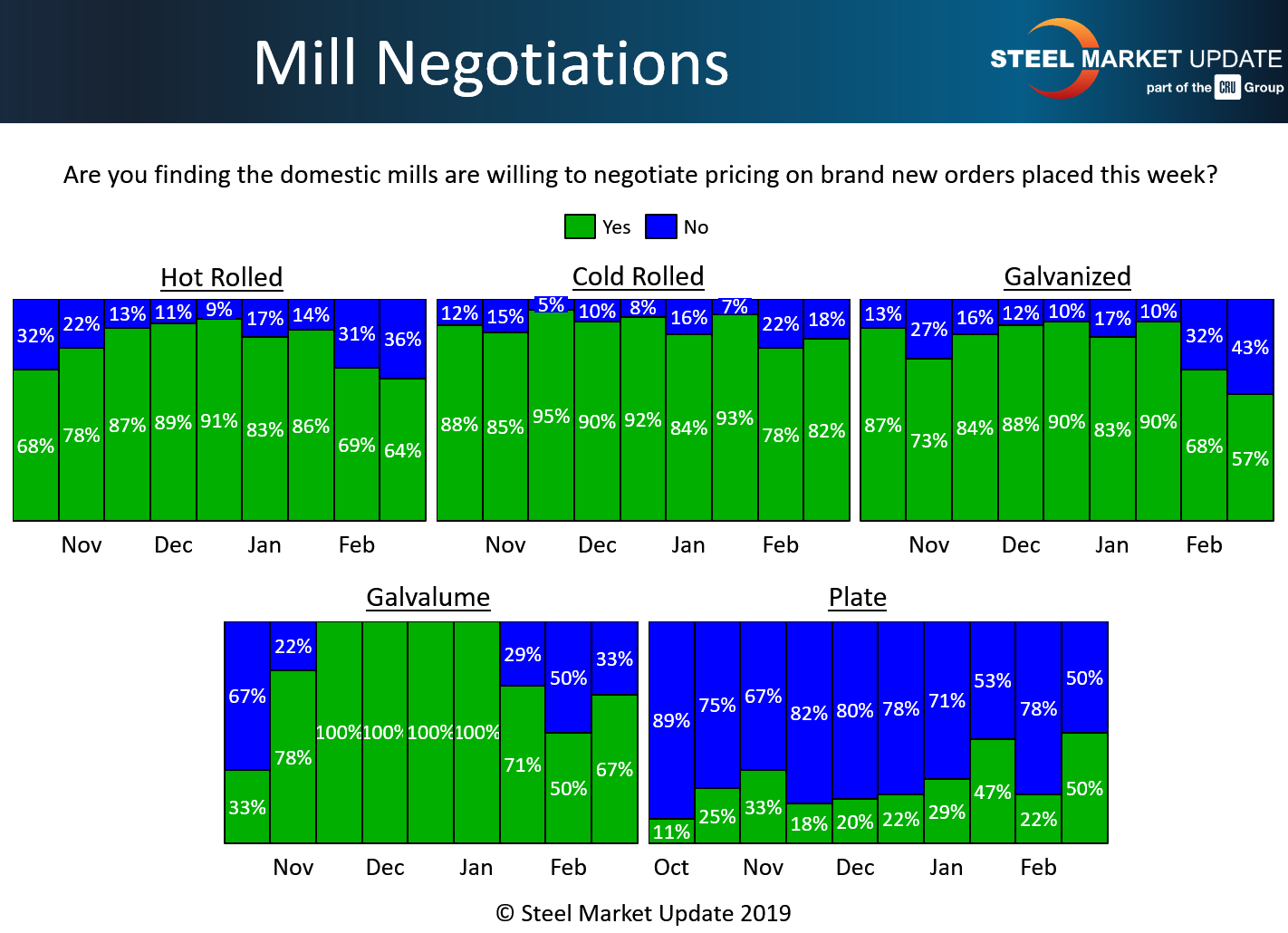

Steel Mill Negotiations: No Clear Trend Yet

Written by Tim Triplett

With steel prices in transition following last month’s price increase announcement from the major mills, the tone of negotiations between producers and buyers appears mixed. The majority of buyers report the mills are still willing to talk price on all products but plate, but fewer in the high-demand categories of hot rolled and galvanized. Most buyers responded to Steel Market Update’s questionnaire prior to the second round of price increases announced this week. SMU will be watching closely for changes in mill negotiations and lead times in the next market canvas.

In the hot rolled category, 64 percent of buyers responding to SMU’s latest questionnaire said they have found mills willing to negotiate on price. That percentage is down from 69 percent two weeks ago and from 86 percent in mid-January. More than a third of the buyers, 36 percent, say the mills are now holding the line on HR.

Talks are little changed in the cold rolled segment, where 82 percent said they have found mills open to price negotiation, up from 78 percent two weeks ago. Just 18 percent reported current mill prices on cold rolled as firm.

In the galvanized sector, 57 percent said the mills were open to price discussions, down from 68 percent two weeks ago and 90 percent in mid-January. About 43 percent of GI buyers report that prices are nonnegotiable. For Galvalume, one-third of the buyers say the mills are unwilling to negotiate. In the plate market, it is about a 50-50 proposition that mills will talk price.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.