Prices

June 18, 2019

CRU: Iron Ore Prices Rising Again on Low Port Inventories

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

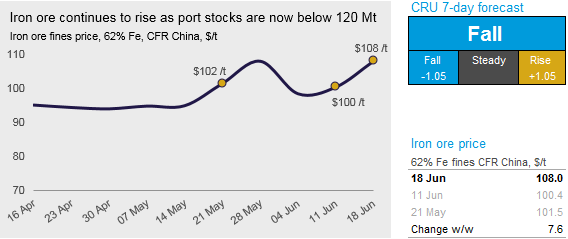

Iron ore prices have continued ascending in the past week as low port inventories in China have forced steelmakers to turn to seaborne cargoes. On Tuesday, June 18, CRU assessed the 62% Fe fines price at $108.00 /t, a $7.60 /t increase w/w.

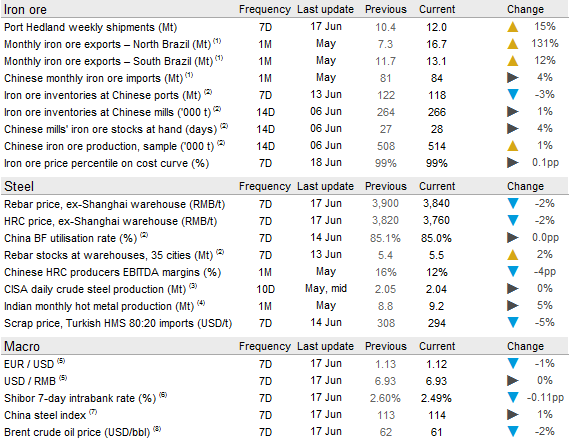

Seaborne supply has been particularly strong recently, with weekly shipments from Port Hedland registering a new 2019 high at 12.0 Mt. In June, both BHP and FMG have shipped well above their nameplate capacities as they have registered annualized shipment rates of 312 Mt and 203 Mt, respectively, so far this month. This is expected considering both these companies are now in the final two weeks of their financial year. Shipments from Brazil, including Vale’s Northern System and the Brucutu mine, recovered in May and those volumes are likely to arrive at Chinese ports in the next few weeks.

In China, the ports stocks have continued to decline and are now below 120 Mt for the first time since January 2017. While previous 2019 declines were caused by falling Australian inventories, those volumes have been flat in the past three weeks and the most recent drop is explained by destocking of Brazilian iron ore.

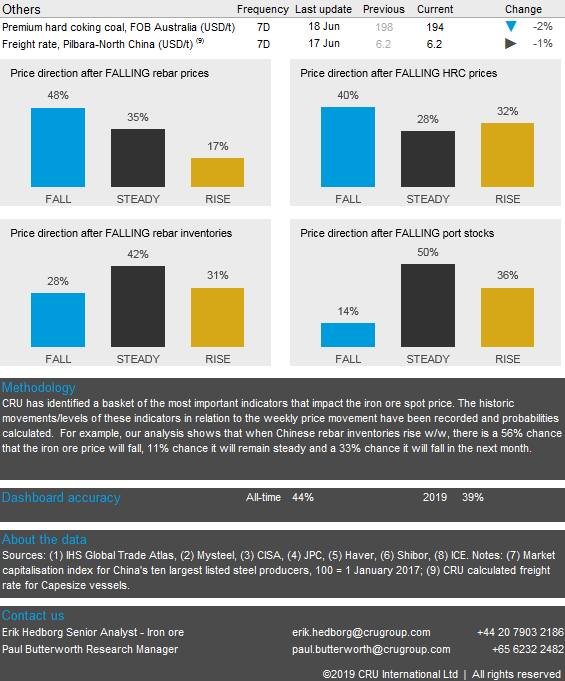

Steel prices have continued to decline in the past weeks and we expect the downward trend to continue. At the same time, rebar inventories in China have risen slightly w/w, which is another bearish signal for steel demand and iron ore prices. Our analysis below points towards falling prices in the coming week as we expect the weakness in the steel market to soften iron ore demand.