Market Data

August 11, 2019

SMU Market Trends: Will the Mills’ Pricing Power Prove Short-lived?

Written by Tim Triplett

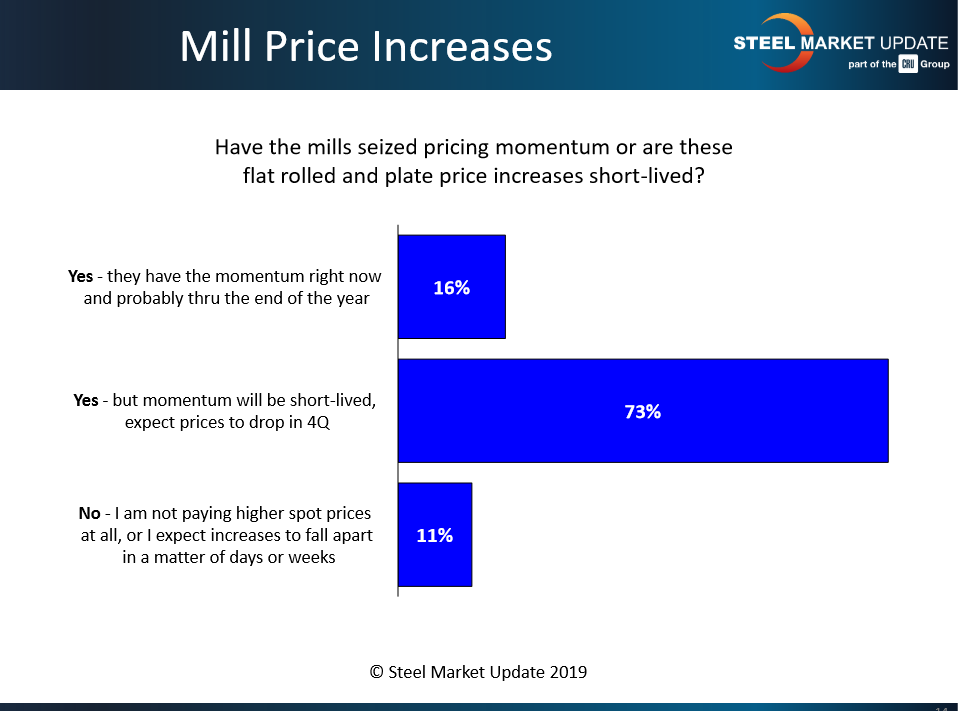

The mills may have the momentum today, but three out of four buyers responding to Steel Market Update’s market trends questionnaire this week expect that pricing push to be short-lived.

About 73 percent said they expect steel prices to drop in the fourth quarter. Another 11 percent said they are not paying higher spot prices at all, even after the string of recent mill price increases. In fact, they expect the uptrend in prices to end in a matter of weeks. The remaining 16 percent expect the mills to maintain their pricing momentum at least through the end of the year.

The longevity of the uptrend in pricing depends in large part on the support the mills get from distributors. Nine out of 10 service centers tell Steel Market Update they are having trouble passing along the higher prices to their customers. Said one service center exec, “Our customers are laughing out loud regarding the increase.”

Following are other buyers’ comments:

“We’re getting some of the increases, not all, around $30-$40.”

“These increases are just an attempt to stop CRU prices from falling any further as many auto contracts are tied to CRU.”

“I think they have pulled orders ahead and we will see some price reduction in late October or November. But I don’t think it will get back to the bottom numbers we saw in July.”

“We feel orders were pulled ahead, and beyond September mills may be challenged to keep order books full.”

“It’s all posturing before contract season. Without supply-side discipline, demand fundamentals will kick in. Also, foreign pricing has already peaked, so any domestic tailwind will quickly become muted.”

“One theory going around is that the domestic mills are smarter today and will manage capacity to ensure that the prices don’t drop. That would be a first.”

“Until the morons in the White House begin to realize their trade wars are not being borne by the Chinese and in fact are inflicting pain on domestic industries and ultimately the U.S. consumer, I see a recession on the horizon.”

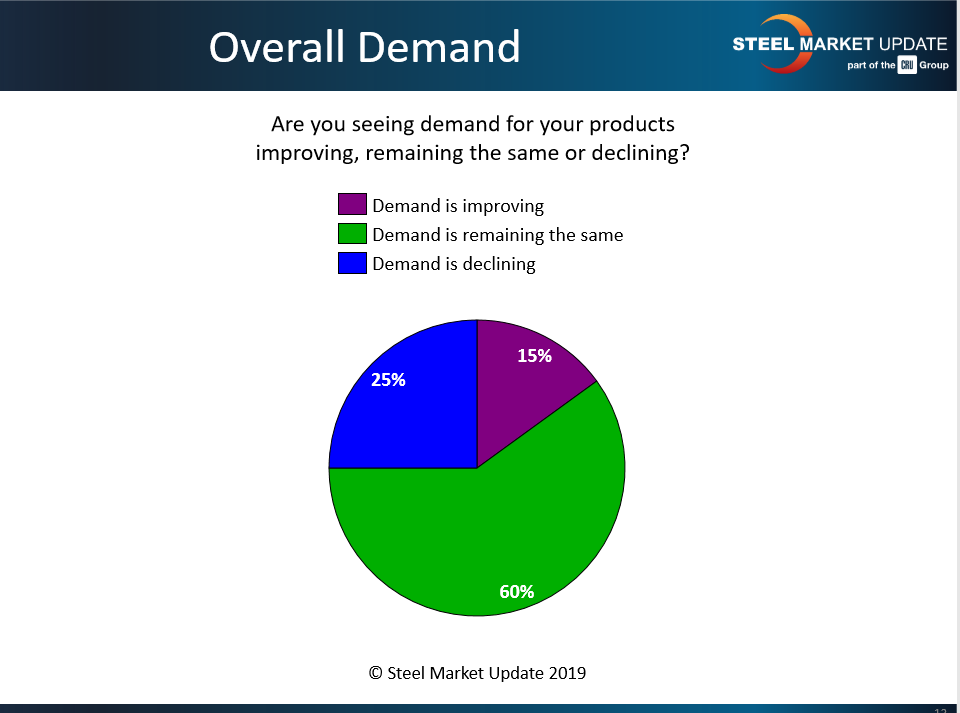

State of Steel Demand

Ultimately, steel consumption depends on demand. When prices go up, demand tends to go down. The majority of respondents (60 percent) report that demand from their customers has remained about the same in recent weeks. Another 25 percent said they see demand declining. Just 15 percent report improving demand in the marketplace, which is what the mills need to sustain their price momentum.