Market Data

September 5, 2019

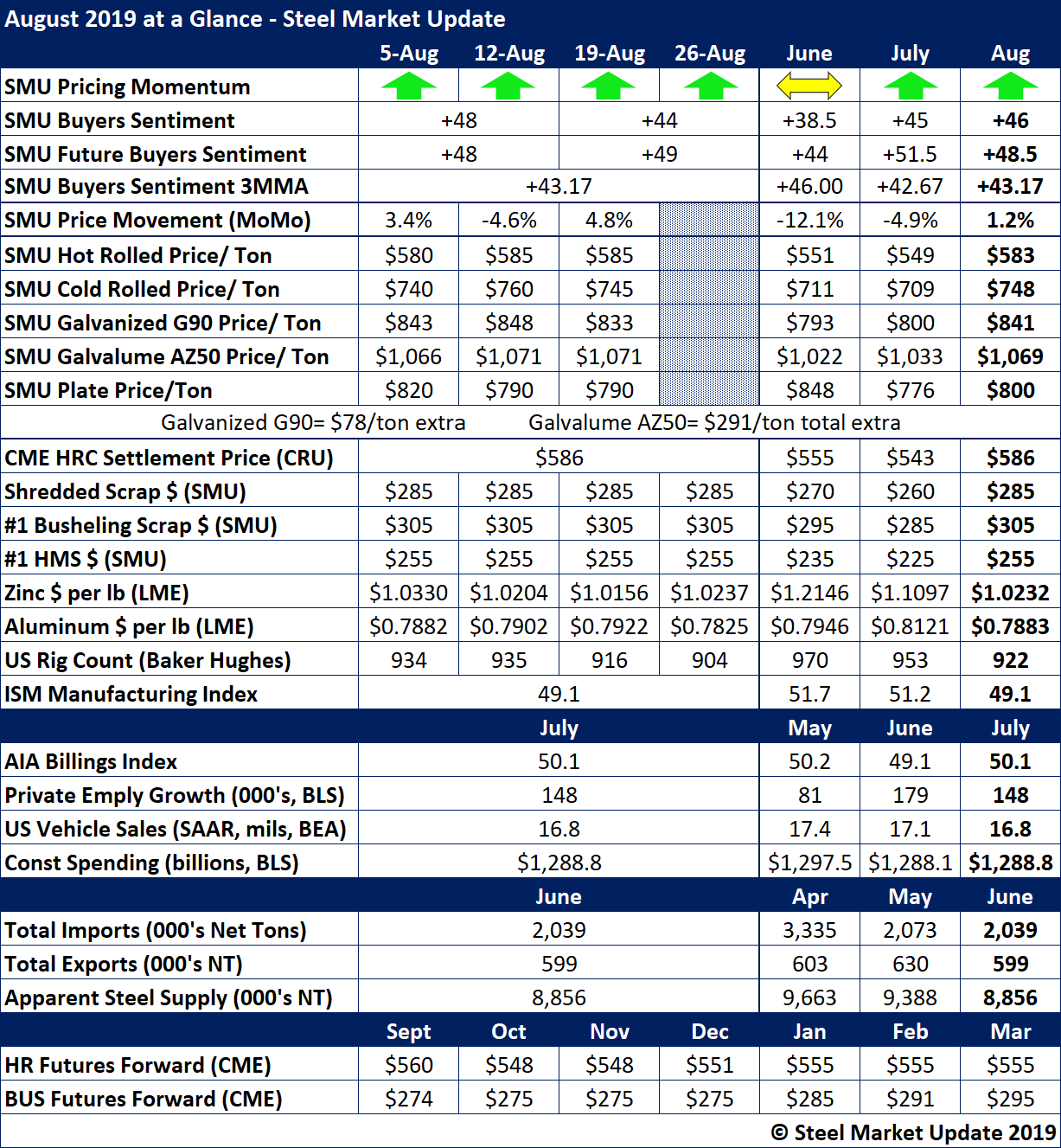

August at a Glance

Written by Brett Linton

Despite slight upward momentum in steel pricing in August, steel buyers’ sentiment languished in the +40s on SMU’s index. This tepid optimism likely reflects widespread concerns in the market about steel demand in the second half and the staying power of steel prices following the recent increases announced by the mills.

The average price for hot rolled ($538), cold rolled ($748) and galvanized ($841) steels in August represented an increase of just 5-6 percent in the past two months, disappointing mills and service centers hoping for a bigger boost to their profitability.

Ferrous scrap prices, which have seen declines for much of the year, rebounded a bit in August, lending some small support to the mills in their quest to collect higher finished steel prices.

The price of zinc declined to nearly $1.02 per pound in August from $1.21 in June, prompting some mills to adjust the coating extras they charge for galvanized steel.

Raising concerns about future steel demand, the ISM Manufacturing Index slipped into contraction with a reading below 50 in August. In the energy sector, the U.S. rig counts saw a further decline to 922 rigs from 970 at the beginning of the summer. In addition, the average annual rate of U.S. vehicle sales has slipped below the 17 million unit mark, while construction spending is flat to down, though both are still at fairly high levels

The market will no doubt be keeping a close watch on the leading indicators for the economy and steel consumption as the year enters its final few months.

See the chart below for more of the August benchmarks.

To see a history of our monthly review tables, visit our website here.