Market Data

September 29, 2019

SMU Market Trends: Demand, Pricing, Economy

Written by Tim Triplett

Steel buyers report flat or declining demand and expect spot steel prices to test the lows reached earlier this year, according to the findings of Steel Market Update’s market trends questionnaire this past week. The consensus view of the economy is more uncertain.

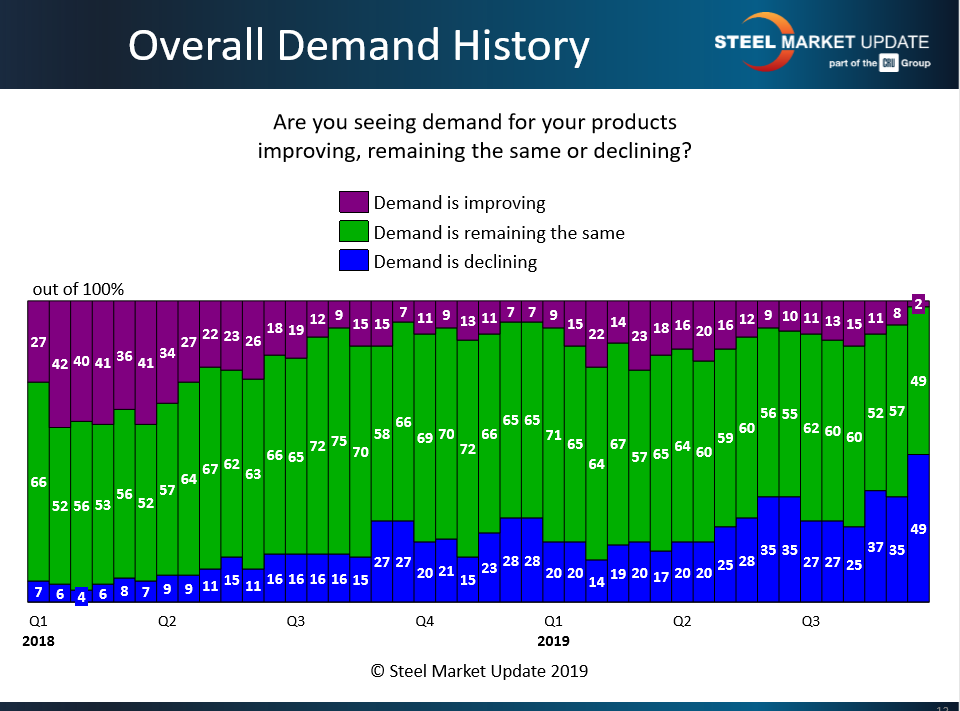

Demand

Nearly half of steel buyers responding to SMU’s questionnaire reported declining demand for their products. The same percentage see demand remaining about the same. Only a small group (2 percent) see demand improving in the current market climate.

Following are some of their comments:

“Construction products are doing well, but manufacturing is slipping.” Service Center/Wholesaler

“Volumes with existing customers are down severely at some customers while flat with others.” Service Center/Wholesaler

“Imports seem as less favorable. Also, there’s been pullback due to all the negative forecasting and predictions that have come out recently from the SMU trade conference. People are just plain scared now. Which is unfortunate as I don’t see actual business that bad. They are just being told it will get bad and thus are acting like it is.” Trading Company

“Actually, slowly improving.” Steel Mill

Pricing

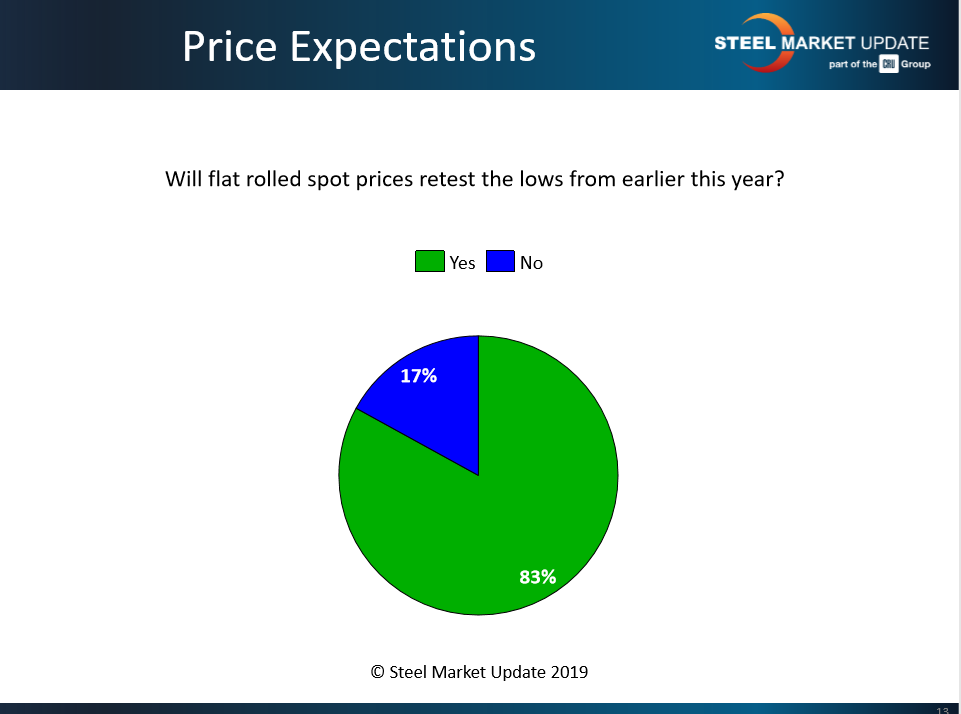

The vast majority of the respondents to SMU’s latest canvass believe flat rolled prices could hit a new low for 2019 in the fourth quarter. More than 80 percent feel flat rolled spot prices could test the market lows from earlier this year.

SMU data shows that benchmark hot rolled prices began the year at around $730 per net ton. With a few ups and (more) downs along the way, HR hit its low point of the year in late June at $520 per ton, prompting a series of price increase announcements by the mills that gained little traction. SMU’s current average HR price is $550 per ton and trending downward, just $31 away from a new low.

Here’s what some respondents had to say:

“With all the domestic outages, prices shouldn’t go that low, but domestic mill discipline will be the key as demand is waning.” Service Center/Wholesaler

“Futures are dropping rapidly. Even mill outages will not deter prices making new lows this year.” Manufacturer/OEM

“There is downside, but it won’t reach the lows experienced earlier this year.” Trading Company

“It’s hard to say. Prices will continue to fall, but I have no idea on how low.” Trading Company

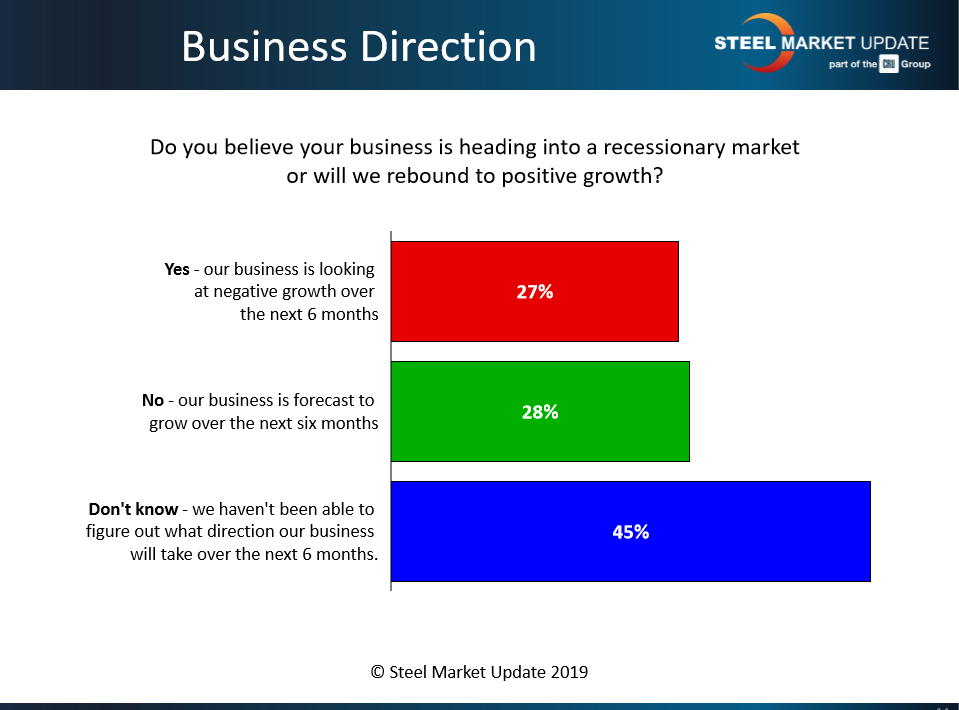

Economy

Opinions are sharply divided over whether steel is heading into a recessionary market. Roughly one-quarter of respondents said yes, their business will experience negative growth over the next six months. Another one-quarter said no, they forecast positive growth over the next six months. The other half admitted they honestly have not been able to figure out what direction the market will take through the fourth quarter and into next year.

Some of their observations:

“Recession is coming, but we don’t expect negative growth.” Manufacturer/OEM

“We believe demand for our products will remain relatively flat for the next six months.” Steel Mill

“We believe we will stay strong until mid fourth quarter, then will slide until late first quarter. Manufacturer/OEM

“We expect business to be flat.” Trading Company

“It will soften but not that bad.” Trading Company