Prices

January 7, 2020

CRU: Iron Ore Prices Rise as Cyclone Approaches Pilbara

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Iron Ore Market Outlook

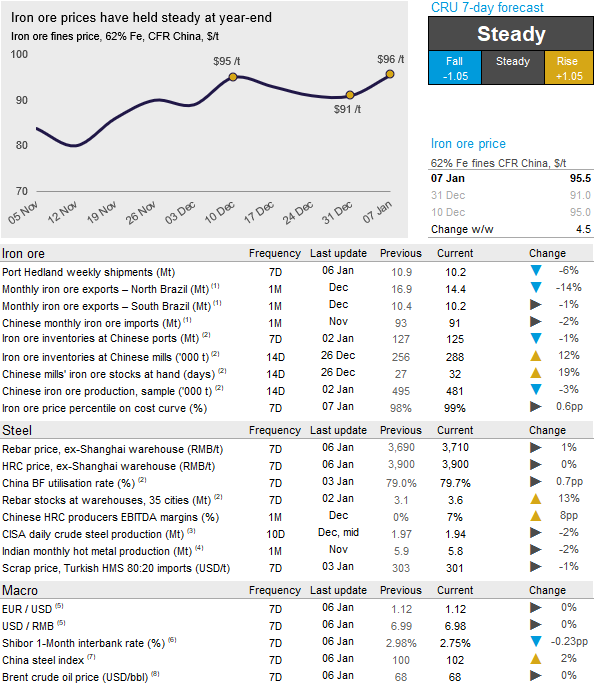

Iron ore prices rose sharply in the past week as Chinese restocking has continued and concerns about a cyclone forming northeast of Pilbara have increased. On Tuesday, Jan. 7, CRU has assessed the 62% Fe fines price at $95.5 /t, up $4.5 /t w/w.

Brazilian shipments came in at 25 Mt in December. Monthly exports from Minas Gerais (south Brazil) at 10.2 Mt is the lowest figure in over a decade, while Vale’s Northern System disappointed yet again with only 14.4 Mt exported in December, the third lowest figure of 2019. Heavy rainfall is the main reason behind the weak supply, with all iron ore producers in Brazil experiencing ongoing production and transportation issues. These figures are also further pushing down global freight rates.

The weak Brazilian supply is offset somewhat by strong Australian supply. Rio Tinto had a very strong December and the company has offered plenty of volumes on the spot market. Port Hedland shipments, once again, came in above 10 Mt for the week. Last year, shipments dropped sharply at the start of January, but that has not been the case this year.

Over the weekend, a cyclone has developed northeast of the Pilbara. Although the cyclone appears to be missing Port Hedland and Rio Tinto’s ports, we can expect rainfall in the mining areas in coming days, which will affect production and processing.

The bearish sentiment in the steel industry continues. Steel inventories have been starting to build prior to the Chinese New Year (CNY), which is now only 18 days away. There is less restocking this year compared with 2019 and steel prices are still in steep backwardation.

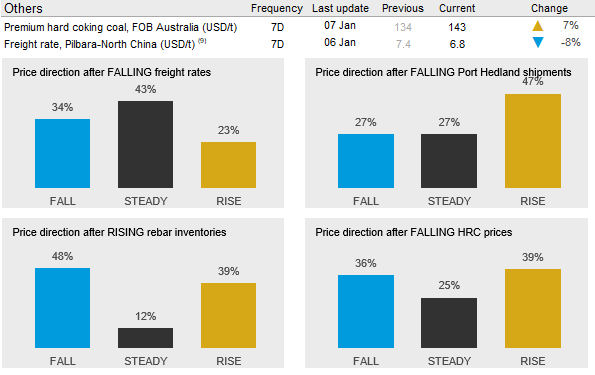

We are seeing bearish signals on the demand side but bullish supply signals, as we are expecting weakening Australian supply and low arrivals of Brazilian ore at Chinese ports. We hold a neutral view on prices in the coming week.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com