Prices

January 21, 2020

CRU: Uncertainty Returns Due to Mixed Supply Indicators, Import Restrictions on Coking Coal

Written by Manjot Singh

By CRU Senior Analyst Manjot Singh, from CRU’s Raw Materials Monitor

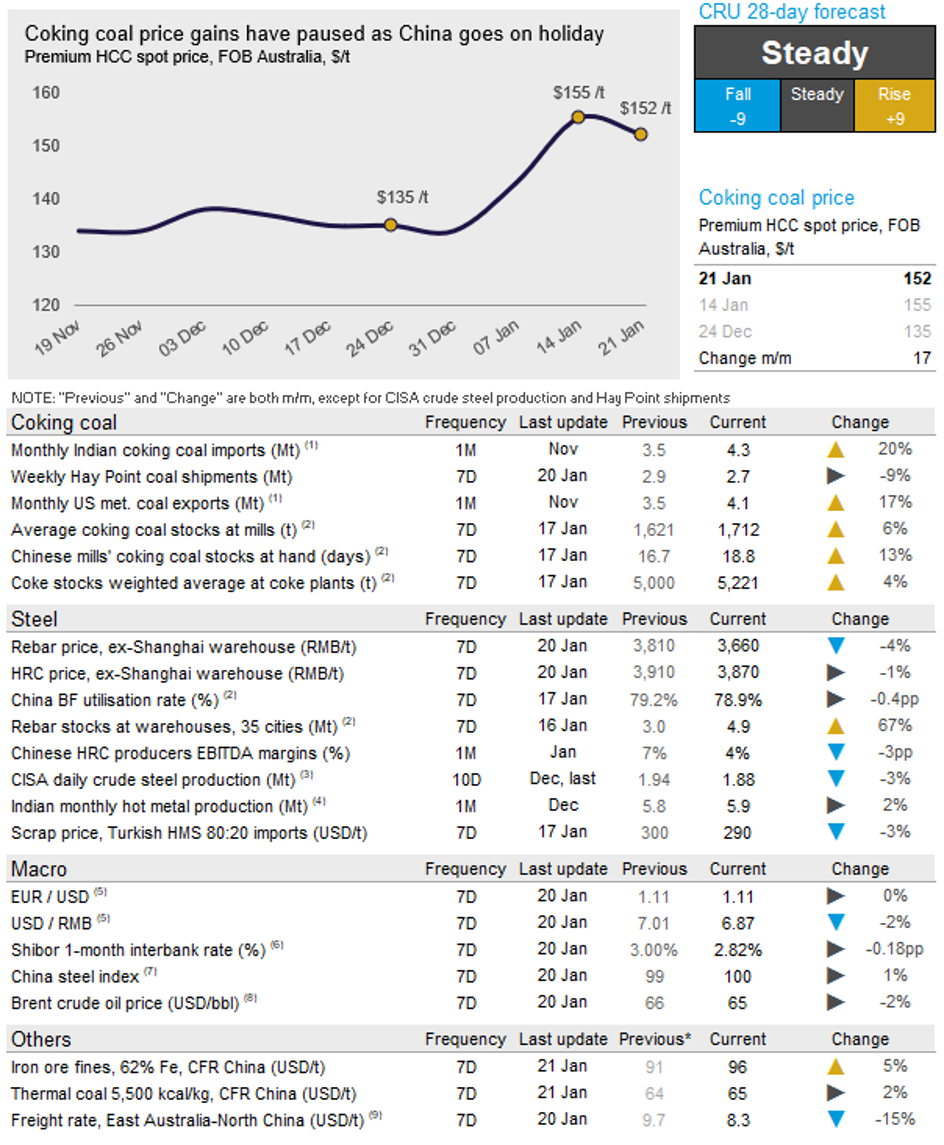

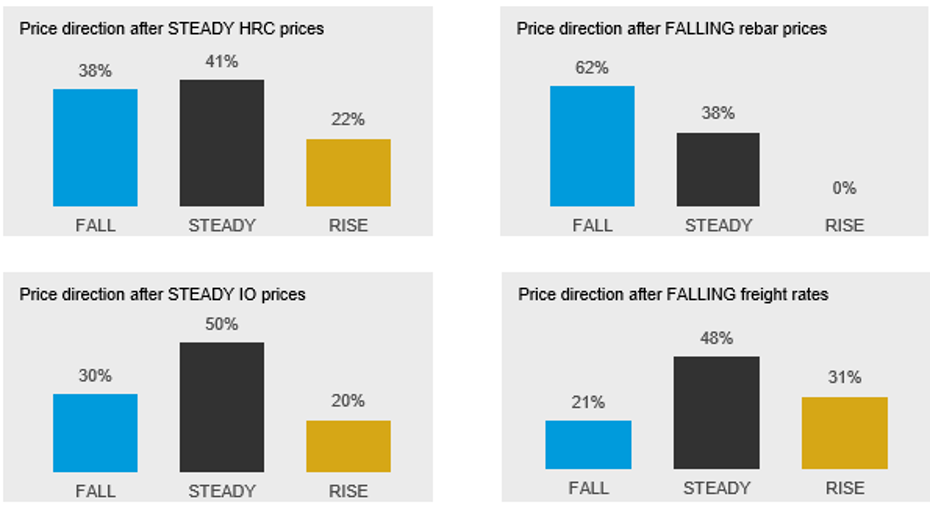

In the past week the coking coal market was characterized by mixed signals, keeping buyers cautious. We heard from a few sources that restrictions on coal intakes at major Chinese ports of Caofeidian and Jingtang could return soon. Currently there is no confirmation of whether these restrictions are being applied officially, but as we have seen in the past, customs clearance times for certain buyers could be extended or cargoes could only be allowed to clear on a case-by-case basis. This, coupled with the upcoming Lunar New Year holidays in China, is causing Chinese buyers to withdraw from the seaborne market, for now. Coke stocks at Chinese mills have climbed even further w/w, indicating the peak of pre-Lunar New Year restocking.

In India, buying interest continues to persist, helped by the better performing steel sector more recently. In Europe, we heard that ArcelorMittal started its first coke oven battery in Gijon, Spain, last week. The company also restarted Gijon’s blast furnace after two months of downtime. Nevertheless, it would be premature to say that European demand has started improving significantly.

On the supply side, a train derailment reported near Middletown, Queensland, poses risks to coal supply from Australia. Aurizon, Australia’s major rail freight operator, has already indicated that there could be train cancellations in the coming days on the back of this incident. Separately, BHP stated last week that poor air quality caused by bushfires in New South Wales was hurting the region’s coal production (mostly thermal). This underscored the view that more coal output could be affected in New South Wales if the air quality does not improve soon. Meanwhile, operations at the Curragh met. coal mine in Queensland have recommenced after the fatal accident at the mine site on Jan. 12.

On Jan. 21, CRU assessed the Premium HCC, $2 /t lower w/w at $153 /t, FOB Australia. We expect prices to stay around current levels in the next couple of weeks as upside pressures caused by supply concerns will be offset to some extent by weak Chinese buying due to the Lunar New Year.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com