Logistics

February 7, 2020

Tariffs Impact Lake Erie Ports in 2019 as Supply Lines Shift

Written by Sandy Williams

The Port of Cleveland saw a significant decline in imports from Europe in 2019 due to tariffs and supply line disruptions. An increase in shipments from Canada, however, drove a 9 percent overall increase in cargo for the year.

“Our European, cross-Atlantic imports were down approximately 35 percent, and our primary import from Europe is steel,” Jade Davis, vice president of external affairs told Crain’s Cleveland. “A portion of that is due to tariffs and those related business decisions, and some to a general manufacturing slowdown.”

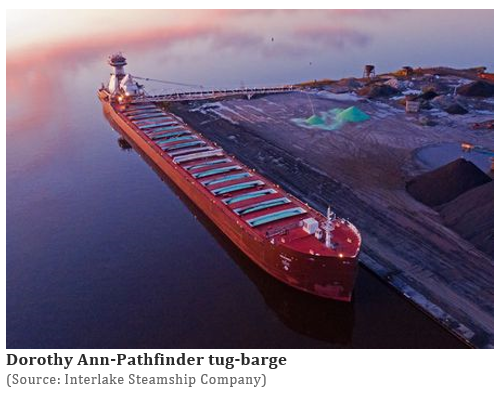

Some of the European steel that used to arrive in Cleveland is now being sent to Canada for processing and then trucked across the U.S.-Canada border, said David Gutheil, chief commercial officer for the Port of Cleveland. Cleveland has also seen increased barge traffic from Canada containing pipe and flat rolled steel.

“This is not just a Port of Cleveland issue. It is other ports on the Great Lakes, other ports around the country, that are experiencing the same issues,” said Gutheil.

The Port of Toledo saw a 2.59 percent decline in overall cargo tonnage in 2019, mostly driven by a 42 percent decline in grain cargo due to weather-related low crop harvest.

Iron ore shipments were up almost 19 percent, boosted by the first order deliveries from the new Cleveland-Cliffs HBI plant in Toledo. Steel and aluminum and project cargos, like wind-turbine components and heavy machinery, rose 55 percent to 277,574 tons last year.

Joe Cappel, Port of Toledo vice president for business development, said the increase was largely due to the termination of tariffs on steel and aluminum from Canada.

“Aluminum came back with a vengeance after the tariffs were lifted,” said Cappel, noting an increase from 130,000 tons in 2018 to 208,000 tons in 2019.

Overall cargo on the St. Lawrence Seaway declined 7 percent in 2019 to 38 million metric tons, according to the Chamber of Marine Commerce. Trade conflict, high water and adverse weather drove the decline, said Chamber President Bruce Burrows.

The Deloitte 2020 Manufacturing Industry Outlook highlighted the sourcing problems manufacturers are facing in the current environment of trade uncertainty.

“Shifts in sourcing (and thus production) are already playing out on the global stage,” said the report’s author Paul Wellener, vice chairman at Deloitte. “U.S. imports from China were down 12.7 percent in the first eight months of 2019 versus the same period in 2018. Meanwhile, U.S. imports from Mexico were up 5.9 percent, and U.S. imports from Vietnam were up 37.4 percent. In a matter of months, manufacturers have shifted both sourcing and production to different geographies, seeking tariff-friendly combinations.”