Prices

February 13, 2020

December Apparent Steel Supply Rises from November's Lull

Written by Brett Linton

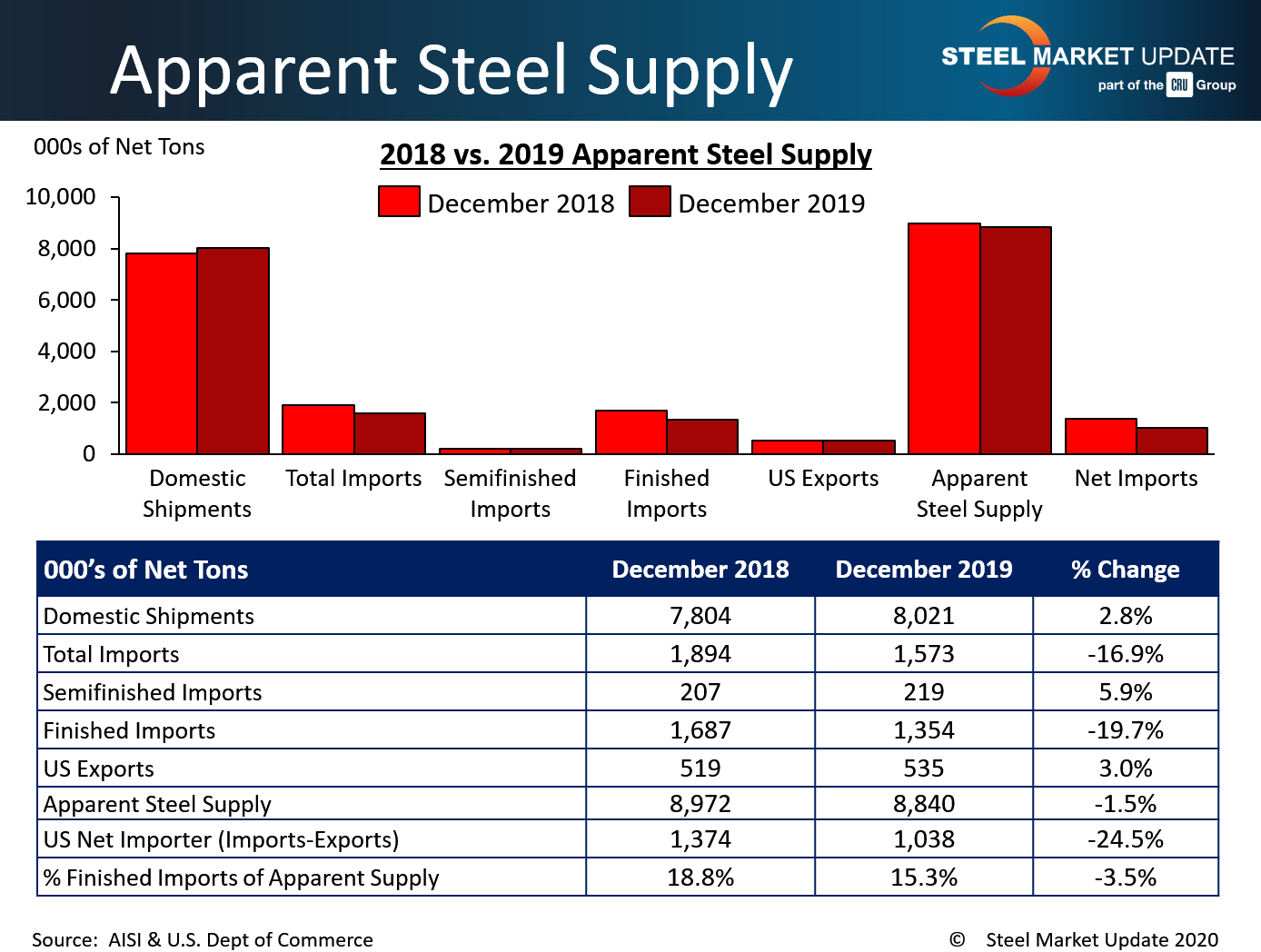

Apparent U.S. steel supply increased to 8.8 million net tons in December, according to data from the American Iron and Steel Institute and U.S. Department of Commerce. While up over the previous three months, December supply remains low compared to the last two years. Last month we reported that November supply was at a three-year low, the lowest seen since December 2016 when supply was 8.1 million tons. Apparent steel supply, a proxy for demand, is determined by adding domestic steel shipments and finished U.S. steel imports, then subtracting total U.S. steel exports.

December apparent supply saw a 131,000-ton decrease (1.5 percent) compared to the same month one year ago. This change was primarily due to a 333,000-ton decrease in finished imports, which was nearly negated by a 217,000-ton increase in domestic shipments.

The net trade balance between U.S. steel imports and exports was a surplus of 1,038,000 tons imported in December, up 9.9 percent from the prior month, but down 24.5 percent from one year ago. Finished steel imports accounted for 15.3 percent of apparent steel supply in December, down from 15.8 percent in November, and down from 18.8 percent one year ago.

Compared to the prior month when apparent steel supply was 8.4 million tons, December supply increased 447,000 tons or 5.3 percent. The increase was primarily due to a 356,000-ton rise in domestic shipments and a 67,000-ton decrease in exports.

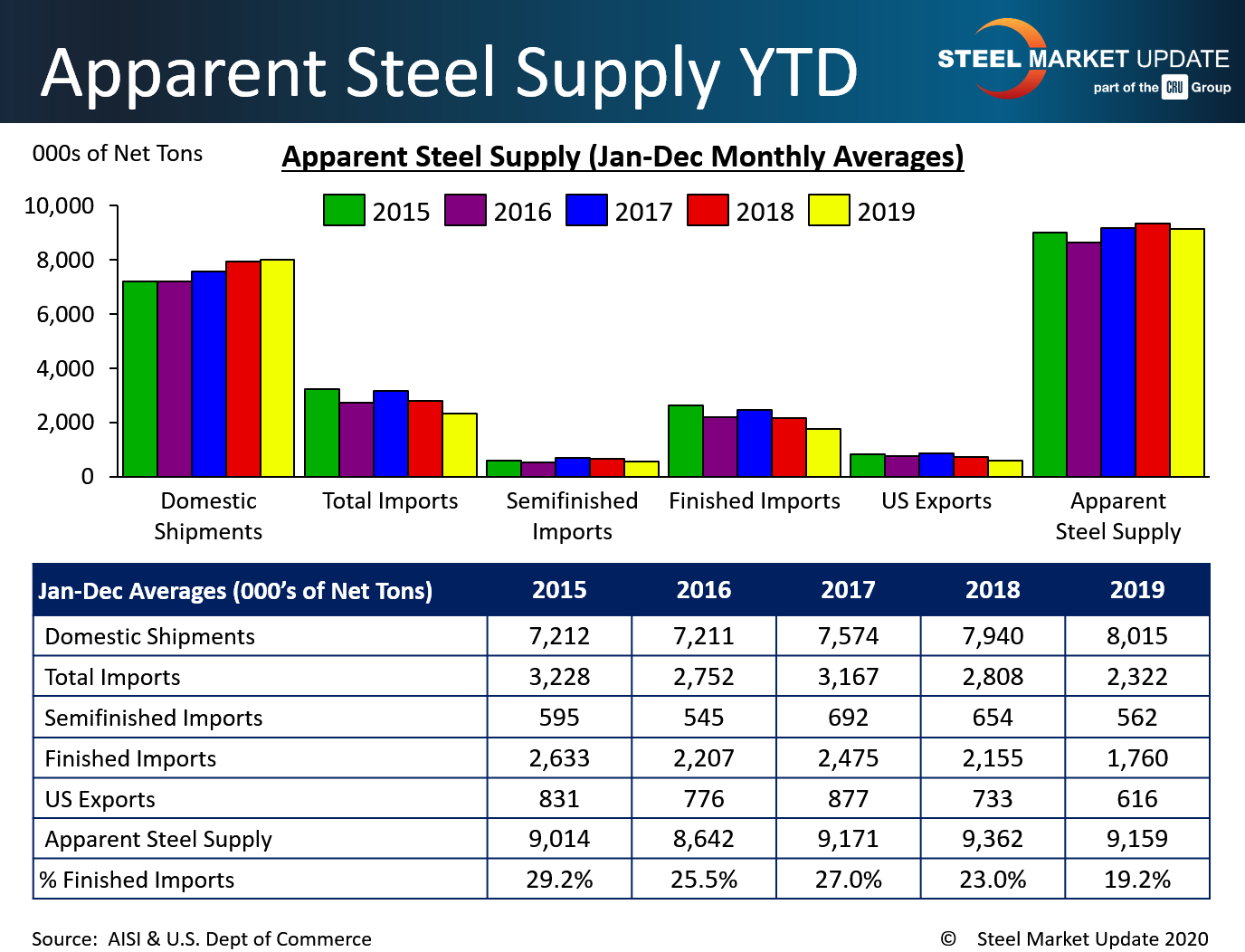

The figure below shows annual averages for each statistic over the last five years. Apparent supply ended 2019 just below the 2018 monthly average, but still on the high side compared to years prior. Domestic shipments surpassed the 2018 monthly average and are at the highest levels seen since 2014. Semifinished imports are slightly down, while total imports, finished imports, and total exports are all down significantly.

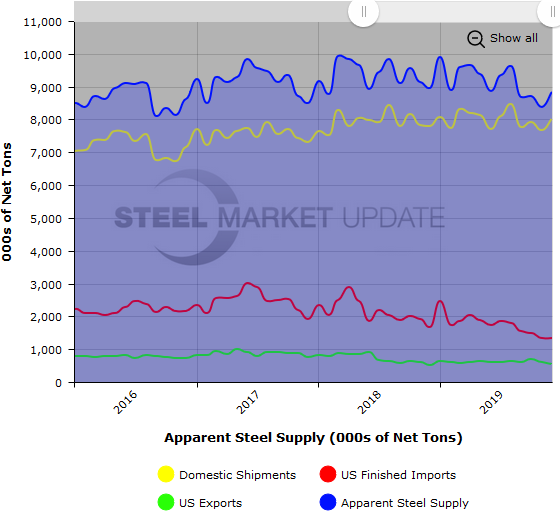

To see an interactive graphic of our Apparent Steel Supply history (example below), visit the Apparent Steel Supply page in the Analysis section of the SMU website. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.