Prices

February 18, 2020

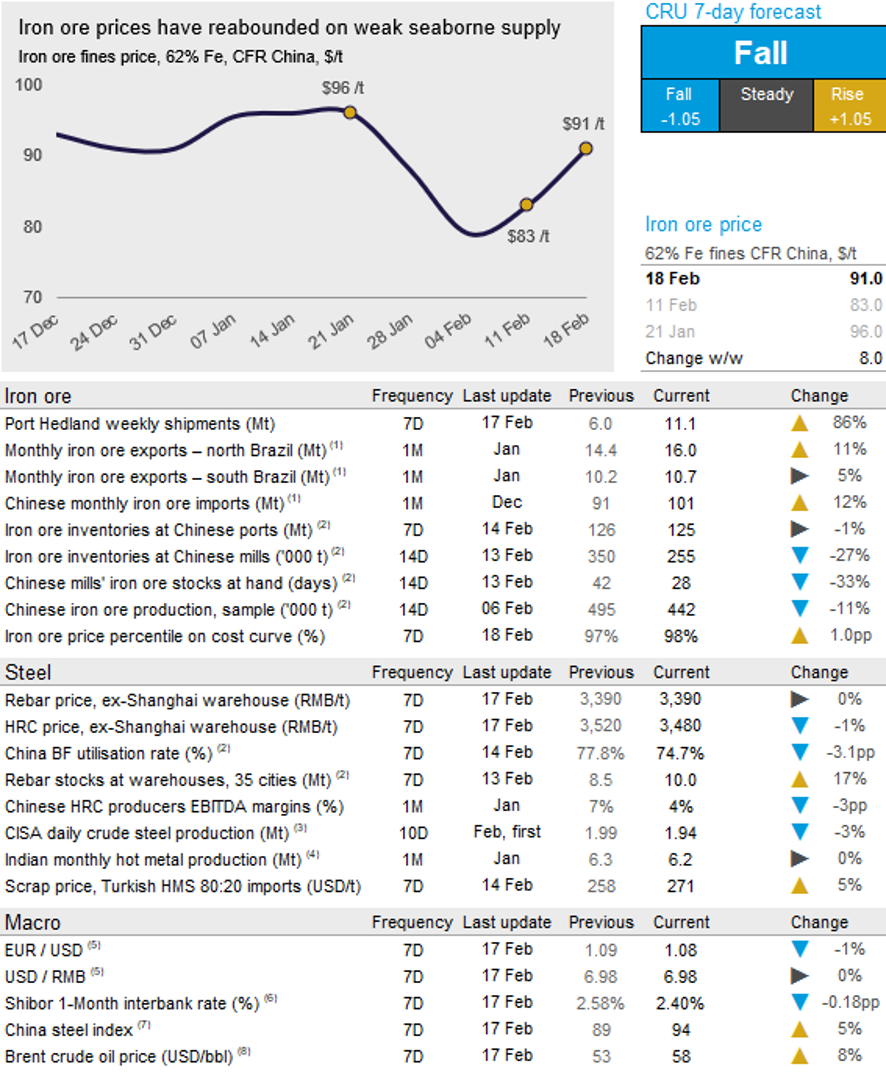

CRU: Iron Ore Back Above $90

Written by Erik Hedborg

By Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Material Monitor

Iron ore prices rebounded in the past week as arrivals of seaborne iron ore to China were at their weakest level in over six months. Port stocks in China fell w/w and talks about further stimulus and a drop in the number of new Covid-19 infections brought the bullish sentiment back to the iron ore market. On Tuesday, Feb. 18, CRU has assessed the 62% Fe fines price at $91.0 /dmt, up by $8.0 /dmt w/w.

There have been few disruptions to BF operations in China with mills drawing down production, which allows them to operate their plants comfortably despite relatively weak availability of iron ore. Our sources say that landborne transportation in China has improved recently, which has improved the flow of iron ore from domestic mines to mills. One issue in the steel market is the weak steel demand. Construction and manufacturing activities are still on hold, which means that steel inventories are piling up, particularly at mills. CRU has heard of several mills having issues with limited storage space at the moment.

On the seaborne market, shipments from Port Hedland have improved significantly after Cyclone Damien forced the port to shut for nearly three days between Feb. 7-10, which we estimate to result in 3-4 Mt of lost supply. In the past week, we saw exports of 11.1 Mt, one of the highest figures observed in the past 12 months. Rio Tinto was hit much harder by the cyclone. Its two ports, Dampier and Cape Lambert, stopped exporting for six days and the company lost ~6 Mt of iron ore supply. Shipments from Brazil have improved somewhat in the past week, but weather conditions in Minas Gerais are still poor and exports are far away from normal levels. In addition, Vale has reduced its Q1 production figure after announcing its Brucutu mine will be operating at reduced levels until end-March.

After a week of exceptionally weak arrivals to China, seaborne supply continues to improve while we expect further reductions to Chinese crude steel production. As a result, we expect iron ore prices to reverse and come under pressure in the coming week.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com