Market Data

February 20, 2020

Steel Mill Negotiations: A Buyer's Market?

Written by Tim Triplett

Price negotiations with the mills have continued to loosen up as it’s rapidly becoming a buyer’s market. The vast majority of service center and manufacturing executives responding to Steel Market Update’s questionnaire this week said the mills are open to price negotiations on nearly all products to win the orders.

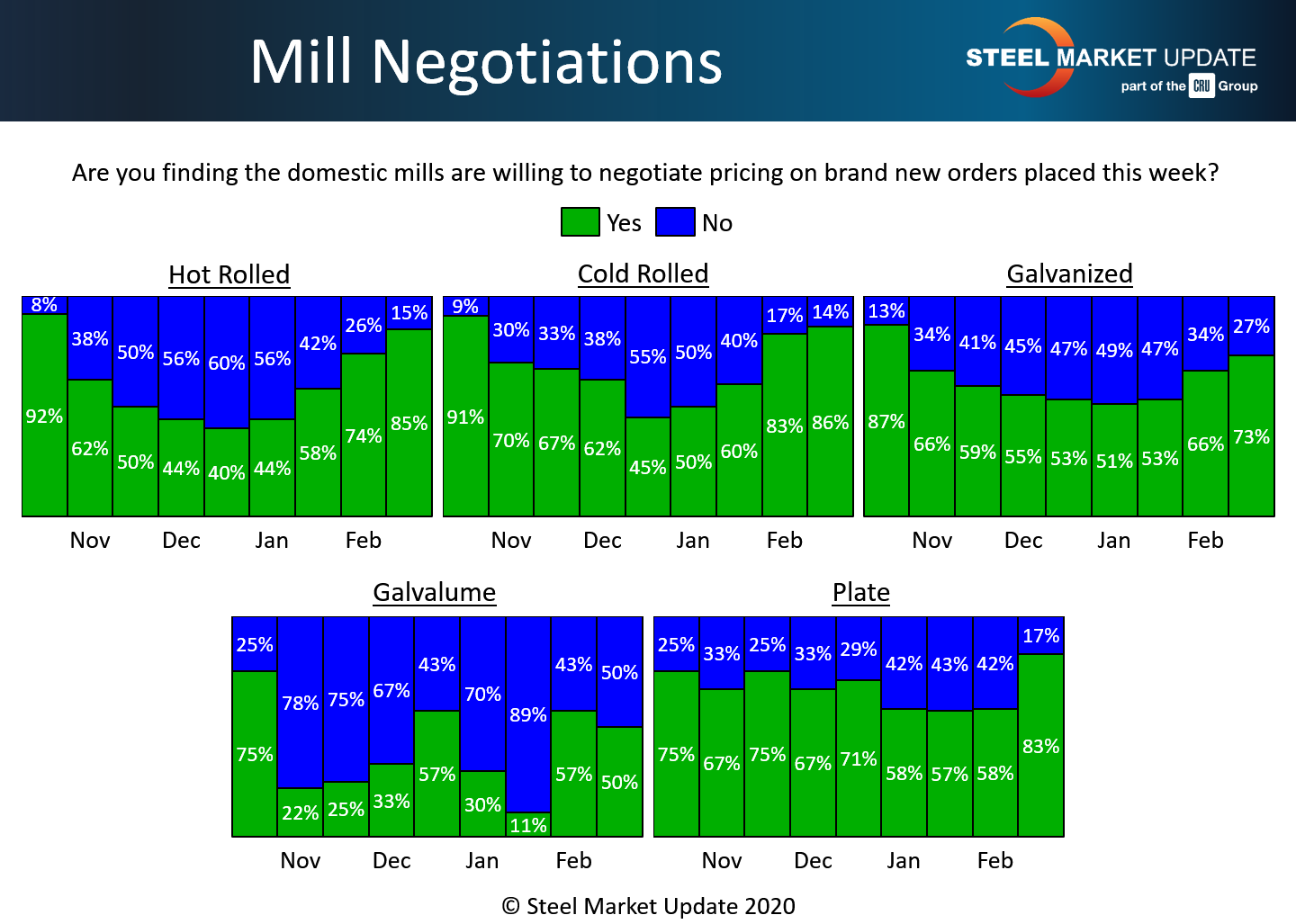

In the hot rolled segment, 85 percent of the steel buyers said the mills are now willing to negotiate prices on HR, up 27 points from 58 percent at this time last month. The percentage reporting mills holding the line on HR has declined to just 15 percent.

Likewise, the cold rolled segment has seen a 26-point swing since mid-January with 86 percent of buyers now reporting mills willing to talk price on CR orders.

In coated steels, the trend is the same. In galvanized, 73 percent reported the mills open to negotiation, up from 53 percent in mid-January. In Galvalume, it’s a 50-50 proposition that the mills will consider compromising on price.

Even plate buyers reported a change in attitude among the mills. About 83 percent said the plate mills are now open to negotiations, up from 57 percent this time last month.

Benchmark hot rolled steel prices reached $610 per ton in early January, but have since declined to $580, according to SMU’s canvass of the market this week. Given the downturn in prices, it comes as no surprise that the mills appear more willing to negotiate to close business.

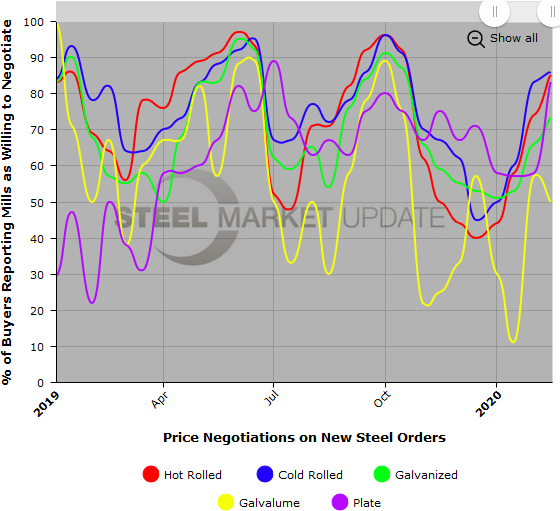

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (example below), visit our website here.