Prices

March 24, 2020

CRU: Iron Ore Falls $10 Per Ton on Global Demand Fears

Written by CRU Americas

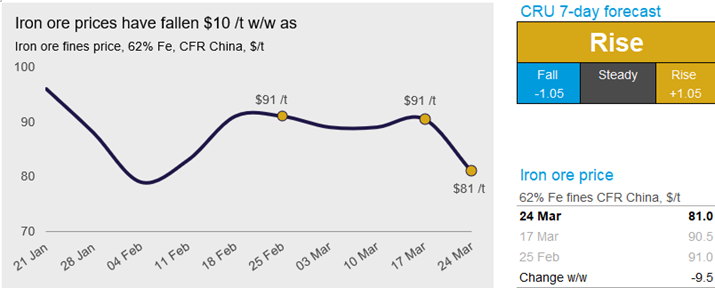

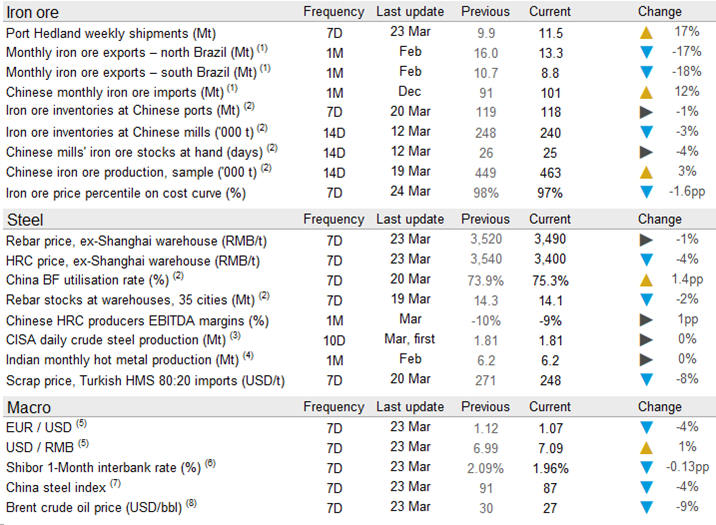

In the past week, iron ore saw its biggest drop of the year as prices fell by nearly $10 /t. The main reason for the fall was an escalation of Covid-19 cases outside of China, which caused concerns of iron ore demand in key steelmaking regions such as Europe and northeast Asia. At the same time, Australian supply has improved in the absence of further cyclones and all major producers are pushing hard to meet quarterly targets. On Tuesday, March 24, CRU has assessed the 62% Fe fines price at $81.0 /t, a $9.5 /t drop w/w.

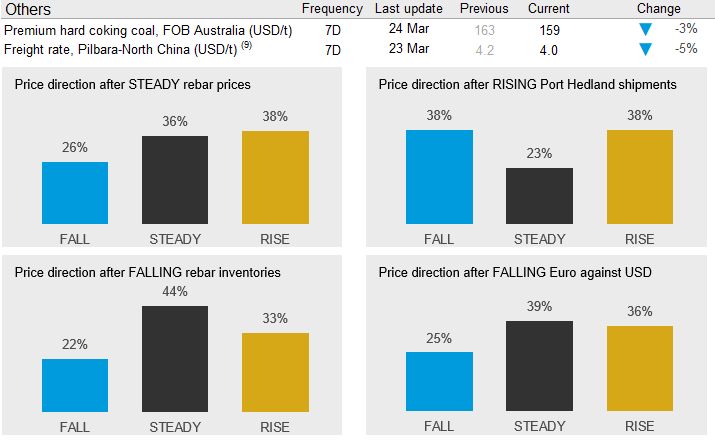

In China, economic activities continue to recover and BFs in the country are maintaining a steady utilization rate. However, steel prices have declined in the past week as steel inventories are now being shifted over from mills to traders. Margins remain weak and there are increasing concerns about steel demand from other countries, which is putting Chinese steel exports at risk. Our sources mention that there is currently a wide divergence in views on the direction of the market in the coming weeks.

The macro turmoil has continued in the past week. The U.S. dollar has strengthened against most currencies and the oil price is down to $27 /bbl, two factors that are keeping iron ore production costs low.

On the supply side, Australian supply has been robust while Brazil continues to struggle with heavy rainfall. In the past two days, mining bans have also been imposed in South Africa and Canada (Quebec), which will primarily have an impact on lump and pellet supply. In addition, Vale has identified two workers in southern Brazil who have been infected by Covid-19, which increases the risk of supply disruptions in the densely populated state of Minas Gerais.

The low iron ore inventories and seaborne supply concerns mean we are likely to see a short-term rebound in iron ore prices in the next week and CRU is expecting prices to increase in the coming week.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com