Market Data

May 28, 2020

Steel Mill Negotiations: Slightly Tighter, But...

Written by Tim Triplett

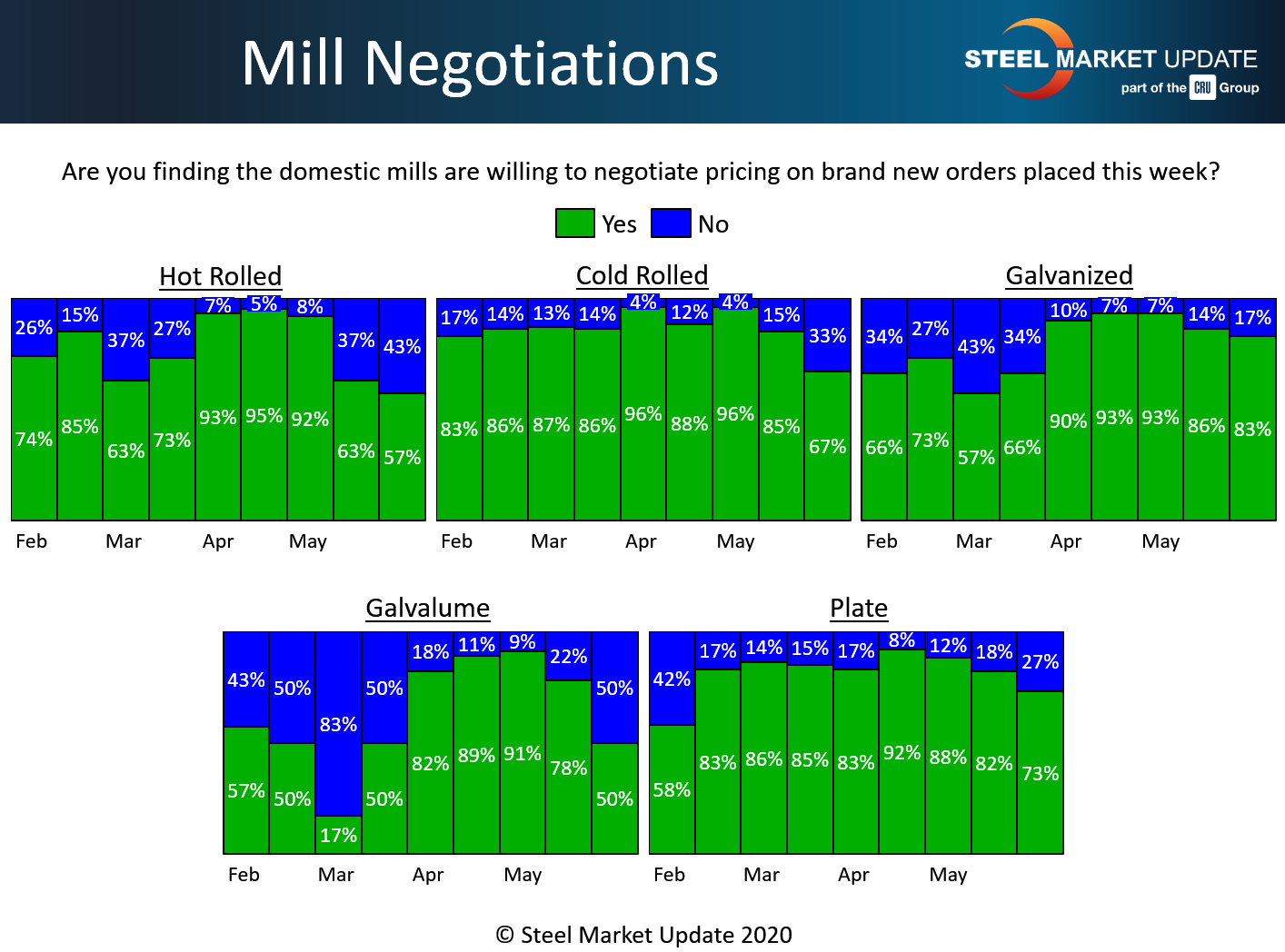

Negotiations between producers and buyers of flat rolled and plate steels have continued to tighten following two price increase announcements by the mills in May. However, the majority of buyers responding to Steel Market Update’s canvass of the market this week say the mills are still willing to talk price to secure orders, given the unpredictable outlook for demand.

Steel prices moved up modestly in May. The benchmark price for hot rolled increased from about $460 per ton at the beginning of the month to $500 per ton this week. Mills are more likely to say no these days when it comes to price negotiations.

In the hot rolled segment, 43 percent of the steel buyers said the mills are now holding the line on prices. That’s up dramatically from just 8 percent a month ago, and 37 percent in mid-May.

In the cold rolled segment, 33 percent reported the mills unwilling to talk price, up from just 4 percent one month ago and 15 percent two weeks ago.

In galvanized, 17 percent reported the mills closed to price negotiation, up from 7 percent last month and 14 percent two weeks ago. About half the buyers said they have found mills unwilling to compromise on Galvalume prices, up from just 9 percent in April and 22 percent earlier in May.

In the plate sector, the percentage saying no to negotiation grew to 27 percent from 12 percent last month and 18 percent two weeks ago.

Nevertheless, from 57-83 percent of buyers reported that the mills are still willing to compromise on price in every product category to secure orders, even as they hope to collect their recent price increases.

SMU’s Price Momentum Indicator continues to point to Neutral indicating a market in transition, but not referencing a specific price direction from here.

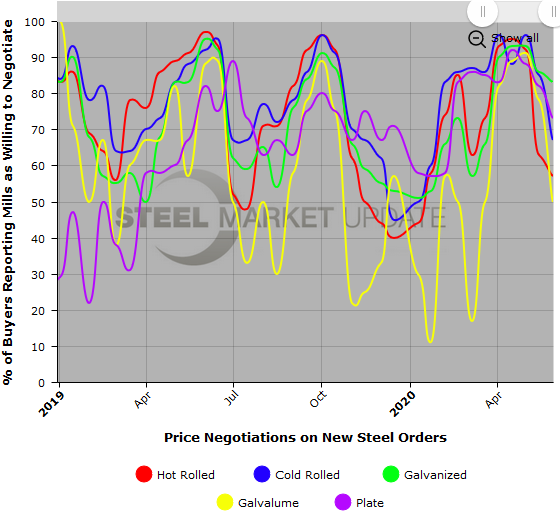

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (second example below), visit our website here.