Market Segment

June 4, 2020

CRU: European Steel Market Stable Ahead of Contract Talks

Written by George Pearson

By CRU Prices Analyst George Pearson, from CRU’s Steel Monitor

Sheet prices in the U.S. Midwest market have continued to rise with HR coil assessed at $510 /s.ton, a w/w gain of $23 /s.ton. While prices are higher, overall volume of transactions has been limited. This is due not only to low demand and plentiful inventories, but also due to lower-priced contracts.

Mill lead times remain short, yet they may start to expand at a faster pace if buyers are able to book more volume on their monthly and quarterly contracts. We have heard of plans for at least one blast furnace to work towards restarting and market participants noted hearing of a second. We expect to see increased steel production come as Covid-19 restrictions continue to ease this month.

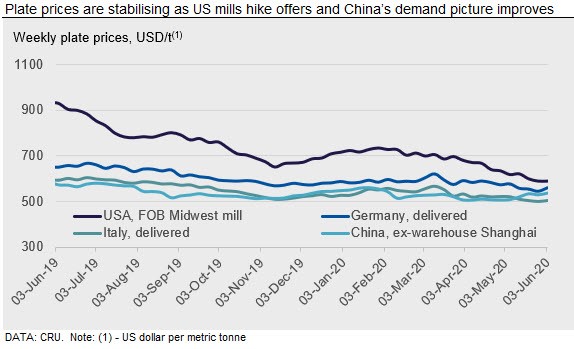

As for plate, prices have now stabilized at a low level after mills raised prices in the third week of May. Prices this week were flat at $533 /s.ton, a level just $23 /s.ton higher than HR coil. The mill price increase of $40-$50 /s.ton has yet to drive prices higher, though the transaction data we received did show some higher prices come through, though they were balanced out by still significant volume at lower prices.

European sheet price declines were small this week, after two weeks of larger falls. Sheet prices in Italy and Germany were down by €2-3 /t. Mills are now preparing for H2 contract negotiations and are eager to stick a stopper in a falling market. European mill margins are still negative at these prices. There are several signs of price support to point to, notably higher iron ore and scrap prices along with a stronger market in China. Import offers have also firmed in general, with offers from Turkish mills in a range of $420-440 /t FOB, up by around $20-30 /t in the last two weeks. Rumors of a price increase announcement in Europe have done the rounds with these reasons to back them up. We expect prices to bottom in June but for increases to be gradual and limited in the next few months. That is because there is still stock in the system and demand remains weak in Europe—we have heard further exports to markets outside Europe in the last week.

In China, steel prices rallied in the past week after a slight decline following the “Two Sessions” disappointment. Rebar price rose by RMB90 /t to RMB3,630 /t, and HR coil up by RMB120 /t to RMB3,670 /t, the highest level since the Covid-19 outbreak. There are a few factors for the stronger price pick-up of HR coil, although some were shared with other steel products. The first one was the announced production cuts in Tangshan, a city with high volumes of HR coil output, although so far, the actual level of production cuts has not been as stringent as previously expected. The second factor was that HR coil prices were under more pressure than the longs since the beginning of the Covid-19 outbreak.

However, the destocking rate slowed over the past week, falling by only 3 percent w/w. Mills are currently producing at high levels on higher margins. Capacity utilization is at around 87 percent, similar to the same time last year. Going forward, we expect production will be strong as mills are enjoying 10 percent margins at the moment, yet underlying demand could fall ahead of the summer. Therefore, prices are likely to stop increasing in June as bullish sentiment fades.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com