Community Events

June 4, 2020

SMU Webinar: Trade Issues at Play in Election Year

Written by Sandy Williams

Section 232 tariffs will likely remain in place no matter who is the White House in January, said trade attorney Lewis Leibowitz during the SMU Community Chat on June 3. Legal challenges to the tariff measures, however, could cause a change.

Firms are challenging the Section 232 exclusion process that appears skewed toward U.S. steel companies that object to loosening tariffs even when domestic production is inadequate, said Leibowitz, the guest speaker for this week’s SMU webinar.

A challenge to the constitutionality of Section 232 brought by the American Institute for International Steel is now under review by the Supreme Court, which will decide in June whether to deliberate the case.

As the tariffs on steel and aluminum continue, the Trump administration is seeking to expand the breadth of Section 232 measures with investigations into the threat to national security from imports of electrical steel, mobile cranes and vanadium. An investigation into auto imports was completed but never delivered to Congress or the public and is now well past its decision date.

Antidumping and countervailing duty cases continue to be brought against imports of a number of products within the steel sector. In the period May 1 through June 1, there were 54 Federal Register notices on AD/CVD matters with 30 of the notices involving steel or steel-containing products, said Leibowitz. China received the brunt of the notices with 26 and India followed with 5.

The newest circumvention case involving steel is on rebar exports from Mexico. Large-diameter pipe from India was removed from contention due the lack of interest by the U.S. domestic industry to make the product.

The U.S.-Mexico-Canada Agreement will be implemented on July 1 setting new rules for North American products. The de minimis content for goods has been raised to 10 percent from 7 percent. That means the product cannot contain non-originating content amounting to more than 10 percent of the product’s transactional value to qualify for USMCA tariff preferences.

Within three years under USMCA, 75 percent of automotive inputs must be from North America and 70 percent of steel used must be melted and poured in the U.S., Canada or Mexico. The steel rule will be a plus for the steel industry, although some auto producers may choose not to comply and pay the resulting tariffs, said Leibowitz.

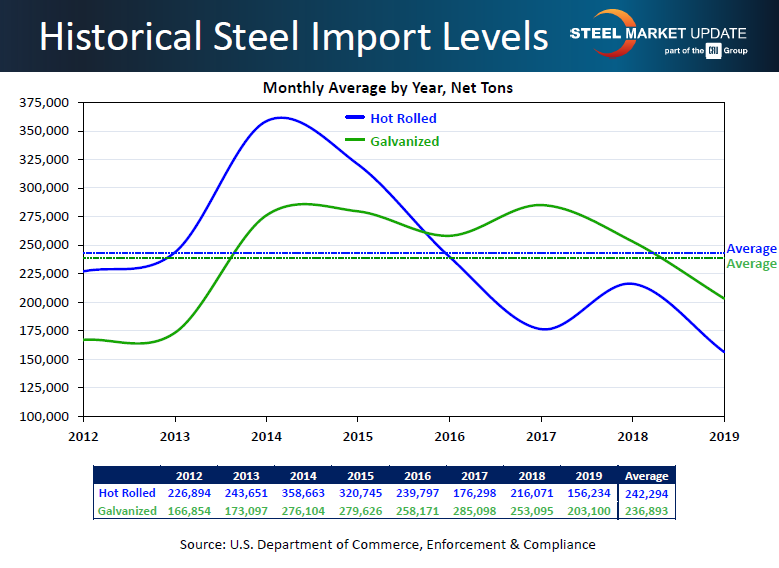

So, are the tariffs and other duties working? The chart below shows the decline in imports as new restrictions were imposed and economic conditions changed. In general, imports increase during strong economies and decrease during weak periods, Leibowitz said. The U.S. does not have the capacity to produce all the steel that is needed domestically. In general, and depending on product lines, the U.S. needs to import between 20 and 30 percent of its steel. Using safeguards as temporary measures can be effective against unfair imports, he added, but long-term restrictions on steel imports could lead to manufacturers seeking alternative materials or manufacturing locations.

A fair playing field means an open and competitive field, said Leibowitz. When GATT rules were formed, fair meant reducing tariff barriers and using more targeted restrictions (AD/CVD) regarding individual products. Steel is why the World Trade Organization is faltering right now. The U.S. loses too many cases and the world thinks U.S. laws are unfair, he said.

On the topic of reshoring, Leibowitz said the trade war with China is driving the impetus to bring supply chains and manufacturing back to the U.S. Future government trade policy, however, will be a determining factor in whether companies decide to make the transition back to the U.S. or seek footholds in other countries that have lower labor costs.

Leibowitz agrees that tariffs have given U.S. mills the time to build new capacity with the potential to take market share from imports. All the new announced capacity is in EAF-based minimills, with virtually no new investment in blast furnaces. Will the new capacity create an oversupply that drives down steel prices? There is a political element to announcing capacity additions, said Leibowitz, and not all may come to fruition.

James Banker, Executive Vice President of NLMK USA, will be the featured speaker at 11 a.m. ET on Wednesday, June 10, for our next SMU Community Chat webinar.