Market Data

June 11, 2020

Steel Mill Negotiations: In Buyers' Favor

Written by Tim Triplett

After a brief period in which the mills tried to hold the line following their price increase announcements in May, negotiations have swung once again in buyers’ favor. Seven out of 10 buyers responding to Steel Market Update’s questionnaire this week said the mills are willing to negotiate on price to win orders of hot rolled steel, as well as other products.

Steel prices have moved up in small increments since bottoming around $460 per ton in late April. SMU reports the benchmark price for hot rolled this week at $515 per ton. But the mills’ apparent willingness to discount in light of the uncertain demand due to the coronavirus casts doubt on their ability to collect further increases.

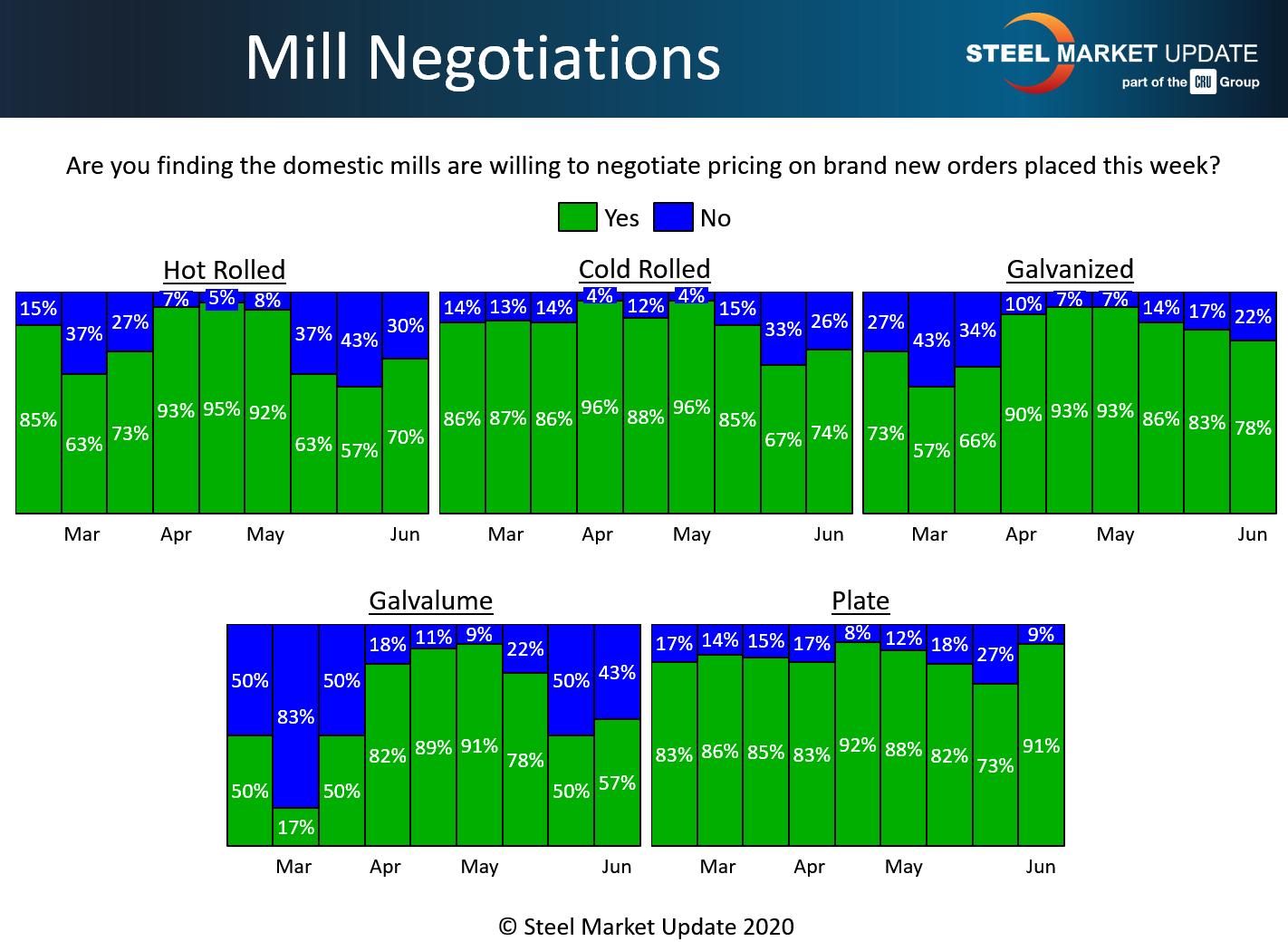

In the hot rolled segment, 70 percent of the steel buyers said the mills are now open to negotiation, while just 30 percent said the mills are standing firm on prices. That’s a 13-point shift from two weeks ago.

In the cold rolled segment, 74 percent reported the mills willing to talk price, up from 67 percent at the end of May.

In galvanized, 78 percent reported the mills open to price negotiation this week, down slightly from 83 percent in SMU’s last canvass of the market. More than half, about 57 percent of the respondents, have found the mills willing to compromise on Galvalume prices, as well.

Negotiations opened up notably in the plate market, where nine out of 10 said the mills are willing to bargain to capture the sale, and just 9 percent reported the mills saying no. That’s an 18-point swing in buyers’ favor from late May.

Steel demand is clearly improving as coronavirus restrictions are lifted and companies are going back to work, but the market remains in transition. SMU is keeping its Price Momentum Indicator at Neutral until the dynamic between buyers and sellers becomes clearer.

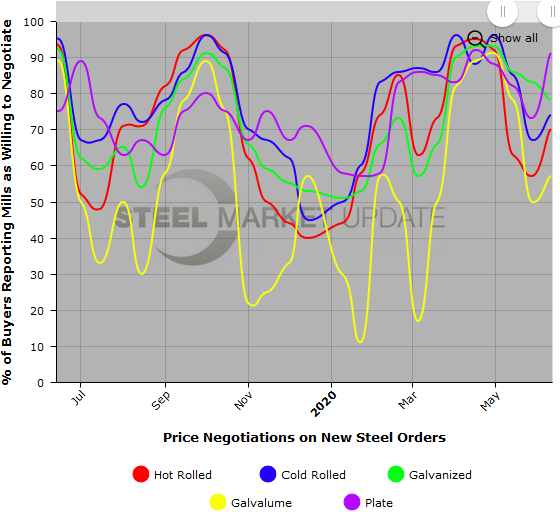

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (second example below), visit our website here.