Market Data

June 25, 2020

Steel Mill Lead Times: HR Unexpectedly Shorter

Written by Tim Triplett

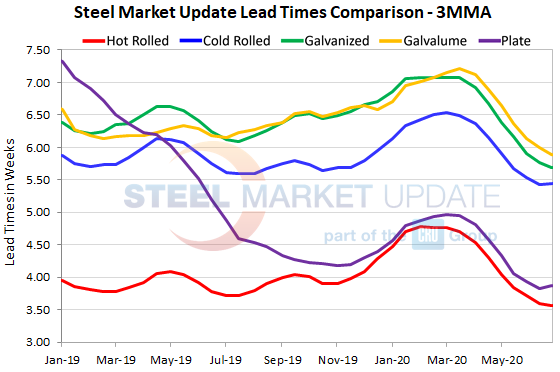

Lead times for spot orders of hot rolled steel have shortened a bit in the past month, which is somewhat unexpected, while delivery times for other flat rolled products have seen small ups and downs as the market searches for a stable footing.

Hot rolled lead times now average 3.59 weeks, down from 3.73 two weeks ago and 3.91 a month ago, according to Steel Market Update’s last three checks of the market. Lead times, especially in the commodity hot rolled segment, were widely expected to lengthen as coronavirus restrictions were lifted and the mills got busier. That the opposite has occurred suggests the market’s recovery still has a way to go.

Among the other flat rolled products, cold rolled orders currently have a lead time of 5.79 weeks, up from 5.71 in mid-June and 5.54 a month ago. The current lead time for galvanized steel is 5.98 weeks, little changed from 5.95 two weeks ago, but up notably from 5.63 weeks at the end of May. The trend is the opposite for Galvalume, now down to 5.80 weeks from 6.00 weeks in SMU’s last two polls of the market. Plate lead times have extended a bit to 4.55 weeks from 4.00 earlier in the month.

Looking at the three-month moving averages to smooth out some of the variability in the biweekly readings, lead times have been trending downward since the coronavirus struck in March and are about a week shorter than prior to the pandemic. The current 3MMA for hot rolled is 3.56 weeks, down from 4.71 in mid-March. The 3MMA for cold rolled is now 5.44 weeks, down from 6.49 weeks. Galvanized lead times, measured as a 3MMA, are now 5.69 weeks, down from 7.07 weeks. The 3MMAs indicate lead times for flat rolled have not been this short since 2016.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.