Prices

July 7, 2020

CRU: What’s Behind the Surge in Freight Rates?

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg and Prices Analyst Rory Knight

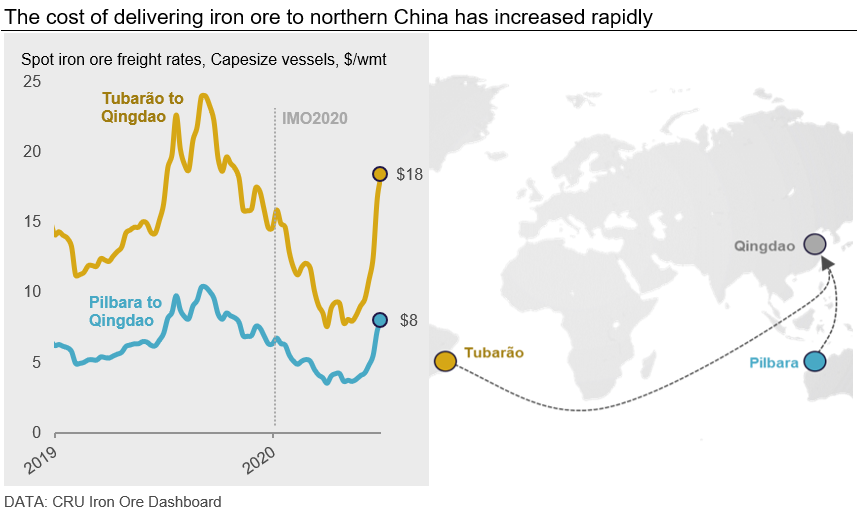

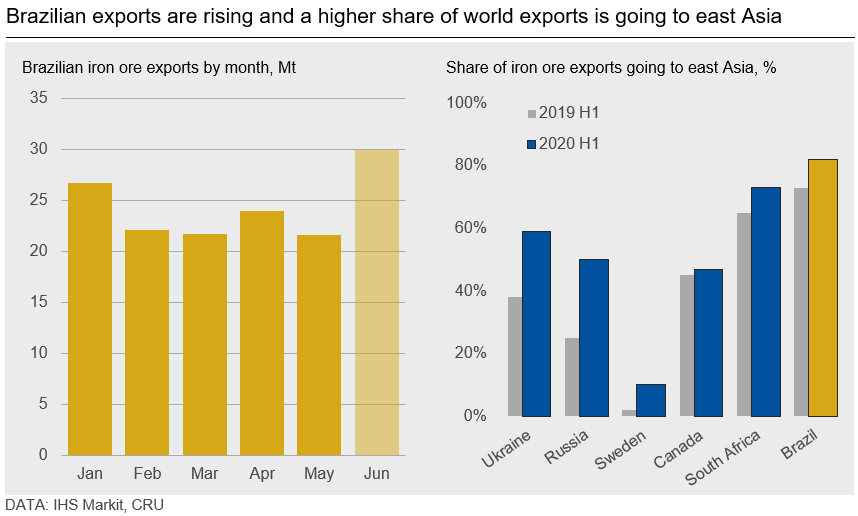

In the past four weeks, freight rates have nearly doubled as Brazilian iron ore shipments have increased while an increasing proportion of global exports are being shipped to distant markets, reducing fleet availability. This is benefiting European steelmakers, while hurting iron ore miners, particularly fines and pellet feed producers.

Freight Rates Doubling in One Month

Having reached record lows in 2020 Q2, dry bulk freight rates rose in an extraordinary fashion in June. While bunker fuel prices have risen somewhat on higher oil prices, the surge is primarily driven by a sharp increase in time charter rates. Leading the charge is the Capesize market that is returning to 2019 Q3 levels as iron ore supply improves and vessel supply tightens.

Capesize Demand Surging on Brazilian Recovery

Capesize freight rates turned the tide at end-May with vessel supply tightening as Brazilian iron ore exports picked up. Compounding the supply situation was Australia’s continued iron ore export strength in the lead up to their financial year-end in June, which has resulted in strong vessel demand in the Pacific region. Moreover, vessels have been employed for longer voyages this year as “tonne mile” demand has increased due to iron ore miners in the Atlantic basin diverting some of their cargoes from the shorter Europe voyage to east Asia. This is in response to weak demand in Europe, where substantial cuts have been made to BF capacity utilization. China has readily absorbed the increased imports as steel production has rebounded strongly in Q2 and, consequently, their iron ore inventories have been stretched in recent months.

With more iron ore already being shipped over longer distances, rising Brazilian exports in June coupled with Vale reaffirming their production guidance for the year has triggered the sharp increase in both physical and paper freight markets. This has led to a sudden rise in Capesize demand in the Atlantic region at a time when most vessels were employed in the Pacific.

In addition to stronger vessel demand, Capesize vessel supply has tightened in the first half of this year. Covid-19 lockdowns in Asia caused significant newbuild slippage in the first few months of the year. Meanwhile, record low charter rates, which were well below opex for many vessels, prompted the scrapping of older ships, including some very large ore carriers (VLOCs). Slippage and scrapping were more acute for Capesize vessels than for other bulk carriers because Capesize earnings in 2020 H1 were particularly low—that vessel class is more reliant on iron ore than other vessel classes, for example Panamax or Supramax.

Q3 is a seasonally strong quarter for the dry bulk market as smaller vessels benefit from strong grain supply in the Atlantic market and, with weather-related disruption risk low at this time of year, Capesize ships benefit from stable iron ore and coal supply. Downside risks remain, however, with a slowing inventory drawdown in China on the demand side and net growth in the fleet as an increasing number of ships are scheduled for delivery in Q3 and Q4.

Pellet Feed and Fines Producers More Affected

This recent surge in freight rates has occurred as the 62% Fe fines, CFR China price has fallen off its peak of $105 /dmt. That means iron ore prices on an FOB basis, after a netback calculation, have been declining even faster. This reflects recent market dynamics with stronger shipments from Brazil, Australia, Peru and higher arrivals at Chinese ports.

Higher freight rates disproportionally affect fines and pellet feed exporters, as those products typically have high moisture levels (i.e. 8-12 percent), meaning the vessels are laden with more water per unit of iron being transported compared with products such as pellet and lump with moisture levels in the 1-5 percent range. Also, low-grade fines exporters are more exposed as the cost of freight makes up an even higher share of the 58 percent Fe fines, CFR China price.

High freight rates give European steelmakers a competitive advantage since they buy iron ore on an “FOB Brazil” basis, effectively getting a discount from the larger freight differential between the Brazil-Europe and Brazil-Asia voyage routes.

CRU expects freight rates to come down from the current elevated levels as this surge is partly driven by short-term positional dynamics and we expect the Capesize fleet to continue to grow in H2.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com