Market Segment

July 19, 2020

CRU: China Pulls the World’s Prices Higher, Again

Written by Matthew Watkins

By CRU Principal Analyst Matthew Watkins, from CRU’s Global Steel Trade Service

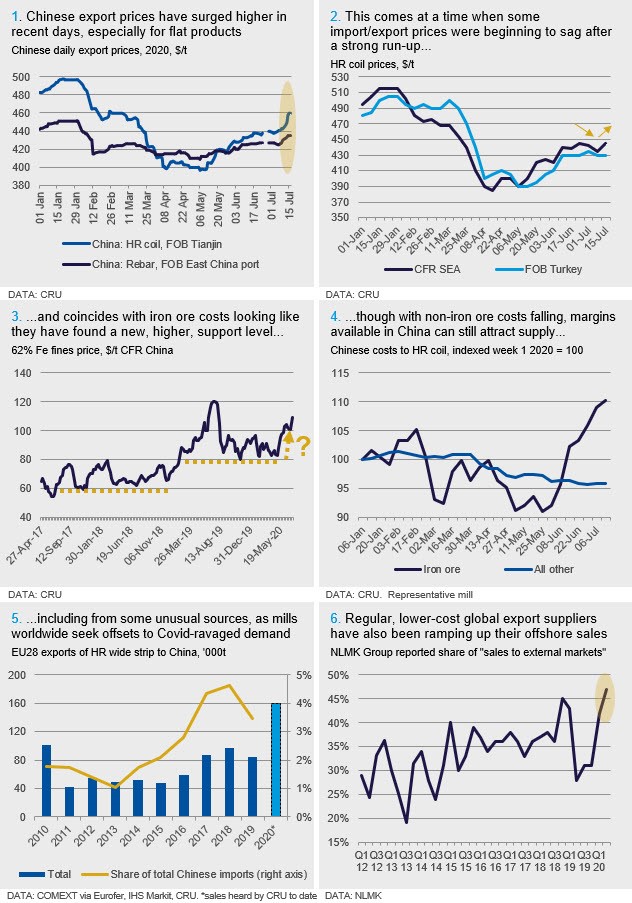

Strength in China has continued. Over recent days there has been a renewed surge upwards in Chinese export prices, especially for HR coil, which rose by a total of $17/t in just three trading days this week (see chart 1).

This comes at a time when some import/export price series were beginning to sag after a strong run-up since May (see chart 2). Southeast Asian import prices have ticked back up as other sellers start to follow China’s lead. Indian steel mills have become firmer on their price requests, perceiving better demand in several of their key export markets as well as expecting improvements to come domestically as lockdowns ease. Meanwhile Turkish export prices have stabilized, while those from CIS origins are all pushing higher with our July assessments.

Positive Chinese Industrial Growth Data Fuels the Surge…

This fresh surge coincides with further positive data on China’s recovery from lockdown. Q2 GDP figures of 3.2 percent y/y confirmed the return to economic growth, after the 6.8 percent y/y contraction recorded for Q1. Of particular note for steel, it is China’s industrial sector driving this growth. Industrial output is growing strongly—up 4.4 percent y/y in Q2—but the consumption side of the economy is not; for example, retail sales are still falling y/y.

…While Iron Ore Costs Provide Further Impetus and Support

Higher Chinese steel prices also coincide with a renewed step higher in the cost of iron ore. This has moved from support at $60 /t pre-Vale accident, to support at $80 /t after that, to an apparently fresh floor being established at $100 /t in the last two months (see chart 3).

Robust demand for ore from China is one piece of this pattern. The other is that supply has seen frequent constraints and interruptions, especially from Brazil but also latterly from other origins including South Africa. Such constraints are not replicated across other raw materials. Scrap costs are falling as supply rises post-lockdown. In July there was an average m/m fall of 5 percent across the scrap import and export prices that CRU assesses.

Margins Available in China are Attracting Supply from Everywhere

While iron ore costs are both driving and supporting steel prices in China, falls in non-iron ore costs (see chart 4) mean that margins on offer in its steel market have actually been growing. This is attracting supply. In the first instance Chinese steel production is still running at very high levels, and Chinese steel mills are not aggressively pursuing exports. But as noted in prior editions, China is also importing steel. This includes from some unusual origins. For example, we have heard of at least four cargoes totaling c.160,000 tonnes of HR coil sold from North Europe to China. Europe typically provides less than 5 percent of China’s total imports of this material, and this kind of volume would far surpass anything of the sort over the past 10 years (see chart 5).

Outlook: Summer Days, Drifting Away

Last month we highlighted that we are moving into what is typically a seasonally weaker demand period for China. In fact, this is generally the case worldwide. All of the major steel-consuming regions typically see a q/q decline in steel consumption in Q3, influenced by weather patterns and holidays. In this unusual year there is a question about whether it will be “a normal summer” or whether industry and construction will keep running to compensate for lost output during lockdowns. It seems highly likely that there will be no q/q contraction this year because that would imply a return to total lockdown. But does that mean that Q3 will be strong in any absolute sense? Perhaps not – Asia will still have a monsoon; barriers to going on holiday are being removed in Europe.

Meanwhile steel supply is not being cut further; rather we are seeing the opposite. Some operations are resuming or set to resume in the USA, Brazil and France, for example. And among some of the world’s regular, lower-cost, export suppliers there has been a shift towards the export market rather than a drive to make large output cuts. Both NLMK and Severstal recently reported high shares of export sales in their commercial mix. At NLMK this share reached its highest level since at least 2012 (see chart 6).

As has been the case over recent months the possible disrupter to this slower trend is China. Its stimulus is the driver here. If that is able to keep sucking in steel, then prices can remain supported. Sharp falls in equity and steel futures markets today suggest that someone agrees with CRU’s China office’s view of the current rally being driven higher than fundamentals of supply and demand would justify.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com