Market Segment

July 28, 2020

CRU: Covid-19 Impact on the Steel Supply

Written by Iris Speelmanns

By CRU Analyst Iris Speelmanns, from CRU’s Steelmaking Raw Materials Monitor

The following is excerpted from CRU’s weekly report on steel supply disruptions and restarts.

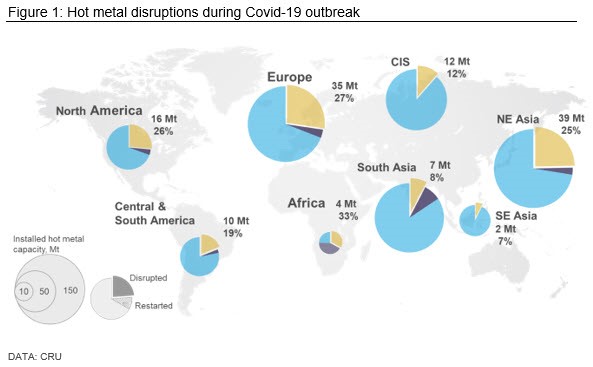

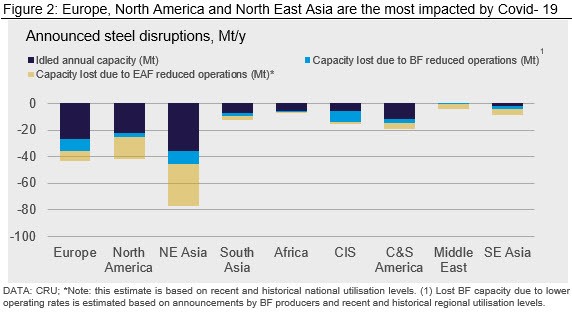

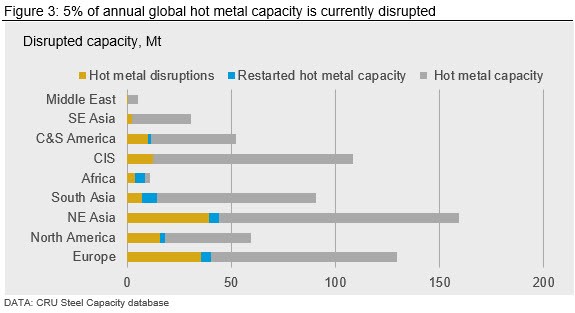

Several weeks after national lockdowns were eased, activity in steel-consuming sectors continues to resume and mills are restarting or ramping up production in some regions. Outside China, the spread of Covid-19 means that 230 Mt of capacity (annualized) is currently lost. This is equivalent to 10 percent of total steelmaking capacity.

Key developments have taken place in North America. Although the USA hit a record high of new daily Covid-19 infections and economic signs have worsened, steel producer U.S. Steel is preparing to resume operations at another BF at its Gary works. The company said strong demand particularly from the auto industry, one of its key customers, in addition to firm demand from packaging, appliances and construction, provides sufficient support for this step.

Demand recovery in Europe continues to be slow and bumpy. BF-BOF producers in most regions have restarted idled facilities. However, so far in Europe, the only BF restart we have heard of was at the U.S. Steel Kosice works following a temporary banking for maintenance. Otherwise, only ArcelorMittal has announced plans of a possible BF restart at Dunkerque in mid-August, while it is reported that SSAB will keep its BF in Raahe, Finland, idled until at least end-2020 Q3, in addition to pulling forward maintenance from Q4 to July and August.

In terms of EAFs, producers have been ramping up production during recent weeks and months after national lockdowns were eased. In Germany, firm demand from construction projects supported EAF-based longs production. In Italy, one of the countries in Europe hardest hit by Covid-19, EAF producers have been gradually ramping up production after they received permits allowing them to operate in late-April and lockdowns were slowly eased from May onwards. Crude steel production in Italy, where ~80 percent is produced via the EAF route, was 1.8 Mt in June, according to the latest data published by the World Steel Association, which is almost back to pre-pandemic output levels when monthly production was ~ 2.0 Mt. This indicates that EAF utilization rates are currently around 85 percent. The summer holidays for Europeans will be spread over the next few weeks up to the end of August, tempering further production growth due to expected weakening of demand.

Independent of Covid-19, Russian steelmaker Evraz has completed the overhaul of BF No. 6, which now has a capacity of 2.5 Mt/y, at its Nizhniy Tagil (NTMK) plant after 16 months of modernization work. With the ramp-up of No. 6 and the launch of BF No.7 (2.6 Mt/y) in 2018, the company has also taken offline BF No. 5 (1.8 Mt/y) that has reached the end of its useful lifetime. However, further decisions on the future of this BF are still pending.

Other developments in the week of July 21 took place in South Asia. India’s state owned, Rashtriya Ispat Nigam Limited (RINL) resumed operations at one of its closed blast furnaces (BFs), while other steelmakers are also lifting output by increasing capacity utilization levels. This ramp-up is backed by demand recovery in the manufacturing sector, a strong revival in white goods and automobile sales in July and high exports.

Although Europe’s steel-intensive manufacturing sector is recovering, inventories of finished products have stayed high even as lockdowns have eased, which may suppress steel demand in the future.

In North America, JSW announced that it is going to idle its plant in Mingo Junction, Ohio. The announcement comes only four weeks after the company had resumed operations at its EAF and rolling mill, which had been suspended in late April due to the rapid loss in steel demand during the first wave of Covid-19 in the USA. JSW is planning to work on modernization during the downtime.

Independent of Covid-19, Stelco has taken offline its BF at Hamilton works in Canada for a planned reline, and the outage period is expected to last for 75 days. Further production cuts in North America are done by ArcelorMittal, where the “D” blast furnace at Burns Harbor works facility suffered an explosion on July 16 and has been taken offline. The impact on production may cause a near-term bottom for sheet prices, which came under pressure after supply in the USA has outweighed demand.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com