Market Data

October 1, 2020

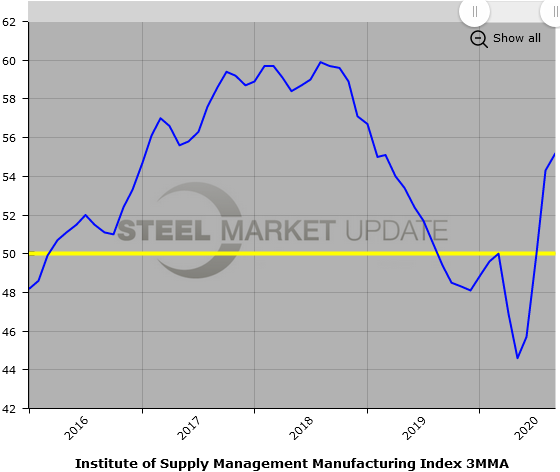

ISM: Manufacturing Expands for Fifth Month

Written by Sandy Williams

The manufacturing sector grew again in September, indicating a fifth month of expansion for the economy, according to the latest Manufacturing ISM Report on Business. The September PMI registered 55.4 percent, down 0.6 percent from August.

“Manufacturing performed well in the month with demand, consumption and inputs registering growth indicative of a normal expansion cycle,” said Timothy R. Fiore, chairman of the Institute for Supply Management Manufacturing Business Survey Committee. “While certain industry sectors are experiencing difficulties that will continue in the near term, the manufacturing community as a whole has learned to conduct business effectively and deal with the variables imposed by the COVID-19 pandemic.”

Production and new orders slowed from August, posting readings of 61 percent and 60.2 percent, respectively. Backlogs were higher at 55.2 percent, and supplier deliveries gained 0.8 points to register 59 percent. Manufacturer inventories gained 2.7 points, but remained in contraction at 47.1. Customer inventories were considered too low at an index reading of 37.9. Prices increased faster in September, posting a 3.3-point increase to register 62.8. Fiore noted higher input prices were passed on to customers.

“Inputs — expressed as supplier deliveries, inventories and imports — continued to indicate input-driven constraints to further production expansion, but at slower rates compared to August,” said Fiore. “Inventory levels contracted again due to strong production output and supplier delivery difficulties. Overall, inputs improved compared to August and contributed positively to the PMI calculation.”

New export orders increased one point in September, growing for the third consecutive month at a faster rate, registering 54.3 and the highest level since September 2018. Imports remained in expansion for a third month as well, but slipped 1.6 percentage points to 54 percent.

Fourteen of the 18 manufacturing industries reported growth in September, including fabricated metal products, machinery and transportation equipment. Primary metals were among the four industries in contraction.

Comments from respondents included:

- “Overall business conditions are improving, but not at the rates we saw them decline.” (Fabricated Metal Products)

- “Business is booming, and the supply chain has been caught off guard. We are working closely with our suppliers to ensure supply and try to control costs. The resin industry, along with plastics, is driving cost increases and scarce availability.” (Transportation Equipment)

- “Our customer order intake is increasing significantly for deliveries in the first half of 2021. Outlook is generally positive.” (Machinery)

- “Demand remains high, strong finish to 2020 projected, with an even stronger 2021 fiscal year. Prices have increased in certain categories, but no major price increases of our own have been implemented yet. We are seeing an uptick in reshoring opportunities in the third quarter across various industries and products.” (Electrical Equipment, Appliances & Components)

- “Raw material shortages, especially of hardwood logs, are starting to impact overall supply. Domestic market demand is fragmented, but remains sound. Export demand, especially to China, is robust.” (Wood Products)

- “Still struggling with long lead times for components coming from China [contract manufacturers].” (Computer & Electronic Products)

- “Our business has not begun to recover.” (Petroleum & Coal Products)

Below is a graph showing the history of the ISM Manufacturing Index on a 3MMA basis. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.