Analysis

October 16, 2020

Final Thoughts

Written by Tim Triplett

Steel Market Update’s service center inventories data for September shows supplies on hand at very low levels. At the same time, the percentage of inventory on order is at very high levels. That suggests, say some observers, that some service centers may have waited too long to replenish their inventories, then did some panic buying to catch up, pulling demand forward. The result may be lower demand than expected from the distribution sector for the rest of the year. On top of seasonal weakness and lower scrap prices, that could add to the challenge the mills face in collecting higher prices.

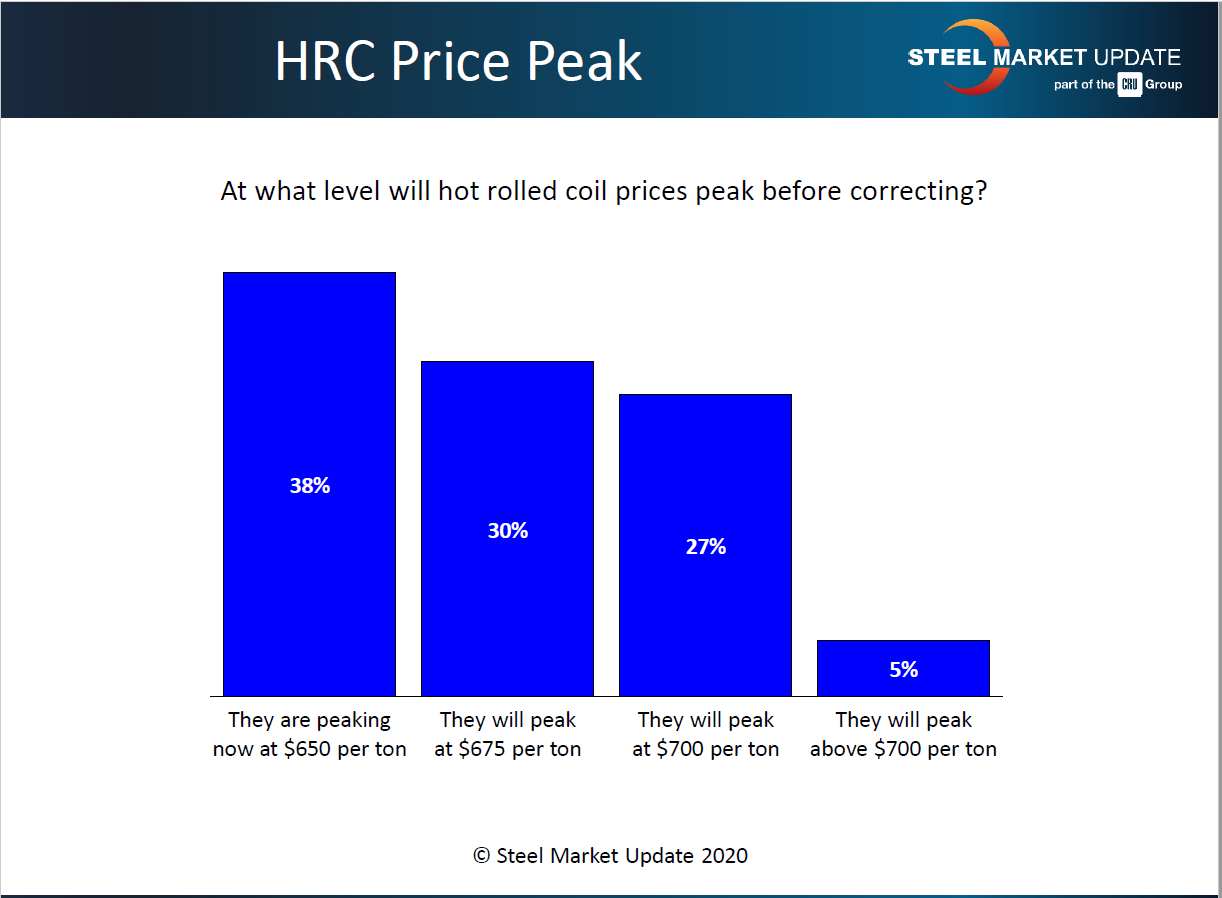

Mills reportedly are pushing for $700 per ton hot rolled, but only 27 percent of buyers polled recently by SMU believe prices will get that high before correcting. About 38 percent believe steel prices are already peaking around the $650 level. As one skeptic commented to SMU: “Pricing at over $650 in this market cannot be sustained. The air is too thin at that elevation.”

Homebuilding has been surprisingly resilient during the pandemic, but the more steel-intensive commercial side of the construction market has been a disappointment. In a recent blog, the experts at ITR Economics point to one sign of life for nonresidential construction, the U.S. Architecture Inquiries Index. Published by the American Institute of Architects, the index rose to 51.6 in August, above the neutral level of 50 indicating an increase in inquiries to architects across the country. This is the first monthly score above 50 since the metric cratered in March, noted ITR, and it’s encouraging because inquiries would naturally precede an increase in actual architectural services. None of AIA’s other indexes have topped the 50 threshold yet, however, and ITR still projects fewer new nonresidential construction projects in 2021.

It’s still not too late to register for our virtual Steel 101: Introduction to Steel Making & Market Fundamentals Workshop this Tuesday and Wednesday, Oct. 20-21. For more information click here. If you miss this one, the next Steel 101 workshop will be conducted in less than two months, on Dec. 8-9.

Registration is also open for the CRU Ryan’s Notes Ferroalloys 2020 Virtual Conference scheduled for Oct. 26-29. This is the ferroalloys trading event of the year, to run on the same virtual platform as the SMU Steel Summit. The agenda includes an impressive lineup of speakers, whose presentations will be available to registrants on-demand for three weeks after the live dates. The virtual conference will include “speed networking” sessions at several points in the agenda to enable introductions among attendees. Click here for more information.

Steel Market Update will be working with the Port of Tampa on the Port of Tampa Steel Conference which is slated for Feb. 2, 2021. More details on the virtual event will be available soon.

As always, your business is truly appreciated by all of us here at Steel Market Update.

Tim Triplett, Executive Editor