Market Segment

October 20, 2020

CRU: How Higher CO2 Prices Could Shift the EU to Low-Carbon Steelmaking

Written by Ryan Smith

By CRU Senior Analyst Ryan Smith and Research Manager Paul Butterworth

CRU analyzes hydrogen-steelmaking costs in the EU and explains why CO2 prices of more than $200/t-CO2 are required to incentivize an EU industry shift to these technologies.

Climate Goals vs. Economics

The 2050 goal for the EU economy is to be climate-neutral, meaning that the EU economy functions with net-zero greenhouse gas emissions. For the EU to achieve this goal, significant emissions abatement will need to be realized across all sectors, including the steel sector that, on average, emits over 180 Mt of CO2 each year.

A technology that is being promoted by steel producers as a means of achieving this is hydrogen-based iron and steelmaking. In this Insight, CRU analyzes the costs of hydrogen-based steelmaking, focusing on the H2-DRI-EAF route, and then demonstrates why current CO2 prices are not high enough to incentivize a whole industry shift towards this process route.

Hydrogen-based Ironmaking is an Emerging Technology

The CO2 intensity of steel is directly related to the amount of carbon-containing inputs used in the ironmaking and steelmaking processes. Ironmaking, which is dominated globally by the conventional blast furnace (BF), consumes coke and accounts for over 80% of the emissions emitted by the steel industry in 2019 and provides the greatest abatement potential.

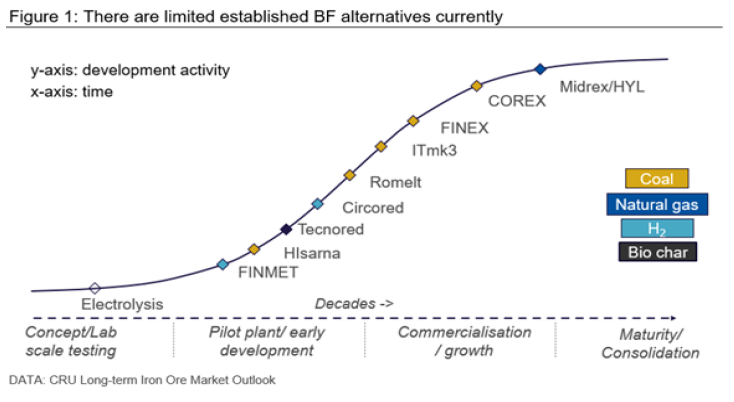

There are numerous examples of BF-alternative, low-CO2 ironmaking technologies in operation. However, only a few of these have reached commercial scale. BF-alternative technologies play a role of providing a scrap substitute in regions where scrap availability is low, scrap prices are high and energy costs low – as with the deployment of Midrex and HYL in the Middle East.

BF-alternatives also find application as a hot metal substitute where conventional BF ironmaking might be constrained due to the availability of coking coal, land constraints, etc.– such as the use of Corex in India. (An in-depth analysis of alternative ironmaking technologies is available to subscribers of CRU’s Long-Term Iron Ore Market Outlook 2020.)

Development and scale up of ironmaking technologies extends over decades and this creates risk for steelmakers with emissions reduction targets that are anticipating a commercial-scale breakthrough before 2050.

One technology that has been receiving attention in recent years is hydrogen-direct reduced iron (H2-DRI). The H2-DRI route of ironmaking that is being investigated and tested by several steel producers in the EU utilizes established Midrex or HYL/Energiron DRI technology. Traditionally these processes operate utilizing natural gas with steam or a CO2 reformer to produce a CO/H2 reductant that strips the oxygen from the iron oxide. Natural gas-DRI is already a low-carbon alternative to the BF. However, to meet regional climate goals, deeper emissions cuts are required than standard DRI can provide.

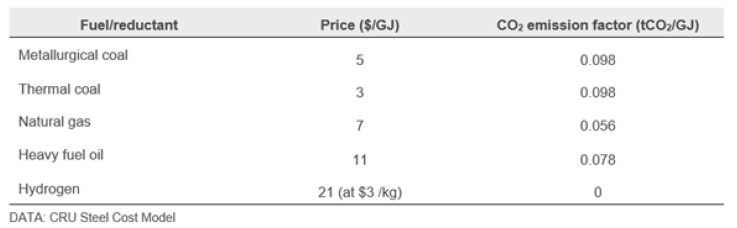

Hydrogen is a High Cost Energy Carrier

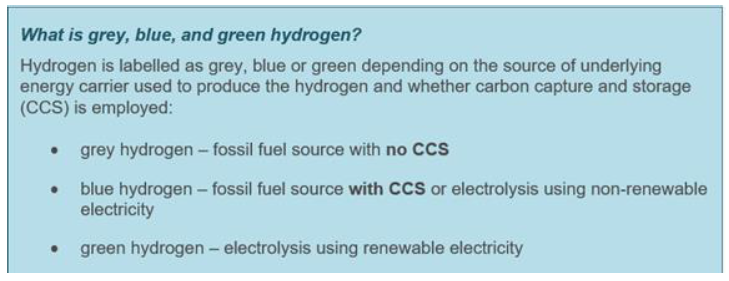

Hydrogen as a replacement for natural gas is costly and, on a $/GJ basis (real 2019$), hydrogen ranges from ~$15 /GJ ($2.4 /kg) for grey H2 to >$20 /GJ ($5.5 /kg) for green H2 – more than double the 2019 average EU gas price. The lowest cost route for producing hydrogen is currently grey hydrogen, utilizing natural gas, or coal gas, with no carbon capture and storage. If steel was produced using grey hydrogen and H2-DRI there would be little difference in the finished steel in terms of emission intensity vs steel produced with natural gas based DRI.

Operating costs are the largest cost driver in the production of H2. In “green” electrolysis processes, such as Proton Exchange Membrane (PEM), the electricity price drives the operating costs and in “grey/blue” – Steam Methane Reforming (SMR) – natural gas prices drive the operating costs. In the absence of carbon pricing it is more cost effective on a GJ basis to reduce iron oxides using natural gas due to the processing required to produce H2 from natural gas and the fact that reduction of iron oxides using H2 is endothermic – requiring more GJ/t of iron produced.

When carbon pricing is a consideration, H2 as a reductant can become a cost-effective option. Hydrogen combusts to produce water that attracts no direct CO2 price, but CO2 emissions produced when producing hydrogen, as in the case of grey and blue hydrogen, will incur a CO2 cost that would need to be passed onto the steel producer.

What CO2 Price Normalizes Fuel Costs?

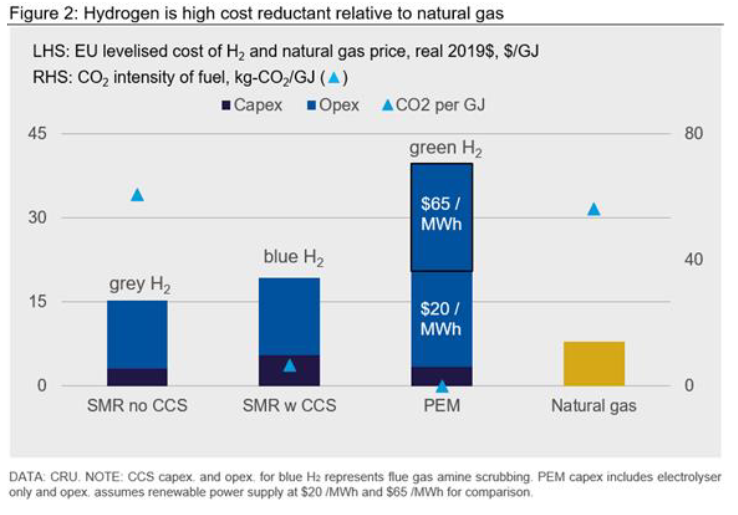

This Insight, and much research in this area, is interested in lots of detail about capital costs, costs of renewables, operating costs, efficiency of use of different fuels and other relevant factors, all of which can serve to cloud the fundamental issues. However, sometimes it is better to simplify things and just look at the underlying drivers. In this instance, what we want to do is compare the cost of hydrogen, which is CO2 free, with traditional fuel sources that will emit CO2.

To do this, below is a table of fuel sources relevant to the steel industry including price and CO2 emissions factors:

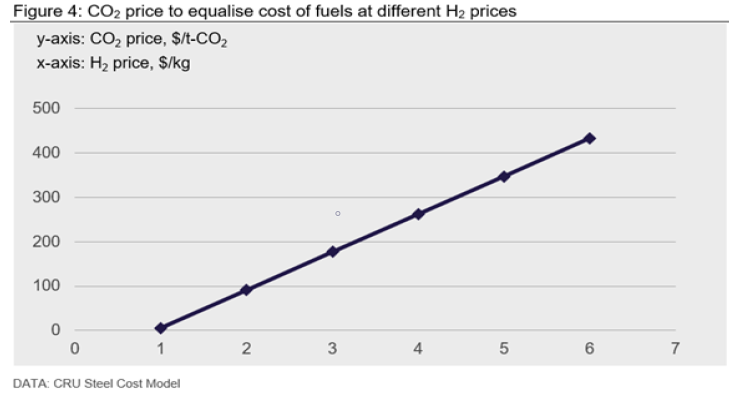

The chart below (Figure 3) shows the CO2 cost that needs to be added to each fuel in order to render the average cost of all fuels (straight average used) the same as hydrogen priced at $3 /kg taking into account the emission factors above. The chart further below (Figure 4) shows how the CO2 price must change under different hydrogen prices in order to render the fuels equally costly. This chart shows that, at $3 /kg for hydrogen, the CO2 price would have to be ~$175 /tCO2 to equalize the cost of fuels, lower than the value discussed above for switching technology in the steel industry. However, this only renders hydrogen viable when it can be switched directly for the fossil fuel in question and so renders operating costs the same. If capital expenditure is required to make this switch, then a higher CO2 price would need to apply to render any investment viable.

Hydrogen-based Steelmaking Has Higher Operating Costs

Using CRU’s Steel Cost Model, we have compared the 2025 operating costs of H2-DRI-based steel production in Europe, specifically H2-DRI charged directly into an EAF (i.e. H2-DRIEAF). The input hydrogen cost plays a large role in driving the cost of this configuration and so CRU has modelled hydrogen costs under the following configurations:

- At cost grey hydrogen (i.e. SMR with no CCS)

- At cost blue hydrogen (i.e. SMR with CCS)

- At cost green hydrogen (i.e. PEM with grid power)

- At cost green hydrogen (i.e. PEM with own photovoltaic power)

The results from the cost modelling are shown in Figure 5.

The operating costs of H2-DRI-EAF steelmaking are, on average, higher than the forecast average costs for the current installed European capacity base. For modelling purposes, we have assumed close to 100% DRI feed with ~50 kg/t home scrap.

It is likely that we could see EAF design and operating practices evolve in response to constraints placed by CO2 costs. We can expect mills to optimize their practices and find ways to reduce costs as they adjust to changing inputs, such as H2-DRI, but, due to the fundamental economic drivers for H2 production, we do not expect that these cost improvements will be sufficient to close the gaps highlighted in Figure 5.

The operator-owned green hydrogen configurations highlight the strong influence of input electricity costs on the competitiveness of hydrogen-based steel production. A steel producer that is paying $65 /MWh for electricity (the EU’s lowest, at-cost renewable power according to CRU research) to produce hydrogen via electrolysis will have costs over $200 /t higher than the lowest cost producer, which is a BF-BOF operation, on CRU’s EU steel cost curve.

The operator-owned grey and blue hydrogen configurations sit around the 95th percentile of the cost curve. The cost position of these configurations is strongly influenced by natural gas cost. The overall CO2 intensity of the steel produced using SMR without CCS will be at a similar level to steel produced using a high proportion of natural gas based DRI in the EAF charge.

This raises the question: If production costs for these technology options are so much higher than current operations – and considering that steel produced via the BF-BOF route averages ~2 t-CO2/t-steel – then how high do CO2 prices need to be to incentivize a technology shift?

To answer this question fully we must first consider the capital intensity.

Capital Intensity for Hydrogen-based Technologies is High

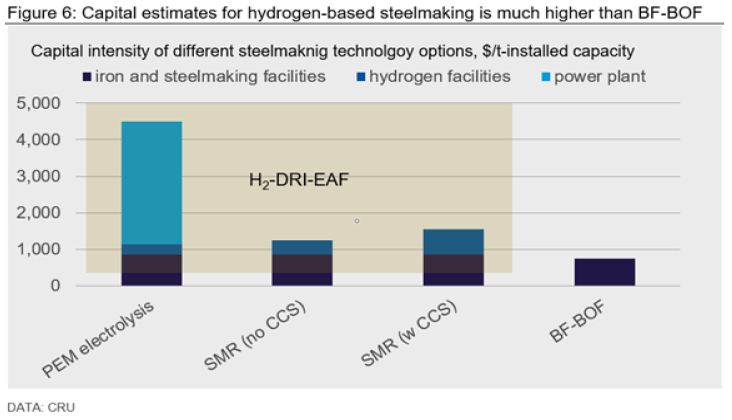

Steelmaking in its conventional form is highly capital intensive and sustaining capital to maintain operations is high. The capital intensity of an integrated BF-BOF mill is approximately $750 /t-installed capacity, which is similar to that of an integrated, natural gas-based DRI-EAF operation with an on-site pellet plant. When the additional capital costs to account for the hydrogen production and storage facilities are added to the capital estimates of an integrated DRI-EAF operation, the costs become much higher than $750 /t, increasing the barrier to entry for adoption of hydrogen-steelmaking technologies.

In order for steel producers to obtain hydrogen at cost it is assumed in this analysis that they will own their own hydrogen production facilities, which will include electrolysers and may include own electricity generation. Figure 6 illustrates the difference in capital intensity for the integrated H2-DRI-EAF operations once hydrogen production facilities have been accounted for. The difference in capital intensity for operations with grey and blue hydrogen production compared with a traditional BF-BOF operation ranges from ~$500 /t to $800 /t installed capacity, with the blue hydrogen configuration at a higher capital intensity overall due to the requirement for CCS, which includes scrubbing processes, compressors, transport and injection into underground basins. The costs and ability to utilize CCS will vary by producer and will be driven by flue gas CO2 concentration and access to storage reservoirs.

The largest capital cost differential is observed for integrated operations with green hydrogen facilities. When the power supply is not included, the capital cost estimates for an integrated H2-DRI-EAF with sufficient electrolyser capacity is on par with an operation utilizing SMR with no CCS for its hydrogen supply. However, when the capital cost for the power supply, specifically photovoltaic cells, is considered, this raises costs substantially.

CRU demonstrated in the previous section that an operation that can obtain low cost electricity would sit within the 3rd quartile of the EU steel cost curve. To obtain the low electricity price a producer would likely need to invest in the power supply or find some other avenue, such as a government subsidy, to obtain low cost electricity. CRU estimates that the capital cost differential between a traditional integrated BF-BOF operation and a H2-DRI-EAF operation with adequate power capacity would be more than $3,700 /t-installed capacity.

With operating and capital costs for hydrogen-steelmaking technologies established, what CO2 price is necessary to penalize CO2 emissions such that a steel producer is incentivized to move to a higher operating and capital cost technology?

CO2 Prices Must be Higher to Incentivize Hydrogen Steelmaking

CO2 prices must be high enough such that average CO2 costs lift to a level at which steel producers will consider switching to a lower-CO2 technology to avoid the CO2 costs, despite the high capital costs involved. Under the EU ETS, higher CO2 prices will lead to higher marginal and average CO2 costs, but the free allocation of some CO2 permits will drive a difference between the marginal and average CO2 costs. When this allocation is removed, marginal CO2 costs will equate to average CO2 costs and this is the premise under which we have estimated a CO2 price below. Any continued free allocation of CO2 permits will lift the required CO2 price to incentivize a shift to low-CO2 technologies higher than stated below.

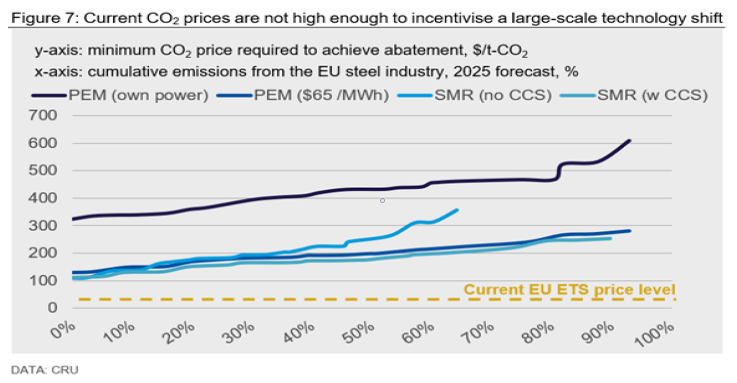

Through NPV analysis, CRU has determined the minimum CO2 price required to incentivize each individual EU producer in CRU’s Steel Cost Model to switch their current CO2 intensive capacity base to a low-CO2 hydrogen-steelmaking configuration. The emissions externality of the current configurations versus a hydrogen-steelmaking configuration is incorporated into the NPV analysis and, using modelled operating costs, capital costs and CO2 intensity of the current and new technologies. The results are charted in Figure 7 below.

The modelling results show that the current EU CO2 price level is an order of magnitude lower than the level required to incentivize an industry shift to hydrogen-based steelmaking. Using Figure 7, we can see that a CO2 price of $200 /t-CO2 would be sufficiently high to justify abatement of up to 60% of EU steel industry emissions through use of SMR with CCS if the whole industry chose, and was able, to utilize this technology. Alternatively, the same $200 /t-CO2 would be high enough to abate ~50% of emissions through the use of PEM at a feed electricity price of $65 /MWh.

In order to realize CO2 abatement in excess of 90%, the CO2 would have to approach $300 /t. Abatement does not reach 100% in our modelling due to the fundamental role that carbon

plays in steelmaking operations (i.e. alloying, slag foaming). To achieve abatement up to 100%, steel producers would need to consider offsetting these emissions, hence why steel producers promote “net-zero CO2” as opposed to “zero-CO2.”

Note that the CO2 prices discussed assume no free allocation. Under the current free allocation scheme, whereby EU steel producers receive up to 80% of their emission allowances for free, CO2 prices would need to increase further, to over $1,000 /t-CO2 at an average level of 80% allocation.

Structural Changes Required to Enable Hydrogen Steelmaking

The outcome of the analysis above points to the need for structural changes across many areas in the EU in order to support a low-CO2 steelmaking sector. This could include changes to policy (e.g. higher CO2 prices, programs/funds to offset capital costs of new technologies), lower, regulated electricity prices, lower gas prices and the development of sufficient renewable, hydrogen storage and CO2 storage capacity.

The EU steel industry operates in a competitive market and steel producers are price takers and compete with steel that has not had to internalize emissions costs. However, the above analysis implies that steel prices in the EU would need to be $100s higher than today in order to support the transition from the current, traditional BF-BOF route to the low-CO2 options investigated. That is, current configurations and low-CO2 options both need to be economically viable for the steel producers to be even in a position to make the decision to transition. As such, very strong measures would need to be in place to stop lower cost imports, with no CO2 costs, claiming market share.

CRU is assessing the spectrum of CO2 abatement options for steel producers both within the

EU and globally. For more information please contact the author on the details provided.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com