CRU

January 15, 2021

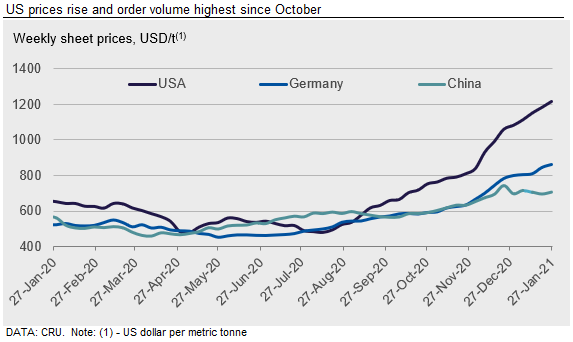

CRU: Competitive Imports a Potential Turning Point for Sheet

Written by George Pearson

By CRU Prices Analyst George Pearson from CRU’s Steel Sheet Products Monitor

HR coil import prices and lead times are now competitive with domestic mills in the U.S. and Europe. Both markets remain tight in the short-term, but this is giving buyers more optionality for forward deliveries than in previous months and some negotiation power again—although still limited—in what has been a very strong seller’s market.

North America

Sheet prices in the U.S. Midwest market continue to rise and HR coil is now at a new nominal high of $1,102 /s.ton. This price reflects actual spot transactions booked last week and the number of contributions to overall volume is the most we have recorded since the first week of October. This suggests to us that the availability of supply has increased materially, and we may now be quite close to a point where prices stabilize, if not peak. While some market participants continue to struggle to book enough steel, we are now hearing of increased import availability where both price and lead times are competitive with domestic offers.

Companies on the U.S. West Coast are finding it hard to source enough tonnes for their customers’ requirements. California Steel Industries and USS-Posco continue to limit the number of tonnes customers may purchase and were able to fill their April order books in a week. As prices continue to rise in the rest of the U.S., offers from the Midwest and Southern mills have become scarce. Steel buyers have been forced to purchase steel from one another, often paying significantly higher prices, just to fill critical items.

Europe

European domestic sheet prices also continued to rise w/w. Prices increased by €4-27 /t w/w across sheet products. The largest increases were for CR and HDG coil, and tightness of supply has shifted to these products over HR coil. That said, stock on the ground at service centers remains low for all coil products, according to market participants. One European mill is offering HR coil for delivery at the end of April, but lead times at several northern mills are in May-June. Import offers for HR coil are at the same price level or below that of European mills and on equivalent lead times. We have heard HR coil volumes booked to southern Europe for March shipment in recent weeks, which is expected to ease supply constraints.

China

Chinese domestic sheet prices were mixed this week. While HR coil and CR coil recovered by RMB 20–60 /t w/w, HDG prices fell significantly by RMB160 /t w/w. Although demand is still expected to be slow in winter, market participants are becoming positive towards the short-term demand outlook. Given the re-emergence of Covid-19 cases in some regions, fewer workers will travel back home. Some local authorities have started to provide financial support for workers that remain at work during the Chinese New Year holiday, so activities may not be as slow compared with 2019. In contrast, coated sheet prices are being impacted by a combination of seasonally slower demand and lower expected car production because of the shortage of semiconductors for the auto sector. Although the impact on production is still limited and restricted to passenger cars, it places a major downside risk for galvanized sheet demand in 2021 H1.

Asia

Prices of imported sheet products in Asia continue to fall on weak market sentiment. CRU assessed HR and CR coil CFR Far East Asia down by $20 /t, and HDG coil down by $30 /t w/w. For HR coil SAE1006 grade, offers from traders were heard at $670 /t CFR Vietnam, while Chinese mills were offering at $690-700/t CFR Vietnam. Buying interest was limited as buyers were waiting for new offers from Formosa Ha Tinh. For HR coil SS400, offers were heard at $650-660 /t CFR Vietnam, while buying indication was below $640 /t CFR Vietnam.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com