Market Data

January 21, 2021

Steel Mill Lead Times: No Clear Trend Yet

Written by Tim Triplett

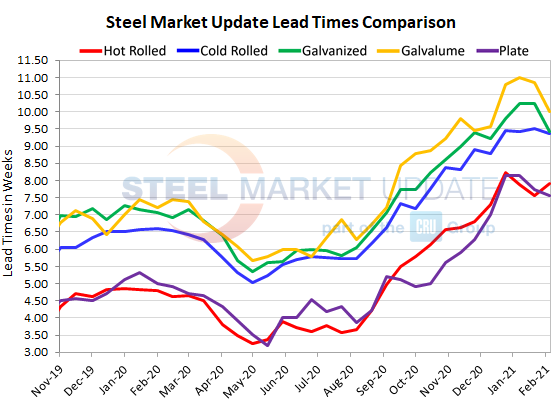

After registering a slight dip in Steel Market Update data two weeks ago, lead times for delivery of spot orders of hot rolled steel inched back out again this week to an average of nearly eight weeks. SMU and most in the market have been watching closely for signs that lead times are beginning to shorten, which would suggest that activity at the mill level is easing and that steel prices might be expected to follow. That is not yet the case, at least for HR, though lead times for other flat rolled products and plate did see slight shortening in the latest data.

Current hot rolled lead times as measured by SMU now average 7.91 weeks, up a bit from 7.57 two weeks ago and 7.87 in the first week of January. At nearly eight weeks, HR lead times remain extremely extended, especially compared with the low point last April shortly after the pandemic hit when delivery times dipped as low as 3.25 weeks.

Cold rolled lead times, now averaging 9.36 weeks, are down slightly from 9.50 in the third week of January. Like hot rolled, cold rolled lead times are more than a month longer than in late April.

Galvanized lead times now average 9.42 weeks, down significantly from 10.24 weeks in SMU’s last check of the market. SMU will be monitoring closely to see if this is the beginning of a real change for galvanized lead times or just a statistical blip. At nearly nine and a half weeks, galv lead times remain highly extended. Similarly, the current average Galvalume lead time dipped to 10.00 weeks from 10.86 weeks last month.

SMU’s latest survey shows that plate lead times now average 7.55 weeks, down a bit from 7.73 two weeks ago. Plate lead times have ranged around 8.0 weeks, plus or minus, since mid-December. The worst of the pandemic drove average plate lead times down to 3.20 weeks back in May 2020.

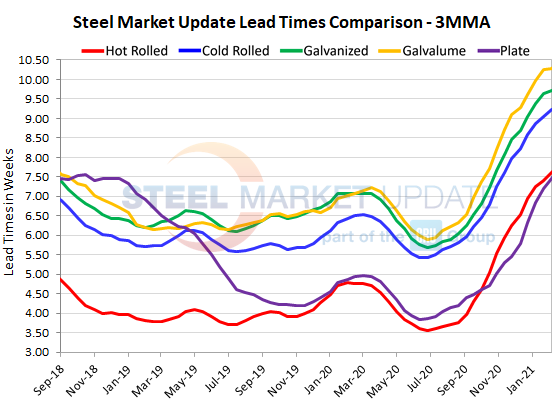

Viewed as three-month moving averages to smooth out the volatility, hot rolled lead times have continued to extend to 7.62 weeks, cold rolled to 9.24 weeks, galvanized to 9.72 weeks, Galvalume to 10.28 weeks and plate to 7.47 weeks.

Steel supplies remain uncomfortably tight, say service center and OEM executives. “There’s no spot volume in Q1. Mills are now quoting April and May deliveries,” said one. Which suggests the high steel prices may still have some legs.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Tim Triplett, Tim@SteelMarketUpdate.com