CRU

March 16, 2021

CRU: Iron Ore Bouncing Back on Rising Steel Margins

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

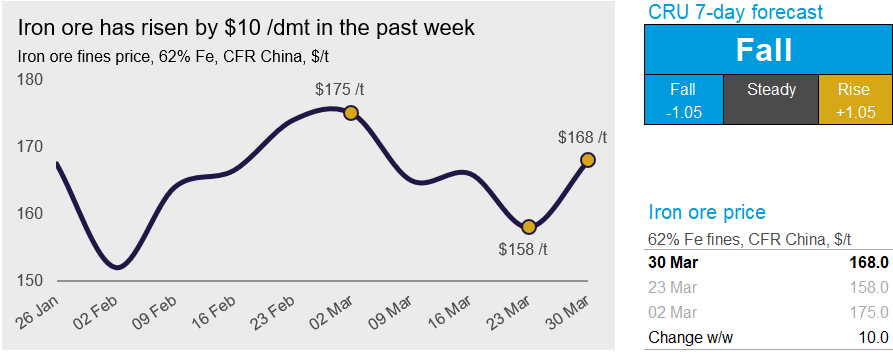

Iron ore prices have risen by $10 /dmt in the past week as Tangshan cuts have raised steel margins and steelmakers in other regions are seeing an uplift in production. On Tuesday, March 30, the 62% Fe fines price was assessed at $168 /dmt.

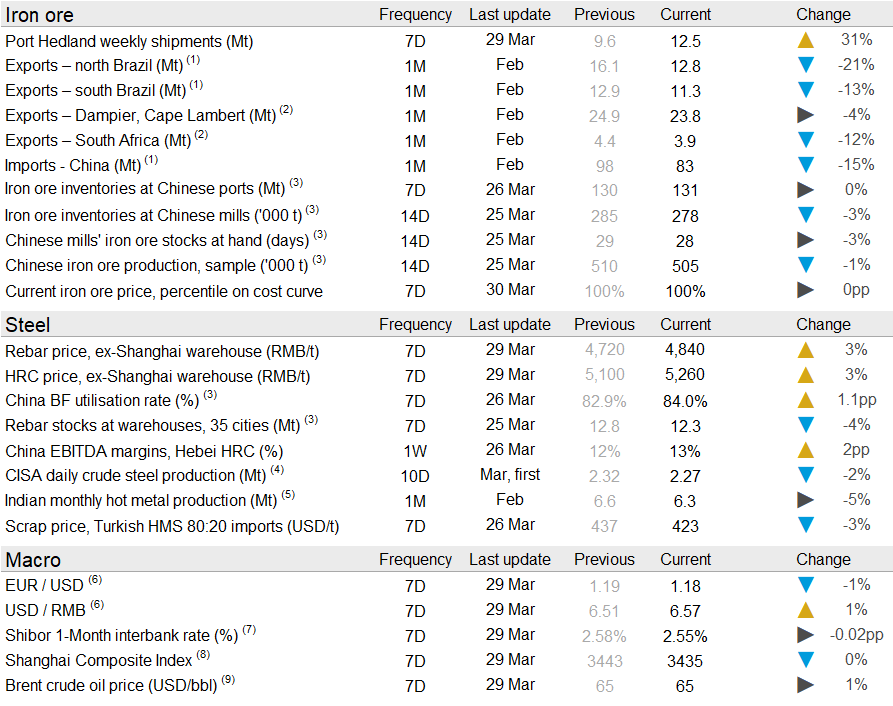

Last week, Chinese domestic steel prices continued to rise on strong underlying demand with our assessments for HRC and rebar both rising by more than RMB100 /t w/w. Although finished steel production continued to increase w/w, steel inventories dropped again to a level that was ~5 Mt less y/y by the end of last week. The w/w steel production increases were made up of both BOF and EAF steelmaking. While surveyed EAF capacity utilization was close to historical highs, BF capacity utilization in regions other than Tangshan ramped up to make up the production loss in Tangshan. Higher hot metal production lifted iron ore consumption, and this encouraged steelmakers to conduct restocking, which brought daily iron ore port outflow back to above 3 Mt in the past week, the highest level over the last six weeks. Having said that, iron ore port inventories edged up in the same period. In combination with more than 100 vessels lining up for unloading, the iron ore market balance is looser compared with that before Tangshan implemented production cuts.

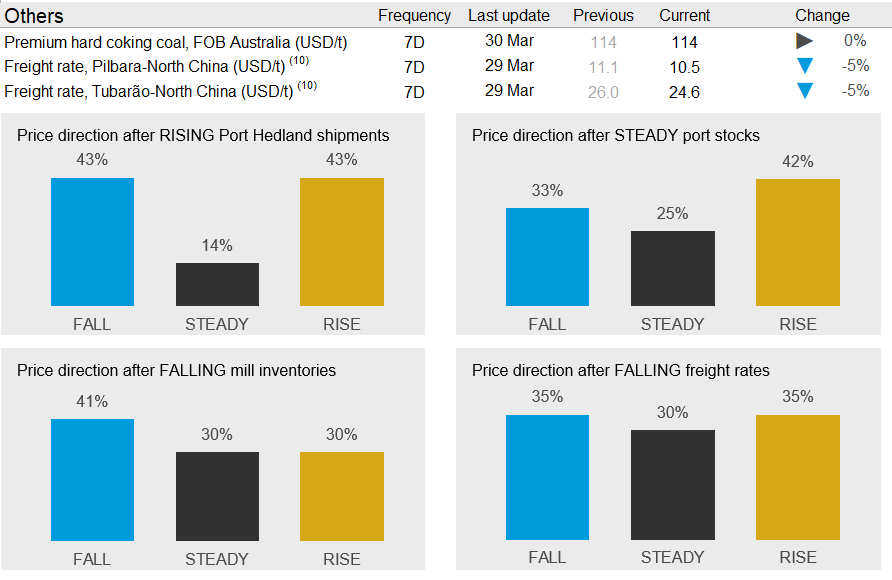

Very strong seaborne supply is contributing to the looser iron ore market. We are at the end of a quarter, which means we can expect a strong performance by the majors. Port Hedland set a new 2021 record in the past week with 12.5 Mt of iron ore exports. At the same time, we continue to see a strong performance by other majors. Rio Tinto’s exports for Q1 are up by ~3% y/y, exports from Port Hedland are flat and Brazilian exports have risen by 15% compared with one year ago. Brazilian exports to the Chinese market have risen sharply this year and Indian producers have taken advantage of the high prices by increasing exports to China. March was a particularly strong month with high levels of pellet and low-grade fines exports from Odisha on the east coast.

The strong preference for pellet and lump continues as we head into Q2. Vale has raised its pellet premia for both BF and DR pellet and the sintering restrictions in Tangshan are keeping Chinese demand elevated.

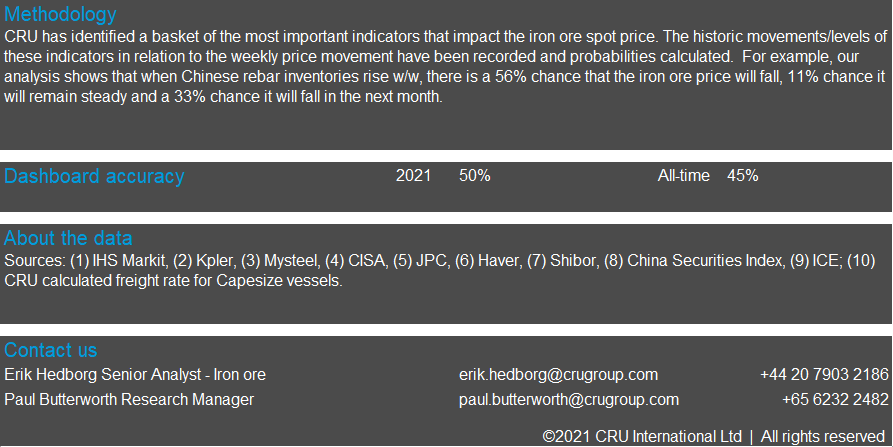

In the coming week, we expect the strong supply to weigh on prices and we expect further price falls. Our indicators below are mixed, but we see further price increases as unlikely considering the robust supply and improving inventory levels in China.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com