Market Data

April 1, 2021

Consumer Confidence: April Data Sustains Strong Momentum

Written by David Schollaert

U.S. consumer confidence saw major gains in April, according to the latest data from The Conference Board. April’s index rose by about 13.0 points month on month, following a nearly 18.6-point increase in March.

“Consumer confidence has rebounded sharply over the last two months and is now at its highest level since February 2020,” said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current conditions improved significantly in April, suggesting the economic recovery strengthened further in early Q2. Consumers’ optimism about the short-term outlook held steady this month. Consumers were more upbeat about their income prospects, perhaps due to the improving job market and the recent round of stimulus checks. Short-term inflation expectations held steady in April but remain elevated. Vacation intentions posted a healthy increase, likely boosted by the accelerating vaccine rollout and further loosening of pandemic restrictions.”

The Conference Board’s consumer confidence index has grown month on month for the past four consecutive months, but the recent surges in March and April have nearly brought the index back to pre-pandemic levels. April’s reading is the highest reading since February 2020 and an incredibly positive push into Q2, as data suggest that consumers are expectant that current conditions will further improve throughout the second quarter, while hopeful that COVID’s worst is behind.

The present situation index, which is based on consumers’ assessment of current business and labor market conditions saw a nearly 30.0-point jump month on month, while the expectations index, which is based on consumers’ short-term outlook for income, business and the labor market, rose by a far smaller scale. The present situation index climbed from 110.1 to 139.6 month on month, while the expectations index improved slightly from 108.3 the prior month to 109.6 in April.

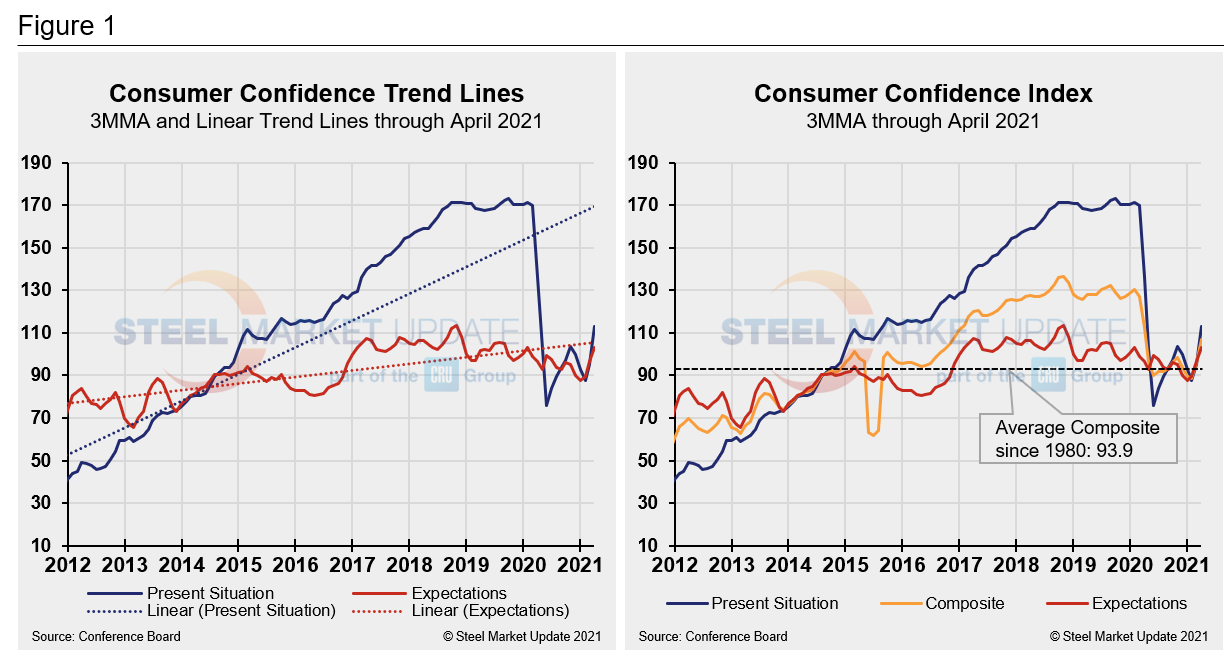

Calculated as a three-month moving average (3MMA) to smooth out the volatility, The Conference Board’s composite index rose in April to 107.0 compared to 96.1 in March. Still well below the pre-pandemic high of 130.4 last February, but edging closer to the 112.4 seen one year ago. The composite index is made up of two sub-indexes: the consumer’s view of the present situation and his or her expectations for the future. Figure 1 below notes the 3MMA linear trend lines from January 2012 through April 2021 versus the trend lines of all three subcomponents of the index: present situation, composite and future expectations. All three had edged above the average composite line in October 2020 before falling consecutively through February. March and April’s surge has pulled all three indexes above the composite line once again.

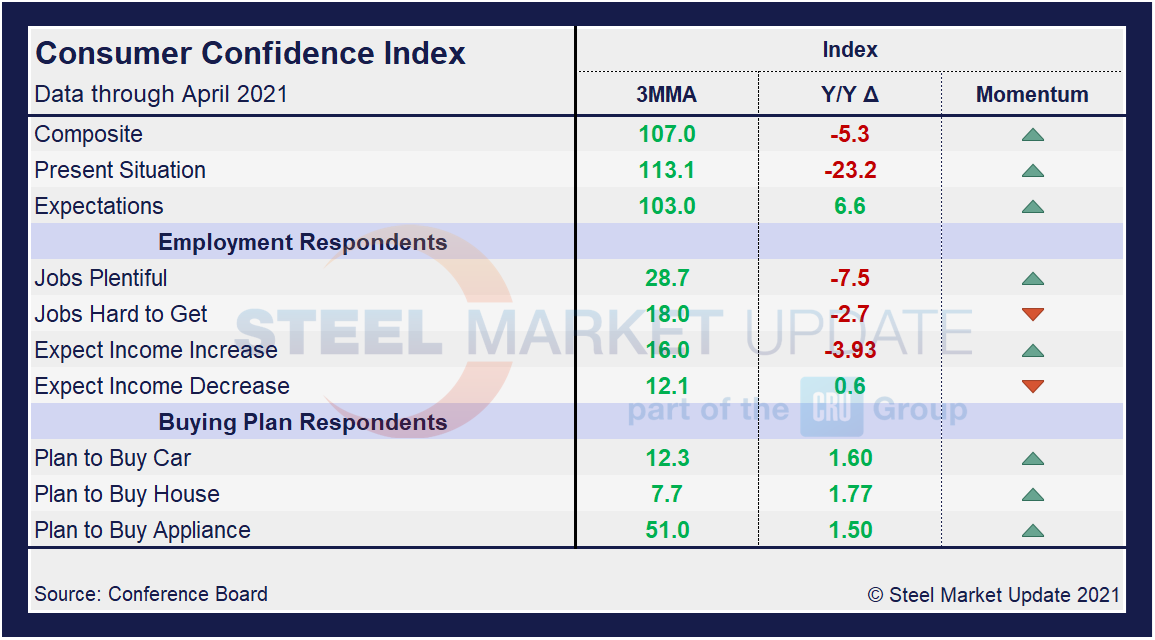

On a 3MMA basis comparing April 2021 with April 2020 in the table below, the present situation is down by 23.2 points, a vast improvement from just last month when the index was down 74.9 points. Expectations are now a positive 6.6 points, up from a negative 1.5 points the month prior. The consumer confidence report also includes both employment data and some purchase plans and these are likewise summarized in the table below. The color codes show improvement or deterioration of the individual components. Most remarkable is that the momentum tracker is moving in the correct direction for all data points.

The composite, present situation and expectations are not only trending up, but have made up much of the ground lost over the past 12 months that resulted from the fallout of the global pandemic. Buying plans for autos, house, and appliances are also up both on a 3MMA basis as well as when compared to year-ago levels. The labor market landscape has also shifted and represents a marketplace steadily moving towards health. Respondents are showing optimism that jobs are not just becoming more plentiful, but the prospect of increased wages are also rising.

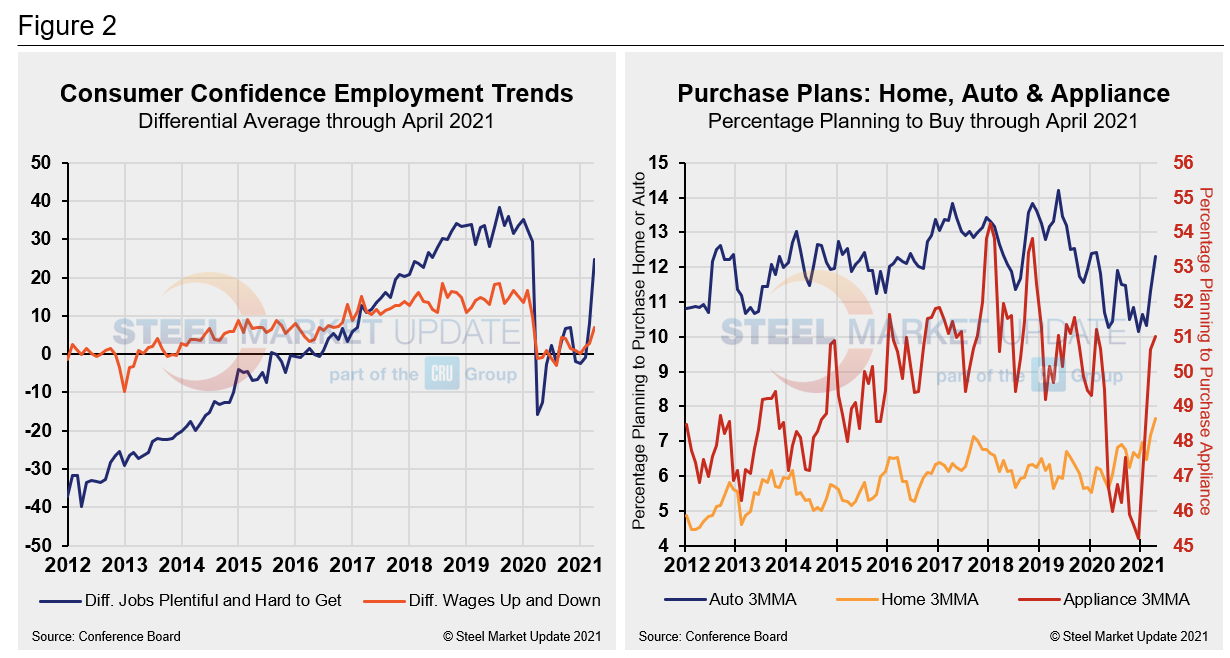

The differential between those finding jobs plentiful and those having difficulty has swung to a positive 24.7 in April, not far behind the most recent pre-pandemic high of a positive 35.3 in January 2020. At the height of the COVID-19 health crisis, the differential saw a 51-point swing to a negative 15.7 from January 2020 to April 2020. In the half year that followed, as the economy improved, the differential rebounded to a positive 6.9 by November 2020 before slipping back to a negative 3.2 in January. Since then, however, the differential has soared following back-to-back months of substantial growth in March and April. Expectations for future wage changes were similarly affected, but not nearly as much. In January 2020, the differential was positive 13.6, falling to negative 3.0 at its lowest in August, but rebounding to a positive 7.0 in April 2021, up from 2.2 the prior month.

The spending plans for consumer goods as measured by automobiles, homes and appliances have seen a similar trend, following the growth in consumer confidence. As buyers have grown increasingly assured of the market’s return to health, both home and auto buying have seen new highs. Home buying plans have reached the 8.9-point mark, up from 6.0 in February and the highest mark ever for this index. Spending for automobiles reached the 14.0-point mark in April, the highest mark since March 2019. These dynamics are illustrated below in Figure 2.

SMU Comment: The jump in consumer sentiment seen in March continued through April and seems poised for further strengthening as positive reports of surging U.S. GDP and millions of COVID vaccinations position the market for a robust summer and strong second half.

About The Conference Board: The Conference Board is a global, independent business membership and research association working in the public interest. The monthly Consumer Confidence Survey®, based on a probability-design random sample, is conducted for The Conference Board by Nielsen. The index is based on 1985 = 100. The composite value of consumer confidence combines the view of the present situation and of expectations for the next six months.

By David Schollaert, David@SteelMarketUpdate.com