CRU

April 30, 2021

CRU: Steel Price Gains Slow After Chinese Prices Fall

Written by George Pearson

By CRU Analyst George Pearson from CRU’s Steel Monitor

Chinese prices have rebounded this week after three consecutive weeks of decline. However, trading in markets outside of China was lower last week as buyers waited for further developments in Chinese prices and this fed through to lower w/w gains in Europe and the U.S.

U.S. sheet prices rose again this week, yet the HR coil gain of $14 /s.ton w/w represented the smallest weekly gain since March 31, 2021. Offers of HR coil were reported up to $1,640 /s. ton and the volume of reported spot purchases continued to increase. Demand remains strong, but some companies have seen the postponement of purchases by their customers due to high steel prices. Service centers report taking offers from domestic and foreign sources to their customers, who are rejecting them, choosing instead to wait until prices begin to ease.

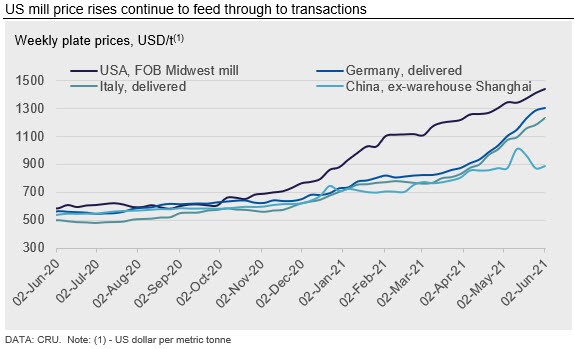

U.S. plate prices rose $26 /s.ton w/w as the previously announced mill price increases began to result in higher transaction prices last week. The spread between HR coil and plate is now $302 /s.ton, a decrease of $12 /s.ton w/w. With further gains expected for plate and the possible slowing of price increases for sheet, the tightening spread between plate and HR coil could continue.

European sheet prices were mixed this week. Trading activity was lower as European buyers waited to for further developments in Chinese prices. German CR and HDG were unchanged w/w, while HR coil rose by €1 /t. For German CR coil and HDG coil, this is the first time since late-July to early-August that prices have not at least shown some increase w/w. Italian prices increased at a considerably slower rate compared to last week yet have risen above prices in Germany. Our latest price assessment for HR coil is €1,112 /t for Germany and €1,116 /t for Italy. Market feedback reports that tightness in the market will continue for some time, especially as some mills are not operating at full capacity. We expect that the currently long lead times will allow European mills to maintain high prices for now, but for supply from domestic production and imports to catch up with demand into the summer.

Plate prices in Europe have risen by €17 /t to €1,070 /t in Germany and by €42 /t to €1,008 /t in Italy. In Italy, plate demand is said to be recovering with prices expected to continue rising in the coming weeks on the back of higher slab costs. There has been no change in lead times, with German mills offering for September and Italian plate mills quoting July delivery and some tonnage available for June.

After falling sharply for two consecutive weeks in response to the government’s intervention to prevent the unreasonable price increases of commodities, Chinese steel prices recovered this week as they had dropped below mills’ breakeven point. Both rebar and HR coil rose by RMB250 /t w/w following a quick increase in the futures market. However, there remains little change in underlying demand and most participants are still waiting on the sidelines with only small volumes of transactions done for immediate spot requirement. As such, steel inventories stopped falling and fell only by 0.4% w/w. The price increase early in the week has since stopped because of a rumor about production curbs easing in Tangshan. According to unconfirmed information, steelmakers in Tangshan can restart 20-35% of capacity once they have completed the ultra-low emission renovation. We believe this will have a knock-on effect on steel margins and therefore iron ore prices especially considering the approaching slow season. Looking ahead, although firm demand and strong cost support will continue to provide a price floor, we expect a volatile steel market in the coming weeks due to unclear policy.

Chinese plate prices have stopped falling this week and turned higher, gaining RMB50 /t w/w after they had dropped below mills’ breakeven point last week. However, there remains little change in underlying demand and most participants are still waiting on the sidelines with only small volumes of transactions done for immediate spot requirement. Therefore, plate inventories stopped falling and increased by 1.4% w/w. The price increase early in the week has since stopped because of a rumor about production curbs easing in Tangshan. According to unconfirmed information, steelmakers in Tangshan can restart 20–35% of capacity once they have completed the ultra-low emission renovation. We believe this will have a knock-on effect on steel margins and therefore iron ore prices, especially considering the approaching slow season. Looking ahead, although firm demand and strong cost support will continue to provide a price floor, we expect a volatile steel market in the coming weeks due to unclear policy.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com