Plate

May 13, 2021

March Import Market Share for Sheet and Plate Products

Written by David Schollaert

This report examines the import share of sheet and plate products. Imports’ share of total sheet product shipments was 12.7% in March, down from 14.0% in February. The decrease corresponds to a simultaneous increase in domestic shipments and a rise in imports; however, the surge in domestic shipments at 17.4% month on month outpaced the 5.1% increase in imports.

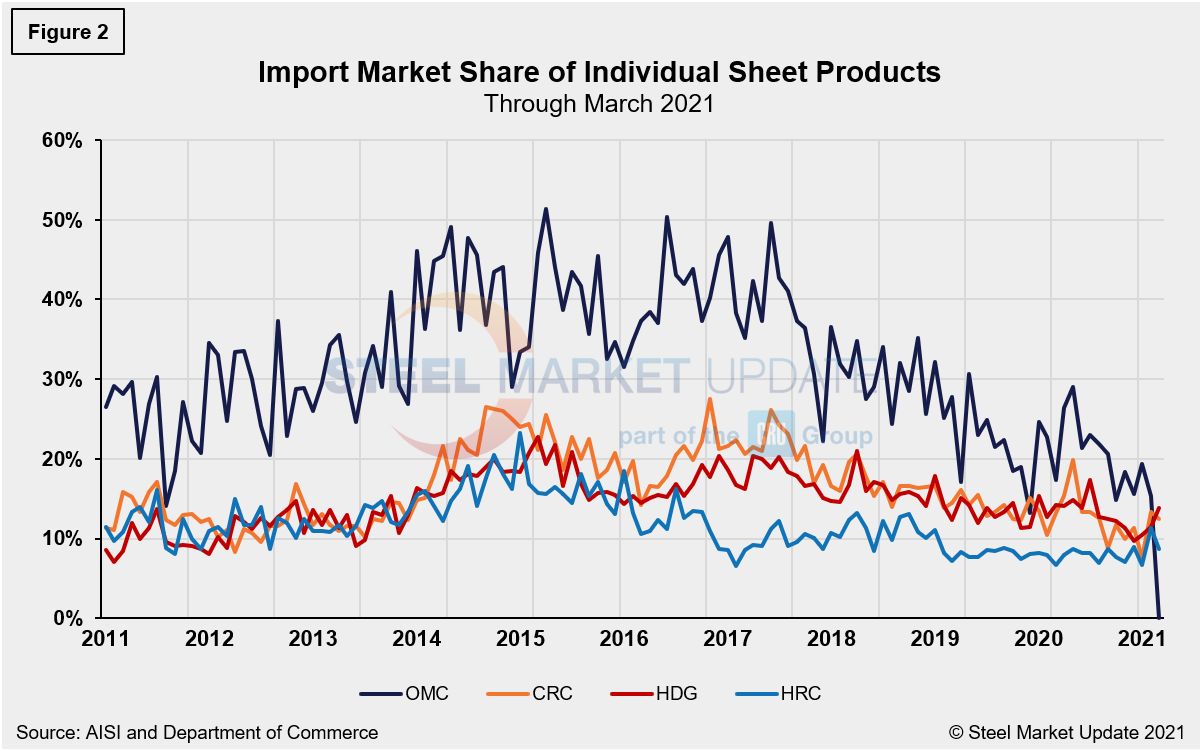

Domestic shipments in March totaled 4.505 million tons, a strong recovery after February posted the lowest mark since this past August at 3.838 million tons. Imports of sheet products in March totaled about 657,978 tons, the highest mark since January 2020 when imports totaled 714,092 tons. Despite the increase in steel sheet product shipments in March, demand continue to outpace supply, driving prices to unprecedented highs. The import share of hot rolled coil (HRC) edged down to 8.7% in March, compared to 11.3% in February. Although HRC imports were down 11.6% month on month, the correction was accentuated due to an increase of 18.6% in domestic shipments in March when compared to the prior month.

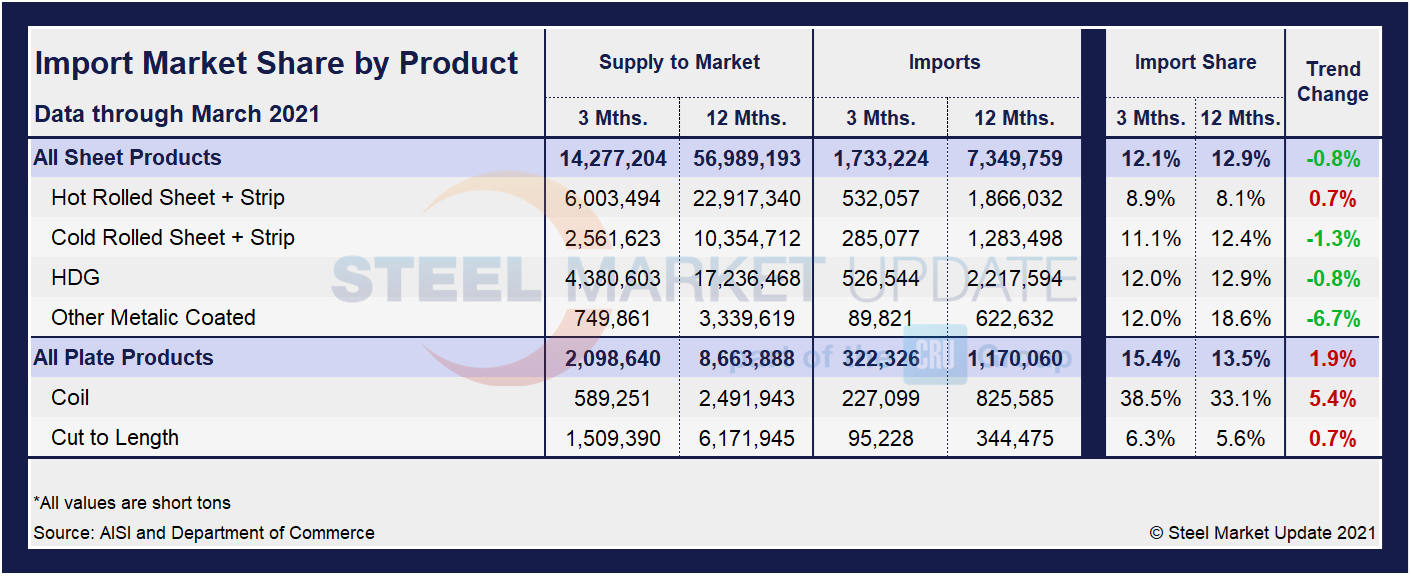

The table below shows total supply to the market in three months and 12 months through March 2021 for sheet and plate products and six subcategories. Supply to the market is the total of domestic mill shipments plus imports. It shows imports on the same three- and 12-month basis and then calculates import market share for the two time periods for six products. Finally, it subtracts the 12-month share from the three-month share and color codes the result green or red according to gains or losses. If the result of the subtraction is positive, it means that import share is increasing, and the code is red. The big picture is that import market share is still competing well with domestic products in three months compared to 12 months, a direct correlation to rising domestic prices. Most notable of those subcategories are plate in coil (5.4%) and HRC (0.7%) in three months compared to 12 months through March 2021. However, import market share overall did edge down in March due to strong domestic shipments.

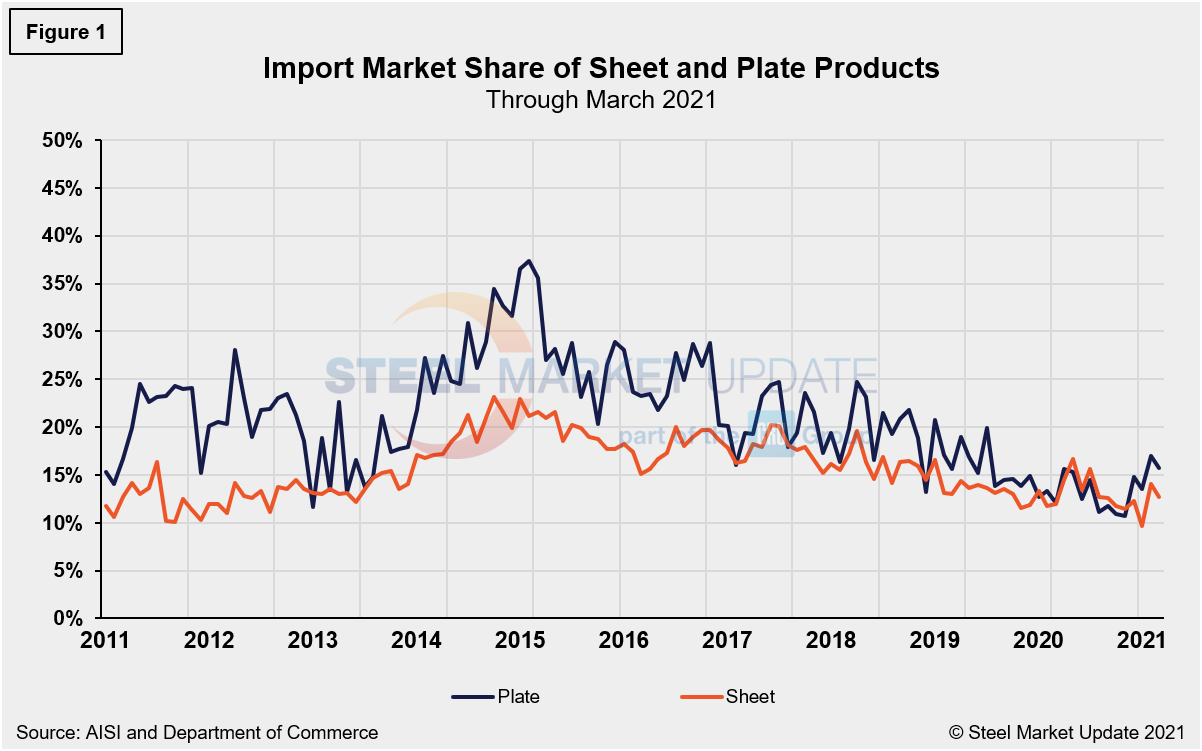

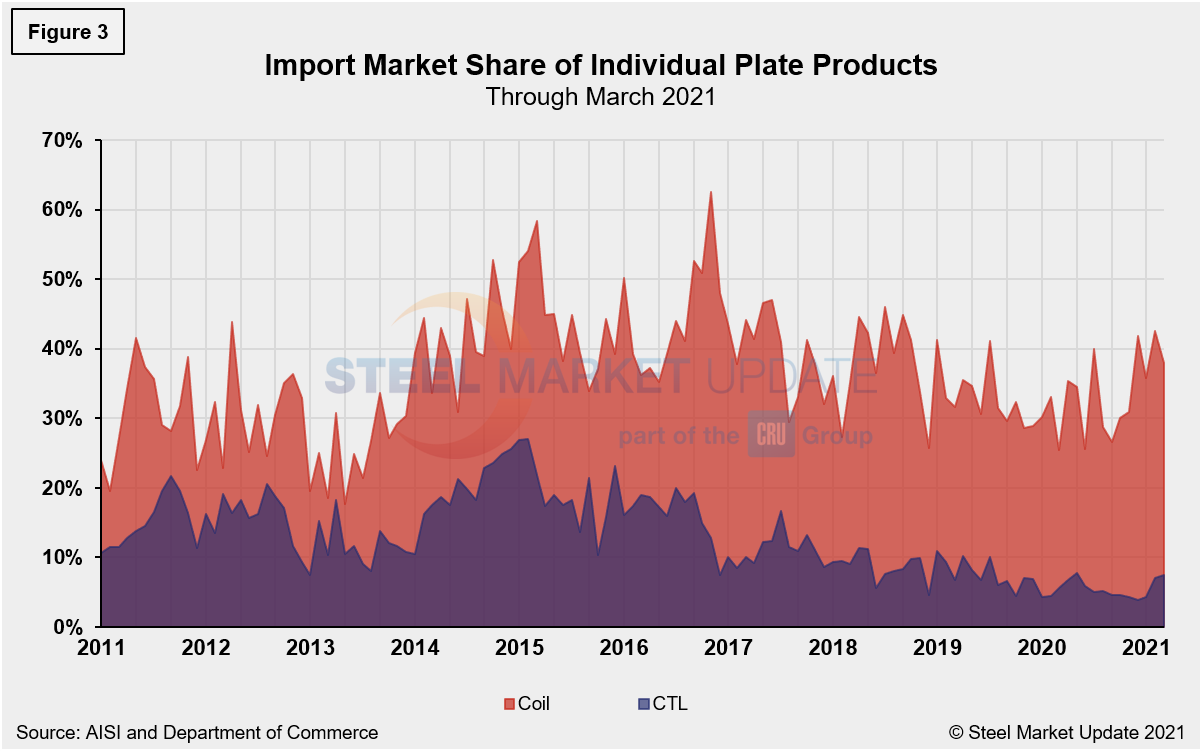

The historical import market share of plate and total sheet products is shown in Figure 1, while the import market share of the four major sheet products is displayed in Figure 2. Lastly, the import market share of individual plate products is shown in Figure 3. The import share of plate has been decreasing erratically over the past six years, while sheet product import share has also edged down over the same timeframe. In March, the import share of all steel sheet and plate products saw a downward correction after rising the month prior. The primary driver of the shift month on month was the increase in domestic shipments following weather-related disruptions in February.

By David Schollaert, David@SteelMarketUpdate.com